Expenditure vs investment — thinking clearly

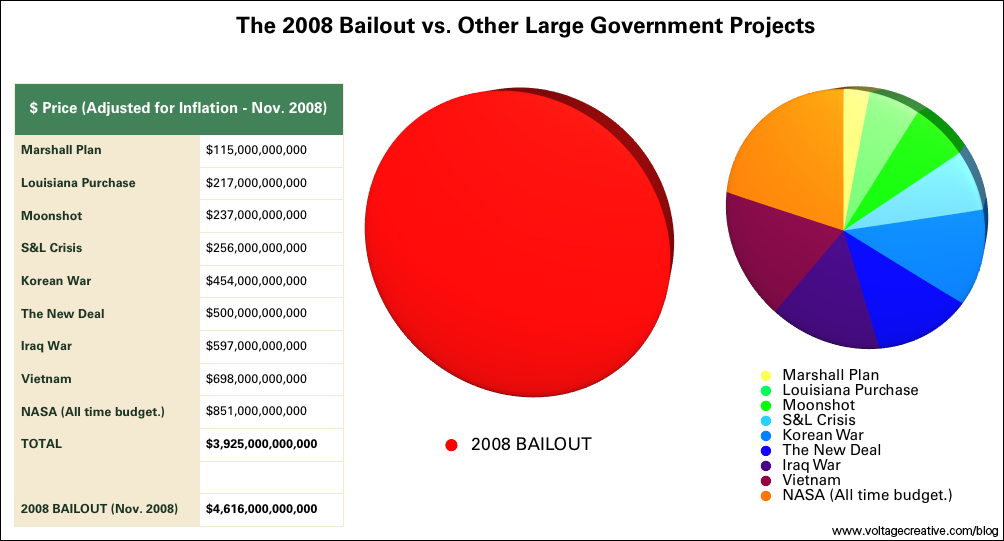

I like this little graphic that’s been making the rounds, courtesy of Voltage Creative, hat-tip nonSense, Simoleon Sense, Paul Kedrosky.

Paul Kedrosky is a reasonable fellow, and takes care to note that the numbers “are in current dollars, and all treat expenditures and investments as equivalent.” Kevin Drum is even more reasonable:

This stuff has gotten completely out of hand, with “estimates” of the bailout these days ranging from $3 trillion to $7 trillion even though the vast bulk of this sum comes in the form of loan guarantees, lending facilities, and capital injections. The government will almost certainly end up spending a lot of money rescuing the financial system (I wouldn’t be surprised if the final tab comes to $1 trillion over five years, maybe $2 trillion at the outside), but it’s not $7 trillion or anything close to it. People really need to stop throwing around these numbers as if the bailout is comparable to World War II or something. That’s not reality based, folks.

But reasonable and right are sometimes different, and this graphic helps to think it through. We have some idea what we paid for, for example, with the $851,000,000,000 for NASA. We bought space shuttles, satellite systems, a moon shot, planetary probes, a lot of research and development, some air bases and research facilities.

What are we buying when the government purchases mortgage-backed securities, or buys preferred shares of banks that can only pay if a portfolio of real-estate loans does not totally sour? We are buying “paper”, right?

No. We are not buying paper. Ironically, the pejorative term “paper” hides what we are actually doing in a way that is overflattering. All of the iffy securities that are weighing down the banking system represents money already spent on real projects or consumption. When the government purchases a security, it is taking the place of the party that originally fronted money for that expenditure. Every penny of government “investment” is retroactive expenditure on housing, real-estate, consumer credit, whatever.

If a government were to borrow funds in order to build a new stadium, we’d call that an “expenditure”, even if we fully expect use fees and incremental tax revenues to eventually turn a profit for the fisc. Politicians supporting the project would call it an “investment”, quite justifiably. But the project would still count as government spending.

