Competitiveness is about capital much more than labor

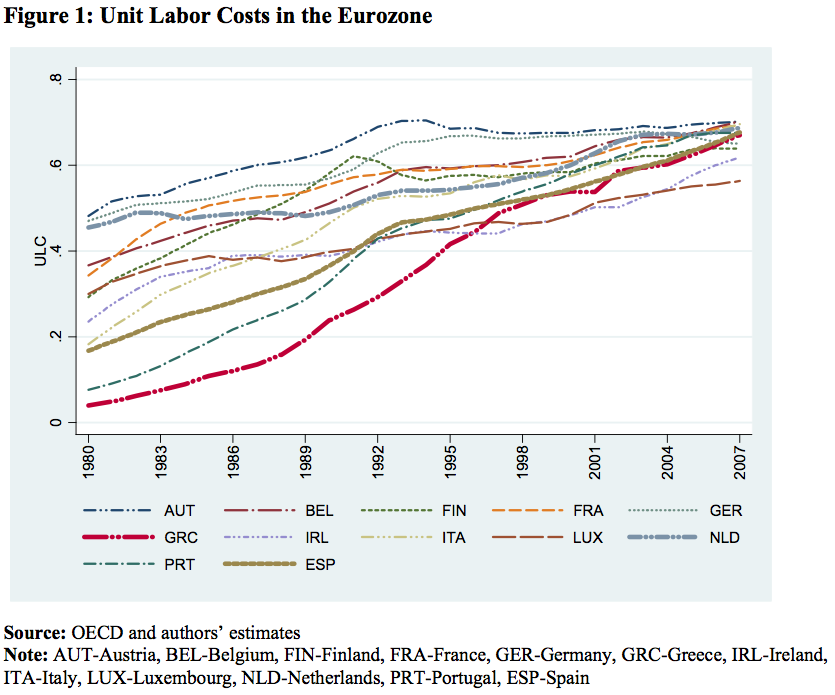

Besides justifying labor-hostile monetary policy, unit labor costs are often trotted out to blame unreasonable wage expectations for troubled economies’ “lack of competitiveness”. For example, here’s a chart published last year by Paul Mason (ht Paul Krugman):

It is a common trope that labor costs in the European periphery have grown to unsustainable levels, while in the prudent and virtuous North, costs have been contained.

But the chart is misleading. Let’s take a look at the same information presented a bit differently, from a wonderful Levy Institute working paper by Jesus Felipe and Utsav Kumar, “Unit Labor Costs in the Eurozone: The Competitiveness Debate Again”:

Rather than lazy Mediterraneans demanding high pay for little output, what has happened since 1980 is a convergence to prudent German norms. Workers in Southern europe are now paid roughly the same amount per unit of goods produced as their counterparts in Mitteleuropa. This is macroeconomics, so the meaning of a “unit of goods produced” is a fuzzy and contestable. But to the degree that unit labor cost statistics capture what they claim to capture, what they tell us is that European workers, North and South, have come to earn roughly equal pay for equal product.

Southern European workers do earn less overall, simply because they produce fewer or lower-value goods and services than their Northern neighbors. Unit labor costs are not the problem at all: it is the scale of aggregate output. And what determines the scale of aggregate output? Is it the laziness of workers? No, of course not. We all know that when residents of poor countries emigrate to rich ones, the same weak bodies and flawed characters that produce very little at home suddenly explode into economic vigor. The difference is “capital depth”, broadly construed to include all the physical equipment, business organization, public infrastructure, and governance that collude to enable two small hands and a broken mind to accomplish outsize things. Workers’ pay level is not the problem in Southern Europe. It is deficiencies in the arrangement of capital, again broadly construed, that have left Greece and Spain unable to produce value in sufficient quantity to compete with their neighbors.

