Visualizing Keynesian & Monetarist recessions

So this will be an unusual post, more picture book than essay. Plus, it’s interactive! If you are willing to install the Mathematica plug-in, you can be the central banker / fiscal authority of your very own graphical economy!

As readers may have noticed, I’ve been thinking lately about Keynesian and monetarist business cycle theories. I don’t mean to wholly endorse these theories. I’ve some sympathy for Austrian-ish or “recalculationist” ideas too. But I do think there’s merit in the idea that recessions frequently occur because aggregate expenditure is, for whatever reason, inadequate. I’ve been frustrated by all the squabbles, between self-styled Keynesians and post-Keynesians, academic defenders of mainstream central banking and the more risqué internet “quasimonetarists”. My view is that these groups are more alike than different in their economic ideas, but that they manufacture controversies to signal political affiliations and institutional preferences regarding how and by whom policy decisions should be made.

So, I’ve been trying to understand the ways in which these theories are alike and different, and organize my own thinking about how to evaluate different policy proposals. I’m a pretty visual thinker, but for a variety of reasons, I’ve never found the most common ways to diagram Keynesian ideas — IS/LM and AS/AD — especially helpful. In my mind, I found myself falling back on Econ 101 style supply and demand graphs, where the commodity of interest, whose “price” and quantity is to be determined, is nominal expenditure. I’m sure this is not a novel approach, but I’ve gotten a lot of mileage out of it. Perhaps you won’t find it entirely useless.

The hardest part is to make sense of the basic set-up, so let’s talk it through.

The Basics

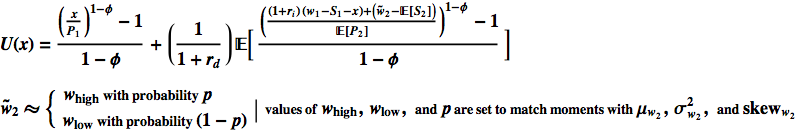

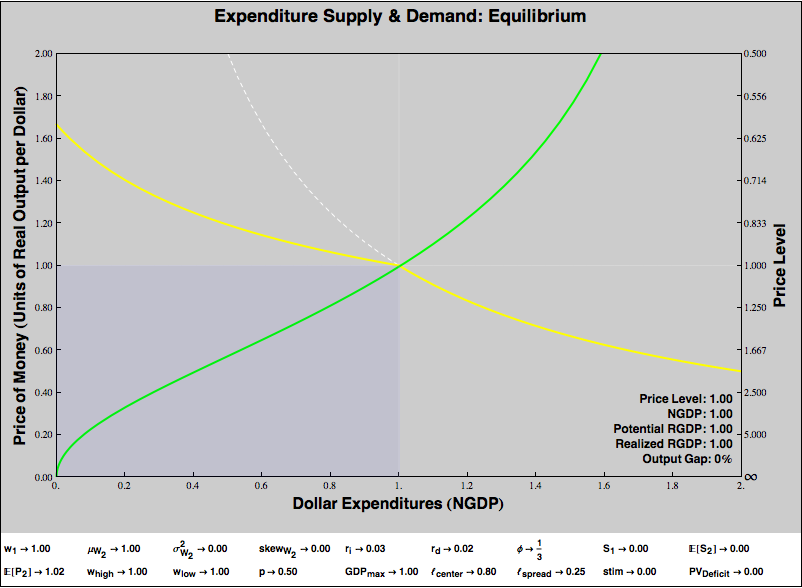

Below is a diagram of an economy in which demand shortfalls do not lead to output losses and money is neutral, because there are no price rigidities.

The downward-sloping yellow line is a demand curve, and the upward-sloping green line is a supply curve. Hopefully that seems familiar. However, we’re in a bit of a mirror universe, because we are graphing the supply and demand of expenditure. So the “expenditure suppliers”, represented by the green curve, are economic consumers. They supply dollars, for a “price”, which is some quantity of real goods and services. The “expenditure demanders” are economic producers. They demand dollars, but are only willing to offer so many goods and services for a buck. The equilibrium, the point where the two lines intersect, shows the price of a dollar, in real goods and services, that equalizes producers’ demand for money and consumers willingness to supply it.

For example, suppose that, at equilibrium, you can buy two widgets for a dollar. So the price of a widget is 50¢. But the price of a dollar is two widgets! Note the relationship — the dollar price of widgets is

(1 / PRICE_OF_DOLLARS_IN_WIDGETS)

This relationship is reflected on the axes if the graph. The left axis shows the price of money in real goods. If money is “expensive”, if you have to offer a lot of real stuff to get a dollar, that corresponds to a low price level, think deflation. Conversely, if money is “cheap” — if the equilibrium falls towards the bottom of the graph — then that means goods and services are expensive, think inflation. The right-hand axis shows the conventional price level, which rises as you travel vertically down the graph. As the price of money in real goods and services falls to 0, so you’d give up a dollar for next to nothing, the price level on the right-hand axis rises to infinity.

The X or quantity axis of the graph indicates how many dollars will be spent at the equilibrium. This has a very natural interpretation as nominal GDP. So, from the equilibrium point on the graph, we can read the price level (on the right axis) and the nominal GDP directly.

Real GDP is represented by the area of the bluish rectangle in the bottom left corner of the graph. To understand why, recall that real GDP is just

(NGDP / PRICE_LEVEL)

But the Y axis of the graph is

(1 / PRICE_LEVEL)

So the area of the bluish rectangle is

NGDP × (1 / PRICE_LEVEL) = (NGDP / PRICE_LEVEL) = RGDP

So what determines the shape of the expenditure supply and demand curves? Let’s start with demand. Suppose the economy produces at capacity and there are no “rigidities” to prevent the sale of all output. Producers will always accept however many dollars are on offer and sell the maximum achievable RGDP. Then

NGDP × (1 / PRICE_LEVEL) = MAX_RGDP

(1 / PRICE_LEVEL) = (MAX_RGDP / NGDP)

Since the inverse price level is our Y axis, and NGDP is our X axis, the function that describes our no-rigidity demand curve is just

Y = (MAX_RGDP / X)

which is the graph of a grade-school hyperbola. We’ll modify this shape a bit, when we start thinking about price rigidity. But let’s hold off on that.