If a private party builds the same stadium, and then is reimbursed by the government in exchange for rights to future revenue, that doesn’t change the economic substance of the transaction at all. But in the second case, the government would buy “paper” — it would enter into a contract trading current government funds for future revenues. That “security” doesn’t make the transaction any more or less an investment than if the government had purchased the stadium itself.

So, in economic substance, the government is currently spending through a financial time machine on the exurban subdivisions and auto loans of several years past. We are retroactively turning in the entire mid-decade “boom” into a gigantic Keynesian stimulus project. Apparently that stimulus was not so successful, since we are likely to enact a brand new massive stimulus very soon. To be fair, it should be easier to design a good stimulus program in the present tense — financial time machines are persnickety things. But the expenditures we are planning to undertake and the “investments” we are making via the universal bail-out are not so different in kind.

I hope that the infrastructure we build next year turns out to be a wise investment, both in financial and use-value terms. It might be, but just because we hope to recoup the cost, we won’t pretend that no money was actually spent. We’ll call the whole thing an expenditure, even though that will probably overstate the ultimate burden. But if a power grid counts as an expenditure on government books, so should a security derived from a mortgage or credit card loan made two years ago. You can argue that the latter are more likely to pay-in-full than the former. Or you can easily argue the opposite, given the prices that the government is paying for its financial investments relative to private-sector bids. But you can’t claim that securities are “investments” while a power grid, or NASA, or even World War II are mere “expenditures”. (It does not seem unlikely that the US government earned has earned more in tax and other revenues over the years having entered WWII than it would if it had not, perhaps by a large enough margin to justify the financial costs of the war.)

Figures of 7 or 8 trillion dollars recently bandied about by the Communists at Bloomberg are overstated, since they do not distinguish between expenditures and guarantees, which are contingent liabilities. The government’s contingent liabilities aren’t usually counted as spending until the contingency has been triggered. But the amount of money already spent or committed on “financial investments” to date is more than $3 trillion dollars, and it is perfectly right to call that government spending on the financial bail-out.

The scale of the largely unlegislated current government program to save the financial system is breathtaking and quite unprecedented. Taxpayers might be made whole, in financial terms, or might reap sufficient dividends in terms of suffering avoided to justify the program. But don’t let anyone convince you that the scale of this intervention is “overstated” because it is all “investment”. NASA and the Marshall Plan were investments too, and pretty good ones.

You have a very interesting perspective here.

If Bernanke and Paulson had a time machine and could go back in time to the year 2004 with their superpowers, what would they do to fix the economy, so it wouldn’t drive off the cliff in 2007-2008? Would they stimulate it more by lowering the Fed rates to zero? Would they raise the rates at least above inflation rate? Would they increase government spending? Would they talk about overheated housing markets? Would they talk about installing more regulation?

I think that they would walk out of the time machine in to the 2004, look at each other, and started doing the exact same things as they did in the past. Their role in the economy is very limited yet powerful. Their DNA and only superpower is money. And I can’t even blaim them.

There is only one key structure change that could have a true meaning, and that is changing Federal Reserve System. Either abolish it, or create another Fed to compete with the current one. Markets aren’t free if government and banks don’t have but one choice where to loan money.

December 2nd, 2008 at 3:57 am PST

link

EDIT: If were to think that we just had an economic bubble, then it means that the economic growth and the rise in the stock market after 2002 has been excessive and partly artificial.

Why would a central bank or a government be worried about high economic growth? Has this ever happened in the history?

December 2nd, 2008 at 4:55 am PST

link

the collateralised non-recourse loans extended by the fed are substantively the same as guaranteeing the collateral received. i.e. the fed only has a contingent liability equal to the loss on sale of the collateral in the case that the borrower goes bust. one would hope that the fed charged a significant haircut when it made those loans (more interesting details to be obtained by bloomberg in its ongoing foi action), in which case such loans in no way equate to “buying paper” and therefore are not “expenditure” either.