One might argue that since “capital” is in some sense a scarcer factor in Southern Europe than in Northern Europe, unit labor costs “should” be lower in the South, as a “marginal unit of capital” adds more value than another hour of labor. I have to use the scare quotes though, because there really is no such things as a marginal unit of good institutions, and to the degree that’s even coherent as an idea, it has no relationship at all to financial returns on invested cash. If governance fairies came to Greece and demanded workers surrender some fraction of their per-unit wages in exchange for the institutional capital that enables German levels of productivity, that might be a good deal. (Perhaps Angela Merkel thinks of herself as just such a governance fairy. I don’t think a disinterested observer of her priorities and demands would agree.) In the real world, there is little consensus, with respect either to institutional development or deployment of physical capital, on how, in the context of a tradables glut from its neighbors, Southern Europe could increase its output of tradable goods and services. Looking backwards, with a converging European price level, restraint in unit labor costs relative to the European norm would have meant increased returns to financial capital, and financial capital was emphatically not a scarce factor in Southern Europe prior to the crisis. On the contrary, financial capital was abundant and enthusiastically misdeployed. That misdeployment, the tsunami of bank-mediated money that found its way into real estate and consumer loans rather than the production of competitive tradables, was the primary and proximate cause of Southern Europe’s diminished competitiveness.

In their role as borrowers, some Southern Europeans were complicit in this process. But, as always, it is creditors rather than borrowers who we must hold accountable for bad lending, if we want incentives consistent with good aggregate outcomes.

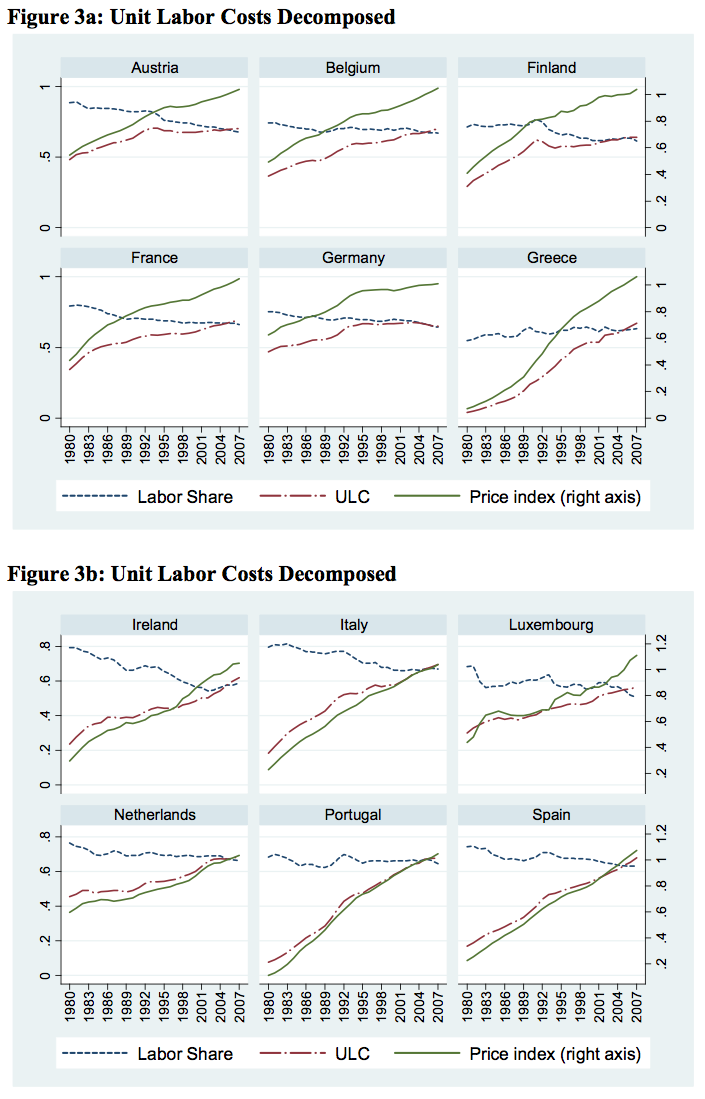

In their role as workers, Southern Europeans were victims rather than beneficiaries of the wave of malinvestment. Recall that unit labor costs can be decomposed into two factors, the price level and labor’s share of output. Let’s take a look at some more graphs, again from Jesus Felipe and Utsav Kumar:

In all countries other than Greece (including the rest of the “PIIGS”), labor’s share of output has been declining. Rather than winning unreasonable victories, workers have been receiving an ever smaller fraction of the output that they help to produce. The rise of unit labor costs in Portugal, Italy, Ireland and Spain have only partially compensated for the steeply rising prices that have attended European convergence.