What determines the shape of expenditure supply? That’s where all of the action is in terms of fiscal and monetary policy, and we’ll graph lots of funky shapes below. But fundamentally, the answer to this question is easy. Imagine a world of consumers, each of whom must decide how much to spend now and how much to save for the future. Suppose we can characterize consumers’ “intertemporal preferences” with a utility function. Then we can compute how much each consumer will spend. Naturally, that utility function will take into account the current price level, among other parameters. If we hold other parameters constant, we can compute how expenditure varies with the current level of prices. We add up all consumers’s expnditures and plot them on the X axis, against (1 / PRICE_LEVEL) on the Y axis. That gives us our expenditure supply curve.

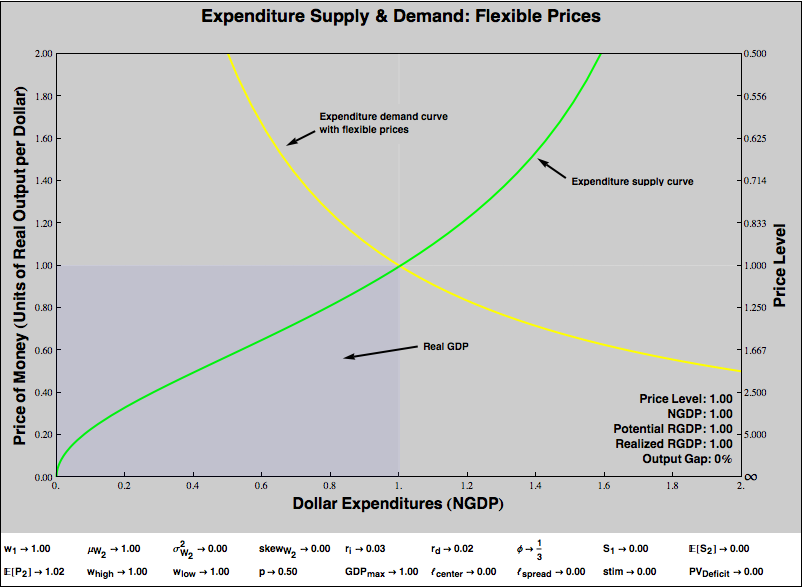

Immaculate Deflation

In the graph above, everything has been normalized to one. The graph shows one unit of real goods “buying” one dollar of expenditures, for a price level of one. Suppose that consumers become more reluctant to spend money, that is, they perceive the marginal opportunity cost of parting with money as increasing. The result would be an “immaculate deflation”, in that expenditure would fall, but so would the price level, so that the reduced expenditure would still purchase all the economy’s real product, and RGDP would not fall at all. Here’s the graph:

Note expenditures have fallen, but the quantity of goods offered for each dollar has risen. Real GDP — the area of the bluish rectangle — has not changed.

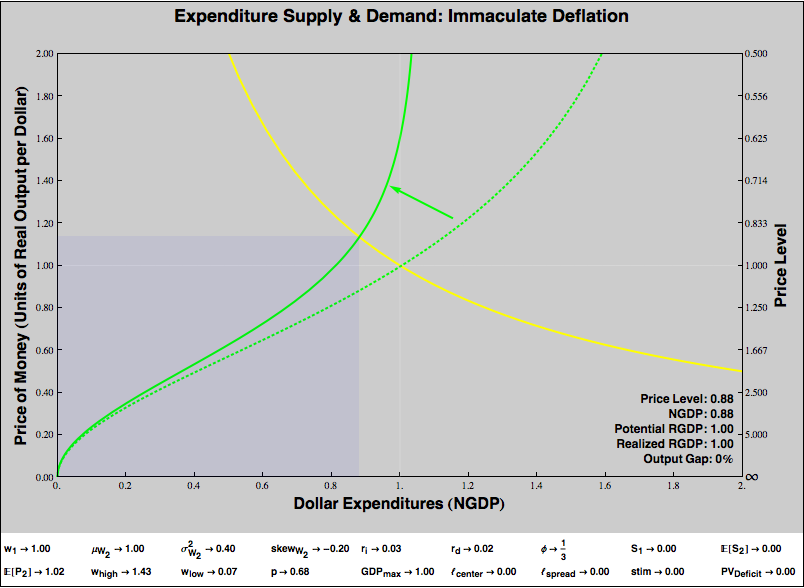

Price Rigidity

In the real world, when nominal expenditures fall, the quantity of goods offered for a dollar doesn’t rise enough to compensate. The quantity of goods purchased actually decreases. Let’s graph that:

The expenditure supply curve is identical to that in the previous graph. However, the shape of the expenditure demand curve has changed. There is now a “kink”, that begins (as I’ve drawn it) just under the original equilibrium expenditure of one. Our steepened expenditure supply hits the kinked region, forcing that the quantity of goods offered for a dollar to be lower — or the price level to be higher — than in the previous graph, with its unkinked, flexible-price expenditure demand curve. This means that, given the reduced level of expenditure (caused, as before, by the steepening of the expenditure supply curve), the quantity of goods consumers purchase is less than the economy’s capacity. We observe a fall in real GDP and a recession.

As before, the area of the bluish rectangle represents Real GDP. The dotted white line shows the flexible-price expenditure demand curve, while the yellow line is the expenditure demand curve that actually obtains, with its kink and price rigidity. The reddish rectangle represents the output gap: the area that should have formed part of GDP, but does not because of the price rigidity.

In this example, the price level has from 1 to 0.96 (a 4% deflation), and real GDP has fallen by 10%. Note that in the previous example, with the same steepened expenditure supply curve but flexible prices, the price level fell even farther (to 0.88, a 12% deflation), but RGDP was unaffected. There’s an important bit of intuition here. We often imagine that deflation causes recessions, and indeed in our graph, we can see that deflation is associated with recessions. We would only see an output gap when the equilibrium fell before the kink in the curve, which is always a price level lower than our original price level. But under flexible pricing, the deflation would have been more severe, without harming RGDP. It is not too much deflation that creates the output gap, but too little deflation given the fall in expenditures! Tepid deflation is a marker of recessions, but it is the decline in nominal expenditure, in NGDP, that drives the show.

If you are wondering where the shape of the sticky-price expenditure demand curve comes from, see my earlier post on sticky prices. Basically, to generate the expenditure demand curve with price rigidity, I assume that industry leverage is uniformly distributed over some range, that firms in industries set minimum prices based in their degree of leverage, and that firms’ capacity is constrained in the short term. If you don’t buy that story, but agree that prices are sticky downward but not so sticky upward, then you can take the shape as an arbitrary qualitative depiction of that.