December 2nd, 2008 at 5:25 am PST

link

I’m constantly amazed by these comments on the Citibank (and Bear) transactions. If you “backstop” $329bn of assets for an effectively insolvent insitution, you’ve written a put on this portfolio (incidentally struck at the buyer’s estimate of “market value”). From Options 101, someone might recall that means you’ve effectively bought the portfolio and sold off the upside. Sure it doesn’t have to be funded now, but let’s consider the capital we’d need if we set up a hedge fund to take the government’s place in this transaction. How much would we need? About $329bn is my guess. That’s real economic capital that has been invested here and will not be invested elsewhere (only important if you think the US has limited capital). This is in many important ways exactly the same as buying the paper: the “backstop” and “first loss” elements are just a bookkeeping gimmick to confuse the public.

December 2nd, 2008 at 8:36 am PST

link

Let’s not let financial jargon get in the way of characaterizing much of the bailout payments as what they really are: transfer payments from the taxpayers to the management of and investors in the firms that made all these bad bets.

Rule Plutocracy! In the current context, a Last Hurrah of Republican Looting of the Treasury on Behalf of Their Friends! Democrats have been known to do the same, but never to the same extent.

As I suggested long ago, it would have been infinitely more transparent and efficient to let all insovolvent firms go bankrupt, transfer the accounts to strong entities, provide a livable dole to the unemployed masters of the universe and the collaterally unemployed, let the chips fall where they may and let the economy get back to the task of creating real wealth.

In this spirit, I like the suggestion that all Credit Default Swaps be declared null and void. Clean up the books before the next wave of mortgage resets and defaults.

December 2nd, 2008 at 9:29 am PST

link

Correction: I like the suggestion that all CDSs not used for genuine hedging be declared null and void.

December 2nd, 2008 at 9:34 am PST

link

You say tomatoe, a la Dan Quayle.

These are investments.

These are expenditures.

These are paper.

These are debts.

Irregardless, a la Tony Soprano, they are all debts.

IOUs ultimately of the American taxpayers.

Some are known quantities.

Some are not.

The problem, yet unidentified, is debt-money.

All money is created as debt.

Repayable at interest.

Which is NOT, in turn, created.

When we design a monetary system where the function of money is to provide a means of excahnge, rather than a commodity with which to enrich further those who have access to it, we will be on our way to economic stability – the ironic purpose of the FED.

Debt-free money.

Government-issue.

One-hundred-percent-reserve banking.

The Chicago Plan.

Economic democracy.

Free enterprise.

December 2nd, 2008 at 9:44 am PST

link

Since the Fed seems to be providing financing for investments that are in various stages of failure, one can hardly make the case that this is equivalent to “investment ex post facto”.

Nice effort though. But it utterly flies in the face of the concept of capitalism, investing, and markets.

December 2nd, 2008 at 11:09 am PST

link

BTW the black lettering on the darkish blue background is a bit difficult.

Enjoy your site as always though.

December 2nd, 2008 at 11:11 am PST

link

It’s a good exercise throwing numbers. As good as it gets

December 2nd, 2008 at 11:47 am PST

link

I wished you reworked the whole and broke it down into different pieces. This is an excellent analysis but imho we need to keep the following aspects separate:

1) expenditure and investment

2) total investments and money at risk

3) what it means in real economy terms when broken assets are bailed out

Your post is standing out from a lot of other posts because you bother to look a 3 – what it means that these assets are bought by the goverment. In a lot of cases the money has been spent e.g. on carpenters for a McMansion. It is not recoverable. If it is forgiven and ends up on the goverment book it is equivalent to a tax free gov cheque to the home-buyer *sent back in time* which was squandered *back then* and dispersed into the economy. If it is on the Chinese gov book – similar near term story but with some implication for future interest rates. If it is on a 401 fund – pensioners will suffer and boomer retirement is near.

First and formost the question is where do the bad assets bomb and what distortions do they cause in the real economy? We have seen that the most urgent issue is the banks freezing and the injected life support may keep some patients alive but it has not decreased the fundamental inbalances in the system.