Felipe and Kumar also estimate “unit capital costs” along the lines I described in the previous post. (See Table 1 of the paper.) For all countries other than Greece, payments to capital providers per unit output have been growing faster than payments to workers.

So what’s does all this mean? Two things:

There’s a common narrative of the European crisis that pins the blame on workers. It is said that during the “good times”, when rivers of money flowed from Northern Europe to the Mediterranean, workers in Southern Europe were able to extract exorbitant wage hikes, forcing prices up and rendering their products uncompetitive in global markets. To put it gently, there is no evidence to support this narrative except perhaps in Greece. In the other PIIGS, unit labor costs failed even to keep up with the rising price level. Workers received a smaller share of the value they helped produce in 2007 than they took in 1980. Southern Europe’s unit labor costs converged with Northern Europe’s because the price levels of the two regions converged, not because Mediterranean workers took a greater share. If Southern Europe lacks competitiveness, the part of the cost structure that needs to be reformed has to do with rents paid to capital rather than the sticky wages of workers.

-

We should beware reductionist accounts that put the blame for the periphery’s misery on inflated relative prices. Though one can tell an alarmist story looking at relative rates of change of unit labor costs, in terms of levels, the periphery’s labor structure looks competitive. Nor can we blame the problems in the periphery on a mere absence of capital. Prior to the crisis, there was plenty of capital available. The European periphery was rendered uncompetitive by toxic patterns of capital allocation, for which both Northern Europe’s financial institutions and Southern Europe’s regulators ought to be held accountable. Altering the relative price of labor between Northern and Southern Europe would not fix these problems. Real devaluation might provide temporary relief in terms of domestic employment, and that might provide breathing room for developing better policy ideas than accepting capricious capital flows and hoping they sustain asset bubbles. But breathing room is all that devaluation can provide. It cannot substitute for better policy. Mediterranean Europe already had much lower relative labor costs than the European “core” prior to the recent convergence. Look how that worked out. The PIIGS should work to avoid falling into a kind of macroeconomic “Groundhog’s day”, cycling between low relative costs, convergence, and crisis.

Even though devaluation is no panacea, the nations of peripheral Europe might still wish to consider dropping the Euro. But the case for that is not, ultimately, about relative prices, but about sovereignty and bargaining power. As the MMTers correctly emphasize, control over money is essential to the sovereign power of a state. For now, the nations of the Eurozone have ceded a significant part of their sovereignty to European institutions. That would be fine, if those institutions could be trusted to look out for, or at least give fair weight to, the interests of the states which have surrendered sovereign powers. If I were a citizen of Portugal or Greece, Spain, Ireland, or Italy, I would conclude that European institutions have unduly little concern for my interests and unduly much concern for a transnational financial system and Northern European taxpayers. If that continues, I’d want my government to retract the sovereignty it had ceded, so that it has the freedom to maximize the forward-looking welfare and growth of my nation without hobbling itself in the interests of claimants to past loans that ought never have been made.

An obvious corollary to all this is that “internal devaluation” is absolutely idiotic. It’s one thing to accept chemotherapy when the disease is cancer and the pain might do some good. But if the disease is not cancer, chemotherapy is just eating poison. Peripheral Europe’s problem is an incapacity to produce tradable goods and services in sufficient quantity to pay for its import bill. That is a structural deficiency. The wages workers are paid for the goods and services they do produce are in line with the rest of Europe’s. Lower wages might help create incentives for new investment to resolve the structural deficiency. But that hasn’t worked in the past when the periphery’s labor has been unusually cheap. The clear and present miseries of “internal devaluation” should not be allowed to rest on so slim a reed.