The Expenditure Supply Curve

Expenditure supply is where the action is in making sense of Keynesian and monetarist interventions. The nice thing about this framework is one can posit any intertemporal utility function you like for agents in your economy and then compute the shape of the expenditure supply curve as you vary parameters.

For the purpose of this exercise, I’ll adopt an unrealistic but illustrative utility function presumed to be shared by all consumers. Consumers will face a two period, rather than infinite horizon optimization problem. Their behavior will be based upon a number of factors, all of which are treated as exogenous parameters:

- An interest rate ri which determines the Period 2 value of money not spent in Period 1.

- An current wage w1, in nominal dollars.

- An expected future wage μw2, in nominal dollars.

- Variance of the distribution of future wages, σw22

- Skewness of the distribution of future wages, skeww2

- A current price level P1

- An expected future price level E[P2]. (Oddly, the current price level is what we are trying do determine. The expected future price level is known, and helps to pin the present price level.)

- A current taxes-and-transfers surplus S1.

- An expected future taxes-and-transfers surplus E[S2].

- A discount rate rd, which is the rate at which consumers discount future utility.

A “real” model wouldn’t treat all these parameters as free. For example, perhaps the expected price level is dependent upon current interest rates, or fiscal policy. My goal here isn’t to present a falsifiable model of consumer behavior, but to illustrate what proponents of various interventions are claiming, and explore under what circumstances they would or wouldn’t work. We will find, for example, that, running a Period 1 taxes-and-transfers deficit while holding interest rates constant increases Period 1 expenditures. However, this effect will be mostly undone if the Period 1 deficit must be balanced by a Period 2 surplus. We don’t wish to take a position here in the “Ricardian equivalence” debate. Allowing the two deficit parameters to vary freely, rather than enforcing some hypothesized relationship, permits us to illustrate the claims of partisans on both sides.

The utility function I’m using to compute the expenditure supply function is shown below.

Our variable x represents nominal dollar expenditures.

There are a bunch of things about this utility function that are crappy, but I think it’s good enough to show how changes in parameters might affect a expenditure supply curve, and offer some intuition about how various interventions might work.

Although I’m using just one utility function here, a nice thing about this framework is that it need not rely on a representative agent. What we will derive, after all, is a Marshallian supply curve. We can define populations of agents with different parameters or preferences and combine the supply curves by “horizontal addition”.

Visualizing Changes in Expenditure Supply

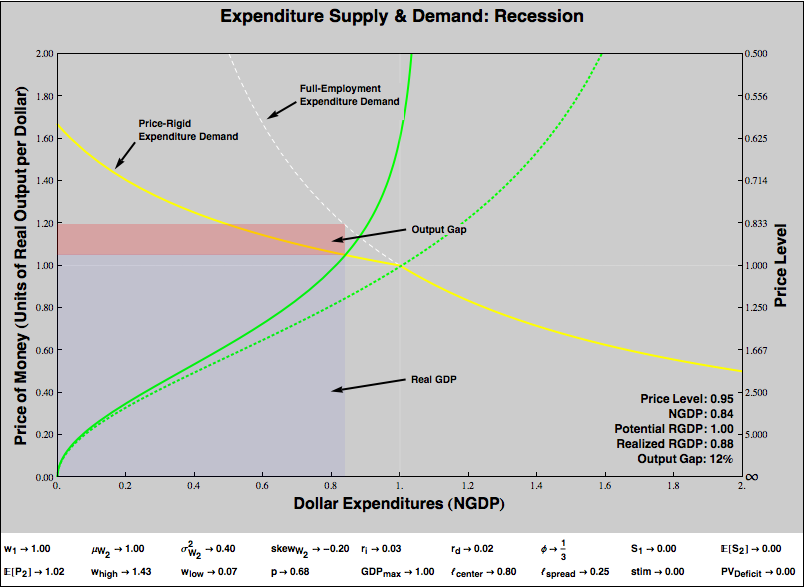

Let’s start with a graph of an economy characterized by price rigidity, but which is currently at “full employment equilibrium”. (The scare quotes are because I am not explicitly modeling labor, so by full employment I just mean that the economy is producing at capacity.)

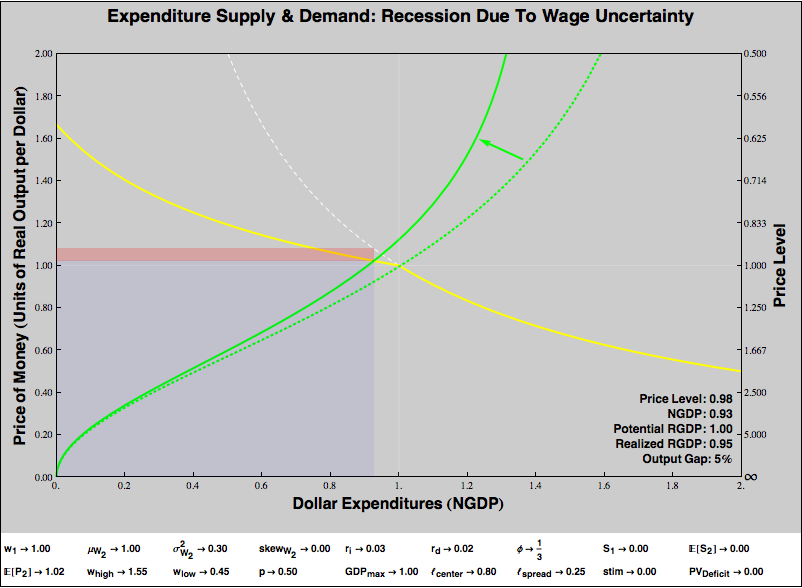

Now, suppose that for whatever reason, uncertainty surrounding future wages increases:

The expenditure supply curve steepens. Consumers become more reluctant to part with dollars, as they have been made worse off in the future and prefer to save. Unfortunately, after this steepening, the expenditure supply curve now intersects with the sticky-prices region of the expenditure demand curve. The resulting equilibrium is recessionary; the economy experiences a 5% output gap.