Huge stores of value have been amassed which are not backed by assets but by either by founded believe in future production (good) or by dubious assets e.g. MBS (less good) or by unfounded belief in counterparties e.g. CDS (evil). These claims need to be partially voided with the only question remaining how. To spell it out: Chinese can not expect to buy as much with their IOUs than they thought, retired people can not collect as much from their investments, next generation will not be allowed to speculate on forgiveness and needs to save more. Painful, very painful for everyone. And then – how to stop a starting downward spiral?

Surgical stikes on banks, Helicopters droping some cheques or tax relief for people earning money may not be sufficient and even worse may increase the imbalances. A large scale carpet bombing with B-52s and freshly minted money could be called for.

December 2nd, 2008 at 4:15 pm PST

link

Steve,

An interesting post on what seems to be a favourite theme. I agree that real economic substance should be under the microscope more in the case of investments and expenditures. Your retrospective expenditure and financial time machine perspective is illuminating.

However:

The financial investments now being made by the government in the credit crisis consist of cash outlays where there is an expectation of a return of and on the original investment. This return is expected from NON-TAX sources.

Conversely, real economic investments made by governments typically consist of cash outlays where there is an expectation of an implicit return of and on the original investment. But this implicit return translates to an equivalent explicit return only by identifying TAX revenue with which to associate it. For example, a government investment in a road or bridge may well provide a real economic return. But if it does, it requires future taxpayers to pay the cost of depreciation and interest that would have been forthcoming from non-tax sources had it been structured as a financial investment similar to the ones being made today.

So I think there’s quite a difference between government financial investments and government expenditures on real projects on this basis, insofar as the taxpayer is concerned.

Yet this is not to contradict your fundamental point on the lack of distinction in terms of the real investment or real expenditure characteristic.

December 2nd, 2008 at 5:50 pm PST

link

Benign B frames the problem correctly and poses the correct solution.

Bigger issue: Why do so few of us see this for the shell game it is and has been for years, and why do we fail to recognize ourselves as the suckers we are?

December 2nd, 2008 at 6:32 pm PST

link

We choose to go to the exurbs. We choose to cover this nation in asphalt and McMansions in this decade and do the other things, not because they are easy, but because they are profitable, because that goal will serve to organize and measure the best … or at least some … of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to regulate, and one which we intend to win, and the others, too.

December 2nd, 2008 at 7:29 pm PST

link

Dear Mr Waldman,

I kindly appreciate you linking today to my website, SimoleonSense. I’m a big admirer of your website and your articles. Thank you for your time.

Best Regards,

Miguel Barbosa

http://www.simoleonsense.com

December 3rd, 2008 at 12:42 am PST

link

It’s good to see that people are starting to separate the different ways of measuring the money involved. The money actually spent to date is less than the money committed, the contingent liabilities, and so on, and it can confuse things when people try to compare these numbers as if they’re equivalent. When I suggested a $14 trillion price tag a few months ago, it was an estimate of the ultimate cost of the political promises being made at that time. That kind of number is a point of reference for planning and shouldn’t be confused with the numbers being discussed here.

Another point of confusion comes when people who think the financial crisis is mostly behind us and the plans are essentially complete talk to people who think the crisis is just getting started and the response is still in the early stages of planning. Is TARP funded for all time, as Paulson suggests, or just through the end of the year, as some others have suggested? The way you see the spending depends a lot on the scenario you have in mind.

December 4th, 2008 at 1:48 pm PST

link

In Canada if the government wants to spend money, it has to win a 50% plus one vote in the House of Commons otherwise the government automatically gets the boot. Ultimately the Queen can also prevent anything retarded from happening. There aren’t any such checks on power in the USA government model?

What government positions are in a position to block the transfer of trillions of taxpayer dollars to bank shareholders? Is the Prez? Would the situation be any different if the money were going to Osama?

December 15th, 2008 at 1:47 pm PST

link