Update History:

- 26-Feb-2012, 2:05 a.m. EST: Dropped superfluous sentence “Patterns matter.” Corrected “Norther Europe” to “Northern Europe”. Reorganized awkward and oververbose sentence beginning with “In the real world…” to a still awkward and oververbose sentence. No substantive changes.

You’ve said your thoughts have been in a dark place recently, but thank you for continuing to write. It’s nice to have fresh air in a cigar smoke filled room.

February 25th, 2012 at 6:45 pm PST

link

Minimizing “deficiencies in the arrangement of capital” as you’ve defined it seemed to be an important goal of many southern European nations when they joined the Eurozone. Why hasn’t that occurred to a larger extent? Would dropping the Euro create or expose additional capital arrangement deficiencies for peripheral Europe in the long term?

February 25th, 2012 at 9:40 pm PST

link

In a large federation like the US, these sorts of pressures can be addressed by labor mobility and consumption mobility.

The EU was supposed to achieve that as well, and I understand that legally a Greek person can just up and go to Germany and apply for a job. If only she spoke German. Or perhaps French. Or English.

So a very real question is – Can any large area large population nation or group of nations thrive without some kind of de-facto common language?

So while improving institutions and social structures is a fine idea, maybe the fix for Greece is to teach everybody French or German or English (2nd language of many) – so that Greeks could leave and flourish elsewhere. This would give “exit” (real exit) and help force the nation behind to fix its ways.

February 25th, 2012 at 10:13 pm PST

link

Using gold prices rather than fiat currencies as the measure, unit labor costs have been in sharp decline now for the past decade — more at:

http://wjmc.blogspot.com/2012/02/us-unit-labor-costs-in-dramatic-decline.html

February 26th, 2012 at 12:02 am PST

link

My take-home from this is that the efficiency of institutions (and level of pubic debt) are key determinants of how badly a country is affected by the ECB’s tight money policies.

February 26th, 2012 at 4:06 am PST

link

Nice you emphasized this and referred to Jesus Felipe and Utsav Kumar’s paper who refers to Nicholas Kaldor.

In the Kaldor language, there are two important things – “price competitiveness” and “non-price competitiveness”.

The “Kaldorians” often quote this from “The role of Increasing Returns, Technical Progress and Cumulative Causation in the Theory of International Trade and Economic Growth”, Economie Appliquée, 1981

“The growth of a country’s exports should itself be considered as the outcome of the efforts of its producers to seek out potential markets and to adapt their product structure accordingly. Basically in a growing world economy the growth of exports is mainly to be explained by the income elasticity of foreign countries for a country’s products; but it is a matter of the innovative ability and adaptative capacity of its manufacturers whether this income elasticity will tend to be relatively large or small.”

At the end of the day – an internal devaluation is needed, unfortunately.

However, the Euro Area policy makers will use a brute force method to achieve this and employment suffers due to this.

That’s like saying TINA. (Though, unilaterally defaulting on debts and regaining monetary sovereignty is no panacea either).

What is needed is a collective wage bargaining process where a central government is involved in making substantial equalization payments in the intermediate period.

Wages have to be adjusted but there are so many other things which need to be done simultaneously.

Topic of my post here:

http://www.concertedaction.com/2012/02/14/imbalances-looking-for-a-policy/

February 26th, 2012 at 4:45 am PST

link

Eye opening article. Numbers do not lie, it is the interpretation of the numbers that matters.

As far as worked mobility, mentioned by Brian, I’ve heard that businesses teaching German are having a boom lately….. somebody is listening.

February 26th, 2012 at 9:49 am PST

link

Two very simple and clear examples of misallocation of resources:

1) entitling people to receive a pension after 20 years of work and in any case much higher of what they accumulated during their working life;

2) hiring in the public admistration 30-40 % of the really required people and, in order to justify their recruitment, instituting a bunch of absyrde regulations for the producers that have to spend time to comply to regulations rather than to innovate.

Both of those have distracted resources from investements. Banks have also contributed as they preferred to give money for speculative games rather than for financing new projects.