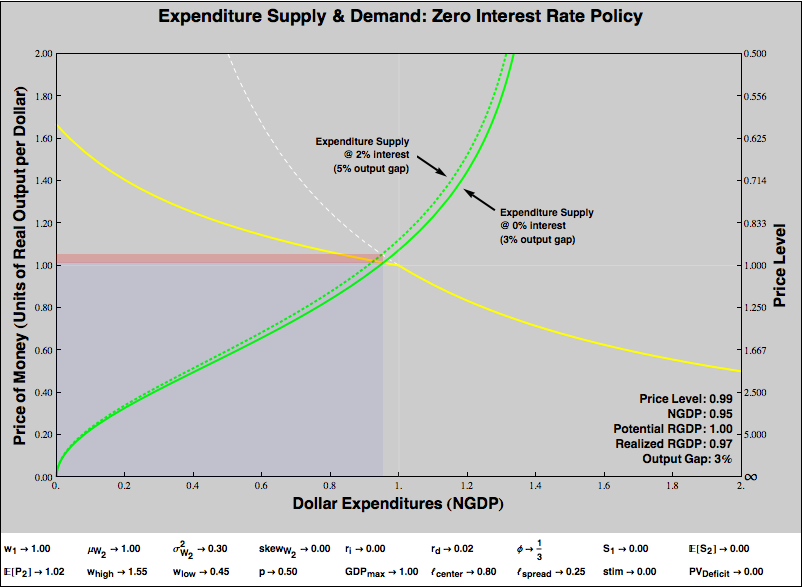

What kind of interventions might we try to fix this? Conventionally, our first resort is to discourage financial saving and promote current expenditures by reducing interest rates:

Dropping interest rates to zero helps, but it turns out to be insufficient, a 3% output gap remains. We have entered the liquidity trap, if you believe in such a thing.

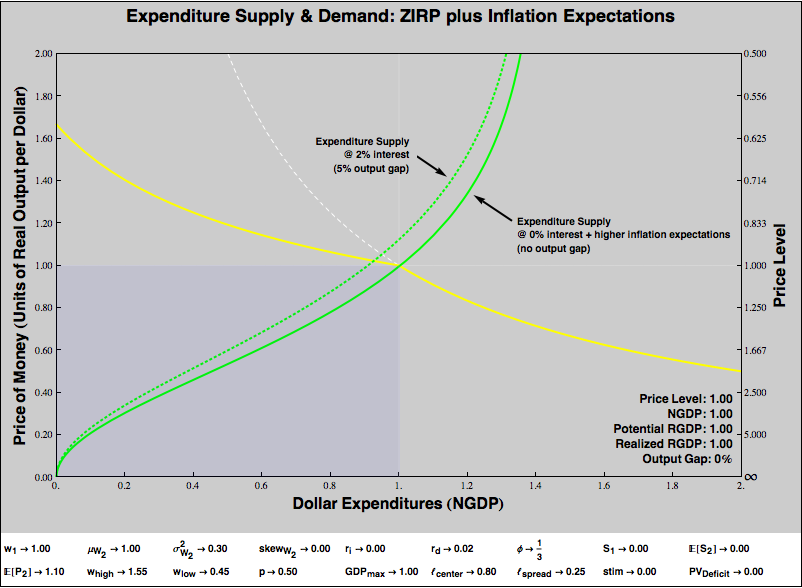

But we are certainly not out of potential of interventions. Suppose we believe that the central bank is very, very good at setting expectations. Okay, if it were really great at that, it could just reverse the shock to consumers’ expectations of wage uncertainty and we’d never leave our initial equilibrium. But suppose the central bank can’t do that, but it can manage expectations of the price level. Then…

That worked! Yay monetary policy, still potent at the zero bound! But, we should be careful. We’ve assumed the central bank could set price level expectations. That’s much less sure than assuming it can set interest rates. Plus, perhaps engineering an uptick in inflation expectations is hazardous. Perhaps the central bank cannot set expectations precisely, so that there is a hazard of overshooting and generating inflation rather than just restoring equilibrium. Perhaps there is value to keeping inflation expectations “anchored”, and the change in expectations required to restore equilibrium would upset that anchoring. So, it’s worth considering alternatives.

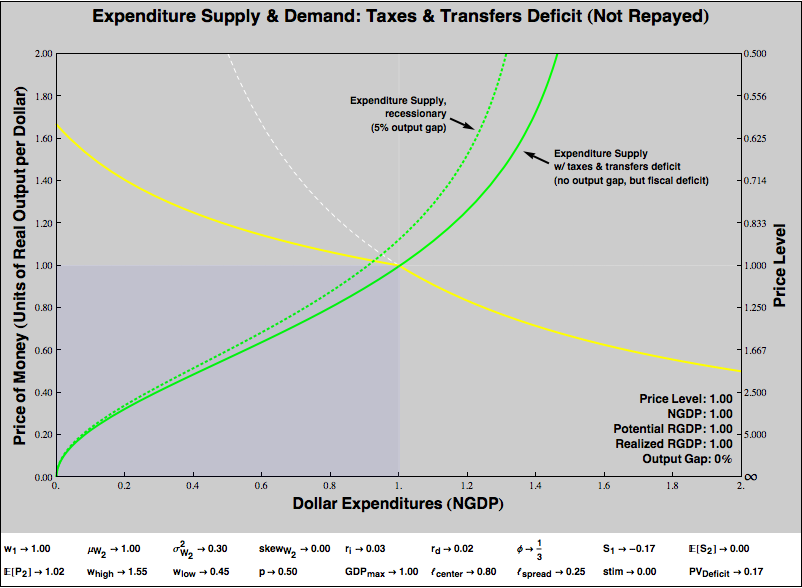

Let’s go back to our original disequilibrium, and let the MMT-ers have their way. Suppose that to counter the 5% output gap, the government reduced taxes and/or increased transfers, to run a deficit. Could that work? Absolutely.

However, there’s a catch. My two period setup is pretty Ricardian. Encouraging private spending through a taxes and transfers deficit in Period 1 only works if that deficit is not repaid by running a surplus in Period 2.

