K is not capital, L is not labor

Garett Jones wonders why a standard result in economics is not more widely entrenched, both in policy conversations and conventional wisdom:

Chamley and Judd separately came to the same discovery: In the long run, capital taxes are far more distorting that most economists had thought, so distorting that the optimal tax rate on capital is zero. If you’ve got a fixed tax bill it’s better to have the workers pay it…

Why isn’t Chamley-Judd more central to economic discussion? Why isn’t it part of the canon that all economists breathe in? Why isn’t it in our freshman textbooks?… The result can’t be waved away as driven by absurd assumptions: It’s not too fragile, it’s too solid…

Good economic policy doesn’t try to do things that are impossible. And if the world works roughly the way Chamley and Judd assume it does, a long run policy that redistributes total income from capitalists to workers is impossible.

So, the quick answer, obviously, is that those of us who support redistributive taxation don’t believe that the world works in the way that Chamley and Judd assume. It is very clear that Jones (who is an unusually insightful guy) doesn’t believe in a naïve mapping between real economies and Chamley-Judd-ville. See the “bonus implication” in his handout on the subject.

To annihilate in broad brush strokes, there is little reason to accept the Ramsey model, upon which the Chamley-Judd results are built, as a sufficient description of the macroeconomy. [1] Some economists might argue that it’s a decent workhorse “asymptotically”, as a means of thinking about some long-term to which economies converge. But that’s a conjecture without evidence. Actual experience, as people as diverse and diametric as Scott Sumner and J.W. Mason point out, suggests that “demand-side dynamics” may overwhelm the bounds of a hypothetical production function in determining the actual behavior of the economy, over periods of times as long as we can plausibly claim to foresee. Redistributive taxation, or tolerance of redistributive inflation in the face of poor real-economic performance, may be prerequisite to maintaining production along the sort of path the Ramsey model presumes is automatic. These possibilities, along with any form of uncertainty, are invisible to the work of Chamley and Judd. They are simply omitted from the model.

But let’s be generous. Let’s put very broad objections aside, and understand the world in Chamley-Judd terms. In practice, what does the Chamley-Judd result suggest about policy?

First, it’s worth pointing out that Jones has overstated things a bit when he claims that the Chamley-Judd result is “not too fragile, it’s too solid”. As far as I can tell [2], the optimality of a zero capital tax rate is in fact a “knife-edge” result with respect to returns-to-scale of the production function. If returns to scale are decreasing or increasing, the optimal capital tax rate from workers’ perspective may be positive or negative, and is sensitive to details. A stable, constant-returns-to-scale production function may be attractive for reasons of convention and convenience, but it is unlikely to be true. Once we admit this, we really don’t know what the optimal tax rate is in an otherwise Chamley-Judd world.

But I promised to be generous. So let’s assume that the economy is characterized by a permanent two-factor, constant-returns-to-scale production function. The Chamley-Judd claim is that it is optimal that one of these factors should be taxed and the other not be. For this to be true, there must be some asymmetry: Factor one, which we’ll call K, must be different from factor two, which we’ll call L. What distinguishes these factors and leaves one optimally taxed, the other optimally untaxed? Fundamentally, the difference is that capital accumulates, while labor does not. Judd assumes completely inelastic labor provision, Chamley allows for a labor/leisure trade-off bounded by a fixed number of hours. Each period labor is born anew, while capital stands on the shoulders of its ancestors. This difference is what drives the asymmetry and then the result. Labor is a factor in strictly limited supply, capital is a factor whose quantity can grow indefinitely and which augments labor in production. Under these circumstances, the way to get a big, rich economy — and to maximize the marginal product of labor! — is to encourage the accumulation of capital. Encouraging labor provision directly can’t take you very far, because there is a ceiling. But the sky’s the limit with capital. Further, in Chamley and Judd, nonconsumption automatically implies useful deployment of capital into production.

If these were adequate characterizations of capital and labor, the Chamley-Judd result would be much more plausible than it is. But these are very poor descriptions of the real world phenomena we ordinarily label “capital” and “labor” when we decide how much to tax them.

Let’s talk first about “labor”. As Jones hints in his “bonus implication”, labor is not in fact measurable in terms of homogenous hours. What a brain surgeon can do with an hour is very different from what a child laborer can accomplish. Macroeconomically, our collective capacity to produce improves. You might, as Jones does, refer to this incorporeal je ne sais quoi that enhances labor over time as “human capital”, or as labor-augmenting technology. Like physical capital, it seems to accumulate. In empirical fact, “human capital” and its more sociable, incorporeal twin “institutional capital” seem to be much more important predictors of the growth path of an economy than physical capital. Europe and Japan bounce back quickly after war devastates their infrastructure. But imagine that a Rapture clears the Earth and pre-agrarian nomads take possession of perfect gleaming factories. I think you will agree that production does not recover so fast. Human and institutional capital dominate physical capital. [3]