February 26th, 2012 at 11:29 am PST

link

You say: “Lower wages might help create incentives for new investment to resolve the structural deficiency. But that hasn’t worked in the past when the periphery’s labor has been unusually cheap”

I dispute this. Spain in fact had very good growth in industrial production in the years following the devaluations of 1992/1993. In fact it achieved a c/a surplus by then. Afterwards cheap money was channeled to r.e. in part because the increase in nominal wages made adittional investment in industrial capacity unatractive. The rest is history, or

what do yo do of a country that suffers AT THE SAME TIME a unemployment rate bordering 24% and a c/a déficit of 4%?

February 26th, 2012 at 11:51 am PST

link

Quick, devil’s advocate points, hopefully without being his representative per se:

Unit labor costs have converged over the full 25 year period, but the rate of convergence over the period since the Euro was adopted has been far more dramatic than for the previous sub-period – when expressed as a percentage of the gap at the start of each respective period: I’d say ball park 100 per cent versus 50 per cent. Somehow that strikes me as important in the assessment of feasible adjustment dynamics, although I’m not sure precisely how.

“Looking backwards, with a converging European price level, restraint in unit labor costs relative to the European norm would have meant increased returns to financial capital, and financial capital was emphatically not a scarce factor in Southern Europe prior to the crisis.”

It might have also have meant some reduction in the current account deficit, which is the source of the demand for net capital inflows.

“But, as always, it is creditors rather than borrowers who we must hold accountable for bad lending, if we want incentives consistent with good aggregate outcomes.”

Well, maybe, but only always in one and only version of the explanation – the version of always. It’s not so clear to me that current account surpluses are always to blame for current account deficits. Something one sided about that, although I guess that’s the point.

Regarding the graphs, I think it’s the slope of unit labor costs that is the most important factor in the explanation of adjustment failure – rather than any divergence from the slope of the price curve, or the idea that convergence per se should have accommodated any slope required to get there.

February 26th, 2012 at 11:54 am PST

link

Excellent post

However it only left me

with a gut wrenching sense of

the limitations of “our” science

The distribution of va thru it’s production chains is indeterminate enough

That between labor and the. Big cat called capital isan ideologies paradise and a scientists nite mare

That market driven citalism favessystemic demand constraints and credit rations

Makes me quiver with a toxic skepticism

However since your on the side of the wage class here

As a unrepentant ideologian I must add

Bravo baby bravo

February 26th, 2012 at 12:57 pm PST

link

Sorry my iPad turned that to gibberish right on the surface

No need to construe the substantive gibberish

February 26th, 2012 at 12:59 pm PST

link

I don’t get why you think internal devaluation wouldn’t work (and, for that matter, why you think external devaluation would only work temporarily). Why would it not be a long-run equilibrium that southerners have crummy capital and cheap labor while northerners have good capital and expensive labor? What reason is there to think that there would be a repeat of the cycle in which this equilibrium was disturbed by rising prices in the south based on unrealistic expectations? Surely there is such a thing as learning. Why would we expect people to make the same mistake twice? If we could turn back the clock to 1995 but endow people with the knowledge they have now, surely they would not bid up prices in the south again.

Granted, internal devaluation would not be the best solution, and it may not be feasible, but if it could be done, I don’t see any reason why it wouldn’t solve the balance of payments problem permanently (to the extent that it’s ever reasonable to talk about solving a balance of payments problem permanently).

Also, I think it’s misleading to talk about “convergence” of unit labor costs. When I look at the charts, the big anomaly that I see is the flatness of German and Austrian ULC since the early 1990’s. If the PIIGS were able to “catch up” with Germany, it was in large part because something very unusual was happening in Germany. It is not normal for unit labor costs to be flat. Of course the Germans would say it was a good thing that was happening: they grew their productivity and reformed and their labor markets and yada yada yada. While I have nothing against rapidly rising productivity and labor market reforms (and I’m not sure about yada yada yada), I’d say that the problem was that the ECB allowed German ULC to flatten. Of course the alternative (from the ECB’s point of view) would have been much more dramatic inflation in the PIIGS — but perhaps that would have been a clue that something was wrong, something that shouldn’t have been papered over by allowing Germany to disinflate.