However, in the real world, deficits needn’t be repaid via prompt surpluses, and economies (measured in nominal dollars) often grow faster than the interest rate paid on public debt. In this case, debt effectively repays itself over time, without ever requiring surpluses. The core new debate over MMT as well as a very old debate over “Ricardian equivalence” turn on the degree to which people have (or by tax policy can be made to have) a special willingness to hold currency and government securities even when doing so implies an opportunity cost relative to a hypothetical asset that matches the economy’s growth rate. I think the case is very strong that, under many circumstances, people are willing to bear that cost, not least because a hypothetical asset that earns the economy’s growth rate with little risk does not exist, and most people are more concerned with managing risk than with maximizing return.

(Note: If you think transfers that will never be paid for in taxes must increase the expected future price level, then in the immediate term, all that does is to reduce the scale of the program necessary to eliminate the output gap! An increase future price level expectations, like the unfinanced transfer itself, renders the expenditure supply curve shallower, helping carry our equilibrium out of the recession region. Of course, we are observing a one period snapshot of the economy, and there may be long-term bad consequences to “unanchoring” the price level. That’s beyond the scope of our little visualization, but that doesn’t mean we shouldn’t worry about it.)

My little experiment is not so friendly to a taxes-and-transfers-based “hard Keynesianism“, which prescribes prompt surpluses to offset cyclical deficits. In my toy model, a reduction of expected future income is very much like a reduction of present income, as agents can borrow and save at “the” interest rate. But this is not realistic: real humans pay more to save than to borrow, and may face outright credit rationing.

I give lip service to uncertainty by calling the future surplus “expected”, but I don’t actually model it as uncertain, as wages are the only random variable in my toy utility function. If I had, the cost of future surpluses to consumers would be even greater, and it would make “hard Keynesianism” look even worse. So implemented in terms of taxes and transfers, ignoring the wedge between saving and borrowing costs, and holding wealth distribution constant, it’s hard to see how one could ease a recession by running deficits which are expected to be balanced by prompt surpluses. Of course, these assumptions needn’t hold. We do not have to restrict ourselves to taxes and transfers, but can have government deficit-spend on real goods and services directly. Savers do, in fact, face liquidity and borrowing constraints that “hard Keynesianism” can overcome by effectively using the government’s balance sheet to borrow on behalf of consumers. And when we tax-and-transfer, we can also redistribute.

I yet haven’t tried to model consumers facing borrowing constraints. But I have played with variations in which government spends, rather than transfers its deficit, and with redistribution. So let’s look at those.

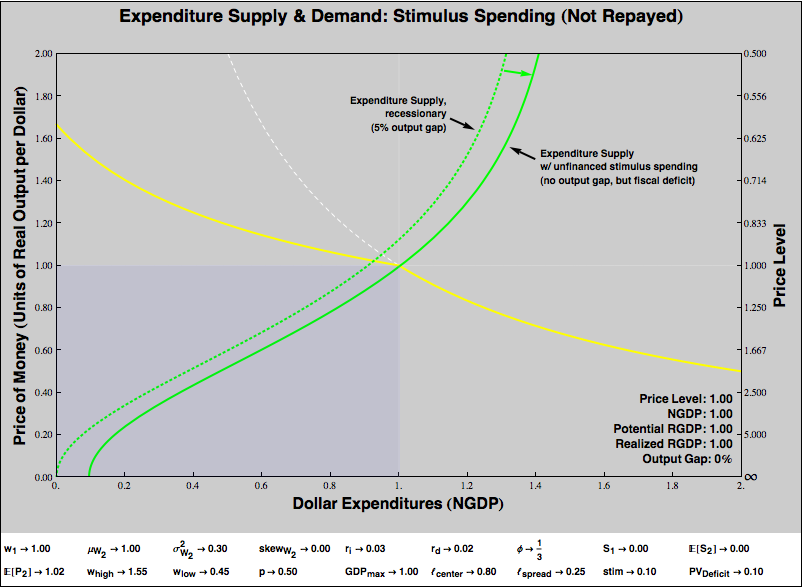

Stimulus Via Direct Government Expenditure

The economy’s true “expenditure supply” includes the inclination of government to directly purchase goods and services. Thus far we’ve ignored that. If we hold government’s propensity to spend invariant to the parameters of our toy model, ignoring government purchases doesn’t much hurt our analysis. But is that a realistic assumption?

It would be hard to model how government’s inclination to spend varies, and upon what parameters that variation depends. However, governments do sometimes respond to recessions by adopting stimulus programs, which in rough approximation we can model very easily.

Here’s how we’ll do it. We’ll imagine that the government first chooses the quantity of dollars it will spend on real goods and services, and then chooses what it will purchase. That sounds unobjectionable, but it’s really very sneaky, because it means that stimulus spending is not a function of the quantity of real goods and services offered for the money. So the expenditure supply curve due to stimulus is vertical. Including expenditure due to government stimulus simply shifts the expenditure supply curve to the right by the quantity of nominal dollars appropriated!

Let’s see, in the simplest case, how a stimulus program that is not expected to be paid for from an increase in taxes can combat a recession. The dotted green represents the expenditure supply curve in our 5% output gap recession, and the solid green line illustrates the intervention.

Note that the expenditure supply curve in this graph is different from all of our previous graphs. For ordinary consumers, the quantity of expenditure supplied always goes to zero as the price of a dollar in terms of goods and services falls to zero. The curve bottoms out at the origin of the graph. To put things in more familiar terms, if the price level today is infinite — you get literally nothing for a dollar spent — and the price level tomorrow is expected to be finite, you’d spend precisely nothing today. With stimulus via direct spending, the government commits to current-period expenditure regardless of the price level. The expenditure supply curve now bottoms out to the right of the origin.