Like physical capital, and unlike hours of the day, the collective stock of human capital grows over time, without obvious bound. Yet, at least under existing arrangements, we have no means of distinguishing between “returns to human capital” and “wages”. “Capital taxation”, in conventional use, refers to levies on capital gains, dividends, and interest. As a political matter, results like Chamley-Judd are often used to support setting these to zero. But eliminating conventional capital taxes shifts the cost of government to wages, which include returns to human capital. If human capital accumulation is as or more important than other forms of capital accumulation, and if the quality of effort that people devote to building human capital is wage-sensitive, then taxing wages in preference to financial capital may be quite perverse. Further, while physical capital grows by virtue of nonconsumption, it seems plausible that human capital development is proportionate to its use, which would render a tax penalty on “wages” particularly destructive. Fundamentally, Chamley-Judd logic suggests that we should tax least the factor most capable of expanding to engender economic growth. You don’t have to be a new-age nut to believe that human and institutional development, which yield return in the form of wages, may well be that factor. It is perfectly possible, under this logic, that the roles of capital and labor are reversed, that the optimal tax on labor should be zero or even negative, because returns to physical and financial capital are so enhanced by human talent that even capitalists are better off paying a tax to cajole it.

So labor is more capital-like than a naive application of Chamley-Judd would assume. But that’s not all. What we conventionally call “capital” looks very little like the commodity in the models. In the models, there are no financial assets. Capital is crystallized nonconsumption, a real resource which is automatically deployed into production if it is not consumed.

In reality, people forgo consumption by holding financial claims. There is no clear relationship between financial asset purchases and the organization of useful resources into production. Many financial assets are claims against the state which fund current government spending. Are those expenditures “investment” in the Ramsey sense? Maybe, partially, but not clearly. Financial claims can fund consumer loans. Does financing a vacation contribute to the permanent capital of the nation? Maybe — perhaps vacationers are in fact far-sighted investors, whose labor productivity and future wages will be enhanced by a recreative break. But, maybe not. It is not at all clear. Empirically, the relationship between the outstanding stock of financial claims and anything recognizable as productive capital is very weak. [4] Finance is not an inconsequential veil over real production. It is its own messy thing.

Let’s approach the mess more analytically. In the models, foregone consumption and productive investment are inseparable. In the real world, purchasing a financial asset (or holding money!) does imply that some agent forgoes consumption. But it does not imply that the foregone consumption will be invested. The consumption an agent forgoes may be consumed by others. It may be wasted. Identities like S = I don’t help us, they just insist that we call purchases of financial assets “investment”, and then account for eventually fruitless claims via revaluation. In real life, there are a lot of those revaluations, and no measure of observable capital corresponds with a cumulation of financial savings. So, if we want to take Chamley-Judd reasoning seriously, we oughtn’t set tax rates capital gains, dividends, or interest to zero. Instead, we should ensure that real investment activity by firms is tax advantaged. There is no Chamley-Judd case for not taxing the interest on consumer loans or government bonds that finance transfers. There may be a case for policies like accelerated depreciation of fixed capital or even tax credits for education expenses. [5] But given the weak relationship between financial assets and real investment, eliminating conventional “capital taxes” just subsidizes the products of the financial sector. It offers a windfall to financiers and their best customers, but creates no foreseeable “piece of a bigger-pie” benefit for the people to whom the tax burden is shifted.

One final point: The force that drives the Chamley-Judd conclusion is the long-term elasticity of capital provision to interest rates. The intuition is that capitalists make a decision about whether to forego consumption and contribute to growth or whether to consume today based on a comparison between available returns and their time preference. Lower capital taxes keep returns higher and make contributing capital “worth the wait” over a longer arc of the production function, leading to a higher steady state.