February 26th, 2012 at 8:48 pm PST

link

Steve,

This is a good post, in response to an important article. But I think you still may be conceding too much. It is certainly true that trade balances do not reliably follow relative labor costs. But it does not follow that they must then follow relative capital costs, or some other component of costs. That trade is driven by relative costs is one of those things that gets drummed into our heads, that we really should try to get out.

Remember, not only are income elasticities often larger, and almost always more stable, than price elasticities, over horizons of a couple years or less; there’s a lot of evidence linking trade to relative growth rates over the long term. It’s perfectly possible for a country to have persistent trade deficits simply because AD grows faster than its trade partners, or surpluses because AD grows slower. In the case of Europe, while the peripheral countries did experience some inflation, the link from Euro -> low interest rates in periphery -> boom in investment (& consumption, but not government borrowing except in Greece) -> greater imports -> trade deficits, is perfectly possible without *any* change in relative prices, and may have been quantitatively more important.

February 26th, 2012 at 10:01 pm PST

link

[…] Competitiveness is about capital much more than labor – via http://www.interfluidity.com – Southern European workers do earn less overall, simply because they produce fewer or lower-value goods and services than their Northern neighbors. Unit labor costs are not the problem at all: it is the scale of aggregate output. And what determines the scale of aggregate output? Is it the laziness of workers? No, of course not. We all know that when residents of poor countries emigrate to rich ones, the same weak bodies and flawed characters that produce very little at home suddenly explode into economic vigor. The difference is “capital depth”, broadly construed to include all the physical equipment, business organization, public infrastructure, and governance that collude to enable two small hands and a broken mind to accomplish outsize things. Workers’ pay level is not the problem in Southern Europe. It is deficiencies in the arrangement of capital, again broadly construed, that have left Greece and Spain unable to produce value in sufficient quantity to compete with their neighbors. […]

February 27th, 2012 at 12:49 am PST

link

On the institution side – Spain had a CB that was well aware of the bubble going on, and tried very hard to something (I’ds say as hard as it could w/o significant political help). Still made not much difference in the long run, as ECB/EU laws just had so much more firepower.

February 27th, 2012 at 7:20 am PST

link

[…] interfluidity » Competitiveness is about capital much more than labor […]

February 27th, 2012 at 7:46 am PST

link

Excuse my ignorance, but I am not clear on what we are measuring here. What is Unit Labor Cost? Is it the cost of the workers at the production site? Or is it the aggregate of the total economic costs for production? Does it reflect the expense of paying just the employees of the producing site, or more broadly the producing company, or does it include as well the external costs of the financial system and government?

Do the relative differences between the North and South of Europe have any relation to the size of the governments budgets VS the private economy? Does the size of the financial sector have any impact on productivity? Does the size of the government or private economy have any correlation to the aggregate debt?

If government costs and regulatory obstacles or expense of maintaining the financial sector are the main driver of the North/south difference looking at Unit Labor Costs may not enlighten us as to the prime factors driving the relative efficiencies of economies. The answer you get depends on which rock you are looking under.

February 27th, 2012 at 11:55 am PST

link

@18

For starters: Spanish manufacturing wages did not increase faster than German ones… With this in mind:

Unit Labor Cost are the labor share of National Income: (total wages)/(total income); and total income is including profits and mixed income of self employed people.

This means that when wages of government employees increase, ULC go up.

This means that whenever there’s a shift from self employed to wage labor, ULC go up.

This means that when profits go down (because of an economic downturn), ULC go up.

This menas that when there is a shift in the composition of manufacturing (for instance a shift from labor to capital intensive sectors of production, as happened in Ireland)ULC will go down

Non of the events mentioned above will influence competetiveness however.

ULC is a lousy metric to investigate competitivess. It should not be used to do this.