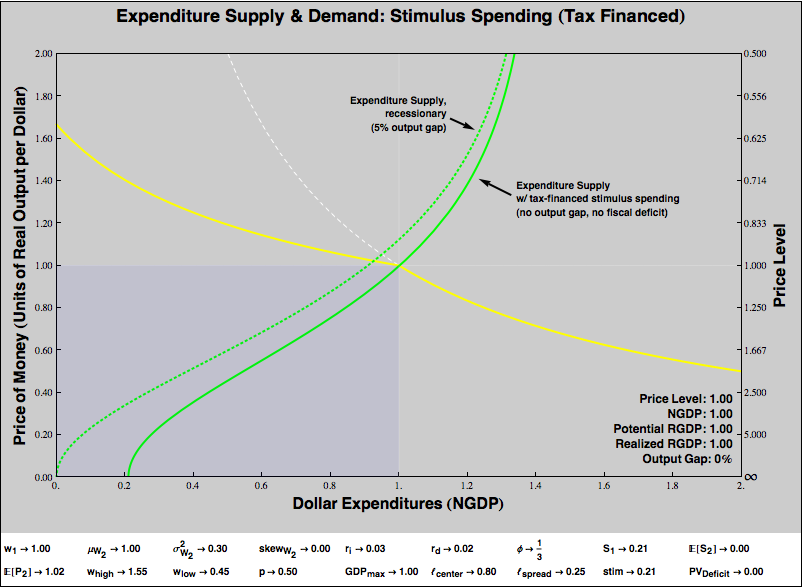

Unlike a taxes-and-transfers deficit, stimulus via direct spending “works” under our toy model even if it is paid for via a fiscal surplus. It doesn’t matter, under our model, whether the spending is paid for out of current period taxation or future taxation. That is, our model suggests that it might be possible for a government to balance its budget in the teeth of a recession and still stimulate its way out of the recession!

There is a hitch, of course. Our balanced budget is stimulative if and only if spending is increased and balance is accomplished by increasing current taxes. Cutting spending to balance the budget would be contractionary under our framework, while increasing taxes to fund spending is expansionary.

The intuition is pretty straightforward: Consumers divide current wealth between spending and saving. If consumer saving decisions compose to insufficient current spending to avoid recession, the government can preempt those choices by taxing current wealth and spending the entirety of the proceeds.

A few issues and caveats —

- Compare the graph above to the previous graph, where the stimulus spending is not funded by taxes. The X intercepts show how large the government’s spending program must be to eliminate the output gap. Unsurprisingly, government must commit to a great deal more spending to render a funded stimulus effective than it would need to for an unfunded stimulus.

- If the spending program were funded by future period taxes rather than current period taxes, the graph would look nearly identical, given the near-perfect substitutability of present and future money in our model. However, as we discussed above, in the real world, consumers find it expensive or impossible to borrow from the future in recessions, so transferring wealth to current consumers and taxing in the near future to pay for it may be directly expansionary. If that is so, then the scale of government spending required to cover the output gap would be smaller if the spending is paid for out of future taxes rather than out of present taxes.

- If a government commits to large nominal expenditures irrespective of what is to be purchased, indiscriminate spending decisions might degrade the quality and value of current output. If so, effect of the increase on current expenditures might be undone, partially or completely or worse than completely, by a supply-side losses. See “supply and technology shocks” below for an example.

Distributional Effects

Part of my motivation in developing this framework was to come up with a way of conveniently analyzing distributional effects. We can compute different expenditure supply curves for subpopulations of different wealth levels, and “horizontally add” those curves to get the economy-wide expenditure supply. I thought I would easily be able to define some very rough distribution parameter, and show how redistribution affects expenditure supply.

I began with a very strong prior: I believed, and still believe, that the poor are much more likely to spend out of current income than the rich, so that redistribution from rich to poor would increase current expenditures (that is, render the slope of the expenditure supply curve more shallow). To get a quick and dirty take on distribution, I compared two economies, one in which all the wealth was held by a single individual, and a second in which the wealth was equally distributed among many individuals. I expected a shallower curve in the second case.

But that is not what I found, under the utility function above. In fact, it is easy to show that, holding total real wealth (both current and expected future) constant, the expenditure supply curves are identical if the economy contains just one spender (while everyone else starves) or a perfectly equal distribution of wealth. So have I revised my priors?

No, not at all. Instead, I’ve understood deficiencies in my utility function, deficiencies that I think are shared with most utility functions used to build macro models. Why is expenditure supply constant, regardless of distribution? It’s pretty simple really. Under the terms of the model, agents are perfectly forward-looking and all wealth must be spent eventually. Intuitively, we think poor people will spend money today if we put it in their hands because the absolute cost of not spending — going hungry, for example — is large. But, given the structure of my and most macro models, agents don’t evaluate current expenditure against absolute gains in present utility, but against opportunity costs in future utility. If an agent is poor, sure, not eating today has a large cost. But eating today exacts a similarly large cost from the still-poor-me of tomorrow. A rich agent gains little by eating a bit more today, but her cost in future consumption for that benefit is similarly low. Under my utility function, as long as the two agents discount future utility identically, they will make precisely the same tradeoff between expenditures today and expenditures tomorrow. So a poor person, despite starvation, will be just as disinclined to spend current wealth as a rich person. The poor person will balance starvation tomorrow against hunger today, and save some fraction of her wealth. The rich person will balance the pleasures of a bon bon tomorrow against a cookie today, and save precisely the same fraction.

I think this is entirely unrealistic, but what’s interesting is to articulate why. Let’s think about it. In my model, all agents live for precisely two periods, no matter how much or how little they consume. In the real world, insufficient consumption today implies death and zero consumption in the future, regardless of how much a person might have saved. So a realistic model needs some concept of subsistence, such that as present consumption falls and the probability of death increases, the value of future savings is increasingly discounted. More generally and less drastically, future wages in my model are stochastic, but independent of present consumption. But that makes no sense. My ability to earn future wages depends upon my current expenditures. My distribution of future wages is dramatically different if I have a home, decent clothing, a telephone, or an education, than if I do not have these things. Ultimately, I need to add to my consumers’ utility function some notion of investment expenditure that impacts future wealth, rather than restricting the choices to pure consumption and financial savings for interest. And there should not be a single, economy-wide investment return, but each individual’s returns should (usually) be diminishing in wealth. My first dollar of expenditure buys me the ability to survive into tomorrow and enjoy potential future wages; its return is very high. Direct investment of my millionth current dollar might buy me an additional nice suit or make some marginal contribution to a business, but its effect on my future wealth is likely to be small. If I include this sort of direct investment in my model, I think I’d generate the expected relationship between poverty and a bias towards current expenditure. But that’s an exercise I’ve not yet done.