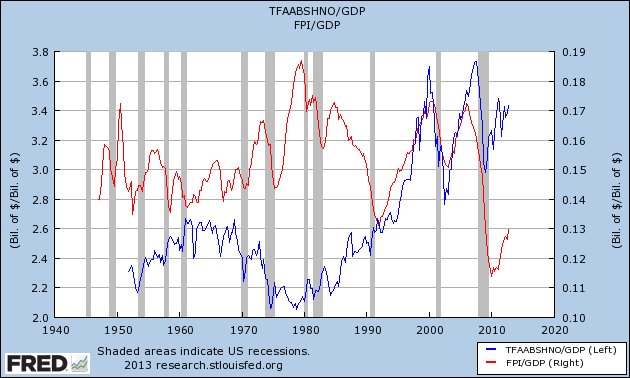

Unfortunately, this sort of calculation does not seem to describe economy-wide savings behavior very well. Aggregate purchases of financial assets seem to be insensitive to returns. In the US, yields on debt, risk-free, corporate, and individual, have been falling since the 1980s, while the stock of financial assets held by households (as a share of GDP) has grown inexorably. (Total equity returns were high only in the 1990s; financial holdings grew about as fast during the low-debt-yield, low-return pre-crisis 2000s as they did in the 1990s, see the graph below.) Unless you posit a peculiarly declining time preference, the core implication about aggregate savings behavior in any Ramsey model seems quite false. We need other stories. I have some! Perhaps consumption is approximately satiable, and the fraction of income saved is just a residual, the difference between income and the satiation level. Perhaps wealthier households save, not to endow future consumption, but because they are in a competitive race with other households for insurance or status that derive from financial holdings. Perhaps for the US, aggregate saving is largely a residual of other countries’ return-insensitive economic policy (Asian mercantilism, petrodollar recycling, etc.). In any of these cases, we’d expect gross financial saving not to be especially sensitive to investment returns. Now human capital formation may be less wage-sensitive than we’d guess too. Maybe we become brilliant more because of expectations and support provided by the people and institutions that surround us than because of the extra money we anticipate. But all these uncertainties undermine the Ramsey/Chamley/Judd edifice, rather than suggesting a zero capital tax.

There are lots of more narrow rebuttals of Chamley-Judd. Jones links Matt Yglesias and Piketty and Saez on the ways the tax result changes if you replace infinite-lived consumers with overlapping generations of people who die. The Chamley-Judd result goes away when labor markets are imperfectly competitive, when economic outcomes are uncertain, when savings are sufficiently return inelastic. Also, see Andrew Abel. To dismiss these critiques as “exotic” is to dismiss reality as exotic, and to rely without evidence on an extreme simplification of the world.

But more fundamentally, what we mean in life and politics by “capital” and “labor” are simply not the phenomena that Chamley or Judd (or Ramsey) model. It is wonderful for Jones to remind his students that, especially in a context of full employment, “capital helps workers”. Stories of what a worker can accomplish with a bulldozer versus a shovel are important and on-point. Students should inquire into the process by which in some times and places construction workers get bulldozers and live well, while in other times and places they work much harder with shovels yet barely subsist.

But Chamley-Judd tells us very little about the tax rate appropriate to income from dividends, interest, or “capital gains” in the real world. How and whether an incremental purchase of financial claims contributes to growth or helps workers is a complicated question, one that a Ramsey model can’t resolve. Models that are more realistic about finance, whether Keynesian or monetarist, predict states of the world where financial capital formation is harmful to real economic performance. To the degree that human and institutional capital grow with use rather than disuse, shifting the burden of taxation from financial claims to labor may be harmful over a very long-term. In the asymptotic steady state, who knows? We have as much reason to believe that you will like strawberries as we have to believe that the capital gains tax should be zero.

[1] You’ve got to love Robert Solow on this:

[I]t could also be true that the bow to the Ramsey model is like wearing the school colors or singing the Notre Dame fight song: a harmless way of providing some apparent intellectual unity, and maybe even a minimal commonality of approach [to macroeconomics]. That seems hardly worthy of grown-ups, especially because there is always a danger that some of the in-group come to believe the slogans, and it distorts their work.

[2] Please correct me if this is mistaken; it’s what I observe in simple simulations [pdf, mathematica] similar in spirit to those published by Jones. It’d take a lot more work than I’m prepared (or able) to do to demonstrate this result under the abstract frameworks of the original papers.

[3] It was Garret Jones himself who offered the single most insightful economics tweet of all time, on precisely this topic:

Workers mostly build organizational capital, not final output. This explains high productivity per ‘worker’ during recessions.

[4] Within the sphere of financial claims, the relationship is sometimes stronger: there may be a relationship between, say, the aggregate balance sheet size of the telecoms industry and fixed investment in telecoms. But the aggregate quantity of financial claims as a whole (restricted to those held by households to avoid double-counting of “pass-through” holdings) has no stable relationship to the quantity of measurable investment in the economy:

TFAABSHNO → “Total Financial Assets – Assets – Balance Sheet of Households and Nonprofit Organizations”, “FPI” → Fixed Private Investment; I should probably have included gross foreign holdings in the financial assets measure, but the series I’d need, though available in the flow of funds, seems not to be published on FRED. (It’d be Table L.106, “Rest of the World”, “Total financial assets”, Line 1 if anyone is more motivated than I am to find the full series and add it to household financial assets.)

[5] Interestingly, Andrew Abel points out that, under conventional Chamley-Judd assumptions, not worrying at all about human capital or the imperfections of finance, optimal tax policy may be to tax only capital, but to permit the ultimate in accelerated depreciation, immediate expensing of capital goods.

Update History:

- 8-Apr-2012, 4:50 a.m. PST: minor grammar fixes, missing the word “a”, missing a comma: “characterized by a permanent two-factor, constant-returns-to-scale production function”; “Factor one, which we’ll call K, must be different”

- 10-Apr-2012, 11:50 p.m. PST: Fixed misspelling of “

GarretGarett Jones”. (Many thanks to Douglas Edwards for pointing out the error.)