See also these posts:

http://rwer.wordpress.com/2012/01/23/europe-constraining-wages-or-constraining-flows-of-capital-interesting-graphs/

http://rwer.wordpress.com/2011/07/28/productivity-in-europe-two-graphs/

February 27th, 2012 at 4:36 pm PST

link

It seems to me that greece should have allocated much money to transport infrastructure. Greece has a relatively long coastline and a warm sunny climate. That should be its strength. But much of Greece is hard to get to, and holidays are short (and water is also a problem). Germans go mostly to Spain or Turkey. That is both a challenge and an opportunity. Unfortunately the opportunity was wasted.

February 28th, 2012 at 4:46 am PST

link

William J Mckibbon

So f…ing what?

Do the same comparison with the price of Picassos.

Now compared to oil – that has some relevance.

February 28th, 2012 at 4:49 am PST

link

Andy Harless –

German disinflation (I live in Germany) is to a substantial degree being driven by the fall of the iron curtain. Competition from Poland (in trades in particular) and Slovakia (manufacturing) are particular threats. Not to mention the increased labour supply from reunification. And the infrastructure investment in East Germany has in a sense made it worse. Those impacts are now beginning to wear off.

February 28th, 2012 at 4:53 am PST

link

Merijn Knibbe

“Unit Labor Cost are the labor share of National Income: (total wages)/(total income); and total income is including profits and mixed income of self employed people.”

No they are not. They are nominal wages / productivity (i.e. wages per unit output). What you are saying is true for wages deflated by the price deflator.

February 28th, 2012 at 5:08 am PST

link

@Reason,

The Eurostat definition of ULC:

“Real unit labour cost growth

This derived indicator compares remuneration (compensation per employee in current prices) and productivity (gross domestic product (GDP) in current prices per employment) to show how the remuneration of employees is related to the productivity of their labour. It is the relationship between how much each “worker” is paid and the value he/she produces by their work. Its growth rate is intended to give an impression of the dynamics of the participation of the production factor labour in output value created. Please note that the variables used in the numerator (compensation, employees) refer to employed labour only, while those in the denominator (GDP, employment) refer to all labour, including self-employed.”

I.e.: (average wage)/(average GDP). Mind, however, the last sentence – its a very messy indicator.

February 28th, 2012 at 2:47 pm PST

link

[…] as store of wealth Defending Independent Invention Competitiveness is about capital much more than labor Incentives Doublethink Share this:TwitterFacebookLike this:LikeBe the first to like this […]

March 1st, 2012 at 6:01 am PST

link

Quote: “The European periphery was rendered uncompetitive by toxic patterns of capital allocation”

And that was not coincidental. Conspiracy? No, the simple logic of national interest. I’m trying to imagine a German Bank financing INDUSTRIAL projects in Greece. Or at least the ECB (which is in Germany) supporting banks which would finance such projects. I’m trying really hard to imagine it… but I can’t.

A lot of Greeks kept their money in Germany and France… THEY financed the mercantilist crooks. Another war was waged against Greece, Spain, etc. Economic Nazism of sorts.

The key is to build up real, productive capital, to institute balanced trade and to control your own currency in your own banks. “Internal devaluation” is nonsense, it cannot support domestic investment and it cannot limit the capital outflows.

It may take getting out not only from the EZ but also from the EU to achieve this. EU has the most corrupt regulations of any economic bloc.

Thank you for this article, a very good piece. I have more on the topic on my blog.

March 4th, 2012 at 1:11 am PST

link

It is a question of common sense. You cannot expect to increase productivity very much (or at all) by decreasing wages, unless you are a complete idiot or you compensate lower salaries with higher insurance costs and other expenses. Since competitivity is measured as a function of labor costs and there is not much room, if any, to increase productivity by lowering wages, the only way to increase productivity and/or competitivity is to increase investments, particularly in capital intensive activities. If every country focused on capital intensive investments we would end in the most stupid competition ever, just trying to produce the same set of capital intensive things in every country. Thus, the rethoric of competitivity and productivity, is absurd besides anti-labor.

March 6th, 2012 at 8:05 am PST

link

@ Eddy (9).