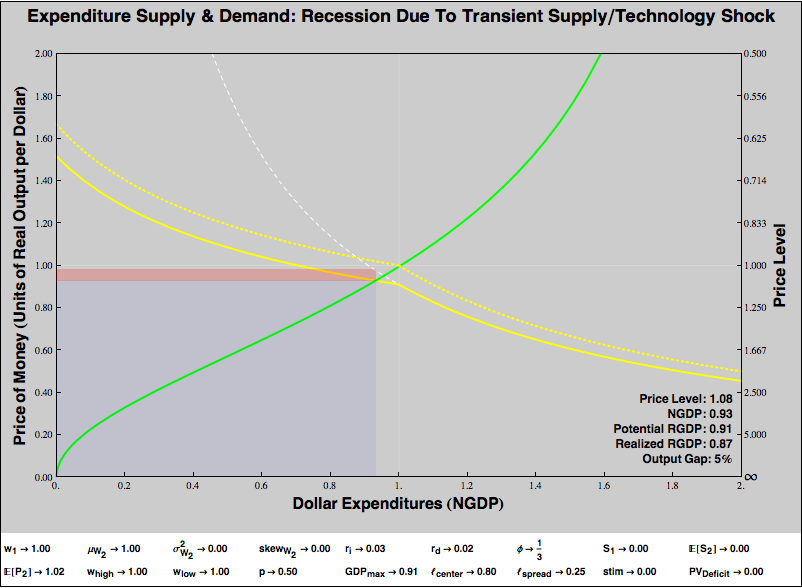

Technology and Real Supply Shocks

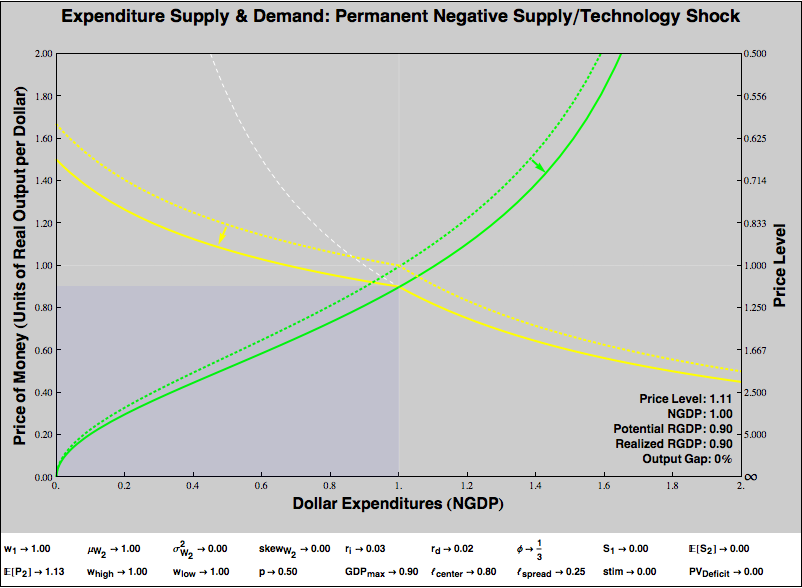

The supply side of our economy is graphical represented by the yellow expenditure demand curve. That curve is based on a hyperbola, whose numerator is the capacity of the economy in units of real output. A negative real supply or technology shock yields a recession, without any change in consumers’ willingness to spend:

Note that the output gap is 5%, just like demand-shock recession we’ve illustrated in previous graphs. However, this recession is actually much worse. The real output of our economy has fallen by 13%, not by 5%. The negative supply shock eliminated almost 9% from our potential output. Plus, even though the expenditure supply curve has not changed at all, the shift in the expenditure demand curve pushed the equilibrium onto that curve’s rigid price region, generating an output gap of 5% of our diminished potential output (about 4% of our original output) in addition to the loss of real capacity. In response to a negative supply shock, increasing consumers’ willingness to spend can eliminate the loss of output due to price rigidity, but cannot affect the loss of real capacity:

It’s worth commenting on how the shape of the expenditure demand curve as it shifts in response to a supply shock. By hypothesis, the “kink” in the curve is a function of nominal indebtedness. A firm that requires a dollar of revenue to service its debts doesn’t reduce the price of its total output below a dollar, even if a technology shock diminishes the quantity or quality of that output. So the kink stays where it began, at nominal expenditure of 1.

Yet consumers’ willingness to spend is a depends on the value of real output provided. Holding constant expectations about the future, consumers are less willing to provide that dollar of current expenditure for less or worse stuff. So despite a higher current price level — which you might think would ease the burden of servicing on nominal debt — the diminishment of nominal expenditure occasioned by transiently higher prices (the left-shift of the equilibrium) means that firms have a significantly harder time servicing their debts.

Note that, perhaps counterintuitively, our output gap arises because consumers are optimistic that the real supply shock is temporary. If consumers expect the supply shock were permanent, and therefore that the future price level would rise along with the present price level, a demand effect offsets the supply effect, and the output gap disappears. Consumers become more willing to supply expenditures now because they no longer expect tomorrow’s money to be more valuable than today’s. (The shift in the yellow expenditure demand curve is the real supply shock. The shift in the green expenditure supply curve shows the increase in current spending due to expectations of future high prices.)

“Stagflation” comes from any sort of negative real supply or technology shock, but is magnified when consumers believe the shock to be temporary!

This is an important difference between demand and real supply side shocks. If consumers’ inflation expectations are “adaptive”, that is, if we learn from experience to predict the future, then for supply shock, changes in expectations help stabilize the current price level and eliminate any output gap. For a demand shock, adaptive expectations about prices are destabilizing. If a demand-driven deflation means we expect future deflation, that diminishes our willingness to spend, which renders our current output gap and deflation even worse. Supply shocks self-heal, demand shocks self-destruct. (Remember, “supply shocks” are shifts in the the expenditure demand curve of our framework; “demand shocks” are shifts in expenditure supply!)

Of course, even if consumers do believe a real shock to be temporary, the output gap can be eliminated by expansionary monetary or fiscal policy. However, no amount of monetary or fiscal policy can undo the real shock. If potential real GDP has fallen by 10%, encouraging people to spend can eliminate the output gap due to price rigidity, but cannot (in a static sense, at least) bring back the lost potential output.