But as Steve argues, those effects are short lived, and as you mention there is a tendency in Spain to divert capital to R.E. While you believe that the cause was higher salaries in manufactures, I make the case of (perverse) incentives in residential construction industry due to excess subsidies, mortgage rules, and property rules that favour (almost) enless real appreciation of houses.

March 6th, 2012 at 9:52 am PST

link

Thx for the excellent post which gives brain food for days and weeks.

SRW: “Looking backwards, with a converging European price level, restraint in unit labor costs relative to the European norm would have meant increased returns to financial capital, and financial capital was emphatically not a scarce factor in Southern Europe prior to the crisis.”

Increased returns to capital was exactly what was achieved by the European norm, as the labour income share declined significantly in most Eurozone countries between 1980 and 2009/2010 according to OECD data (no link available). Greece was an “underachiever” in this regard.

Labour Income Share Ratios:

0,857 (1980) – 0,672 (2010) – Austria

0,743 (1980) – 0,693 (2010) – Belgium

0,713 (1980 – 0,683 (2010) – Finland

0,787 (1980) – 0,673 (2009) – France

0,758 (1980) – 0,681 (2010) – Germany

0,549 (1980) – 0,643 (2010) – Greece

0,793 (1980) – 0,633 (2009) – Ireland

0,795 (1980) – 0,684 (2010) – Italy

0,683 (1980) – 0,593 (2010) – Luxembourg

0,763 (1980) – 0,685 (2010) – Netherlands

0,703 (1980) – 0,667 (2010) – Portugal

0,743 (1980) – 0,625 (2009) – Spain

Should we interpret this data as the Eurozone part of an ongoing global wage race to the bottom in which countries have to expect a downward spiral of increasing current account deficits and decreasing investment when they don’t run fast enough?

In many Eurozone economies a basic agreement among neoliberal-conservative and social democratic elites on a ‘profit-led growth’ strategy seems to exist. Staying in this race, although impoverishing for most wage earners, is perceived as advantageous for the country and their careers.

March 8th, 2012 at 4:07 am PST

link

Great Post, Idea, Numbers, Everything!

Internal devaluation…done the laissez faire way, of course that means unemployment that increases until finally those on top get the ax too. Max Pain. Somehow we never go all the way there, along the way something breaks, TR or FDR appears, will that happen this time? Nobody says this now: what about internal devaluation through wage and price control as part of comprehensive industrial planning? If so, I’d like to see it all on the table, banker’s income, haircuts too.

Con: I’d never even heard the strawman argument about wages. I thought the bogus issue (as often outlined by Krugman) is belief that the problem was profligate Government Spending in the southern states. Rarely suggested is inadequate tax collection. There’s Greece in a nutshell.

March 9th, 2012 at 4:45 am PST

link

I am willing to provisionally accept the argument that Greece’s relatively low national productivity is due to capital and governance shortcomings, rather than to any shortcomings in the Greek labor supply. Let’s follow that idea and see where it leads.

I would further say that the systemic inefficiency observed in Greece is not being prevented or curtailed by the government there. If we set ourselves the long-term goal of improving Greek governance and institutions, then artificially sustaining the inflated money supply to the present government is a dubious way to get there.

“Internal devaluation” means, in essence, that individual Greeks must begin consuming less than they produce — by quite a lot, for quite a while — in order to create surplus wealth to repay (plus or minus) bondholders who earlier helped them consume more. How else can debts be repaid?

So the alternative to a consumption cut now is a consumption cut later, or a default. A later consumption cut will only be more painful, unless Greek productivity can somehow greatly increase between now and then. But no one seems able to propose any mechanism beyond “then a miracle occurs” to increase productivity.

It certainly does not seem that sending additional cash to prolong the current system is the magic bullet that will improve either institutions, or expectations, or productivity, or governance — regardless of whether the sending is done by Greek taxpayers, by private bondholders, or by the Troika.

The latter are in fact attempting to use their financial leverage to improve governance (from some perspective). But this is exactly what Mr. Waldman is decrying.

March 9th, 2012 at 1:28 pm PST

link