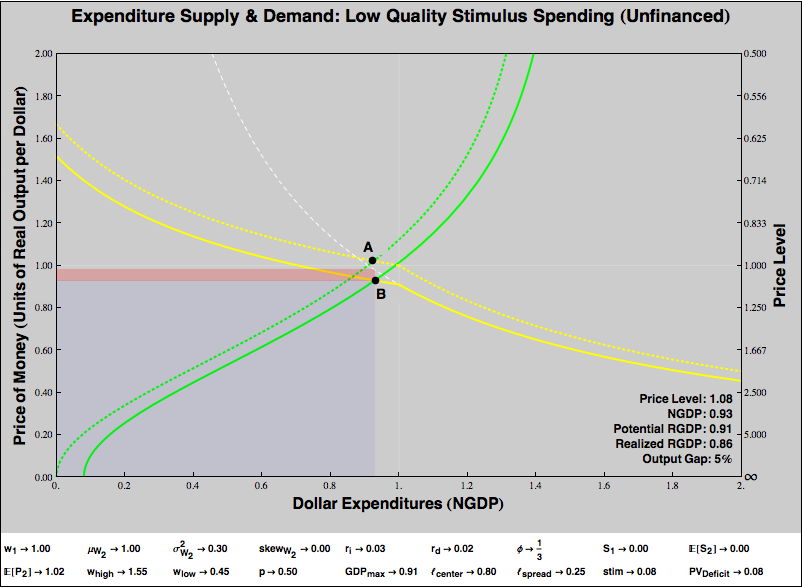

Until the last graph, we’ve considered changes ceteris paribus, adjusting one or two parameters and imagining that all the rest can be held constant. But of course, most of the controversy surrounding proposed policy interventions is about the way in which various changes are interrelated. So, for example, earlier we showed a graph in which stimulus spending eliminated the output gap from a demand shock. However, those who oppose stimulus often argue that poorly targeted government spending will reduce the quality of real output delivered by the economy. Thus, a demand-side remedies will provoke a reduction of real supply. Let’s illustrate that claim:

Point A on the graph represents a demand-driven recession, the same recession we graphed in Figure 5. If we left it alone, the economy would face a 5% output gap. That sucks, so we try fiscal stimulus, exactly as we did in Figure 9. Unfortunately, although we successfully shift the expenditure supply curve, poorly targeted government spending leads to suboptimal real production. The expenditure demand curve shifts downward. We end up in a different recession, a worse recession in this example, at Point B.

So what does our analysis say? If we use stimulus spending to counter a recession, will it lead us towards the happy outcome diagrammed in Figure 5 or the terrible outcome diagrammed above? I don’t know. As we said at the outset, our toy model is designed to illustrate possibilities, not to choose among them. But he have learned something about how to consider the question. If government spending is of sufficiently high quality that it doesn’t much reduce the value of aggregate output, then it likely can counter demand-shock recessions. If government spending is of such poor quality that the value of aggregate output is impaired by its psychotic purchaser, than stimulus spending may prove badly counterproductive. People’s views on the quality of government expenditures tend to correlate with tiresome political affiliations. My own view is that we have free will, collectively as well as individually, that governments sometimes do deploy resources wisely, but sometimes they make choices that are awful and corrupt. Our work is not to estimate the odds, but to shape the context in which government acts so that it is likely to act well.

If you think this story argue for monetary expansion as opposed to fiscal stimulus, think again. We can tell almost exactly the same story. Expansionary monetary policy, like government spending, increases our aggregate propensity to spend. But who says it has no effect on the production side of the economy? My own view, with the Austrians and other cranks, is that stimulating demand via low interest rates does cripple real supply over time, in part by favoring producers of durable goods, but more insidiously by altering the incentives of holders of financial assets, who diversify to capture monetary policy subsidies rather than discriminate between worthy and unworthy enterprises. I would rather take my chances with more transparent (if transparently corrupt) fiscal policy than with status quo monetary policy.

But that’s just me. The framework we’ve set up can illustrate happy and tragic stories, for both monetary and fiscal interventions. Further, if we come up with models that specify relationships between the parameters, or between the demand side and the production side of the economy, we can illustrate those models with the same sort of graphs we’ve shown here.

We’ve been working with a discrete, two period toy model. However, that’s limiting. For example, if poor government spending harms the supply side of the economy, the effect may not be simultaneous. We’ve crammed several non-instantaneous effects into “Period 1”. But we can draw graphs like this as “snapshots” of models that evolve over time. We can even combine graphs into annoying little movies to watch the economy evolve under various scenarios.

This has been a long exercise, and I’m grateful to readers who’ve made it this far. I’ve learned a lot from playing around with these graphs, but I’ve no idea whether doing so will help others. I hope so!

If you haven’t yet, do try playing around with the interactive graphs here. (You’ll need to install the Mathematica plug-in.)

- 28-May-2011, 8:00 a.m. EDT: Many thanks to JKH, fixed the explanation of Figure 1, which confusingly referred to the Y axis as the X axis.

[…] Visualizing Keynesian & Monetarist recessions Steve Waldman. Wonks will have great fun with this one… […]

May 27th, 2011 at 3:24 am PDT

link

[…] den makroøkonomisk debatten om stimulanser, rentesetting, Keynes og monetarisme har Steve Waldman skrevet en veldig god bloggpost hvor han tegner og forklarer. Noen ligninger og modeller er med, men intuisjonen får man med seg […]

May 27th, 2011 at 5:04 am PDT

link

Great work! Just one quibble.

You’re absolutely right in asserting the commonalities between monetarists and New Keynesians – almost all the differences between them are ideological. But I think you’re a little unfair in lumping the Post-Keynesians with them. The fundamental difference between Post-Keynesians (Minsky, GLS Shackle, Paul Davidson) and the rest is that they don’t rely on sticky prices/wages. And working from Keynes’ 1937 QJE article and Chapter 12 of the General Theory, they emphasise the impact of radical uncertainty and financial markets on investment expenditure. There are a lot of things on which I disagree with the Post-Keynesians but just on the above (especially Minsky’s thesis) I tend to agree.

May 27th, 2011 at 7:27 am PDT

link

“Perhaps the central bank cannot set [inflation] expectations precisely, so that there is a hazard of overshooting and generating inflation ”

Are you saying that expectations-setting is a sham? That they set expectations of higher inflation to spur growth, while intending to deliver a lower level of inflation once the growth has arrived? If so, it’s no wonder that credibility is an issue…

May 27th, 2011 at 11:29 am PDT

link

Isn’t your revelation about the distributional effects in the model just a restatement of marginal-utility theory? If you have only a few dollars, another dollar has higher utility than if you have a lot of dollars. Being able to put your two kids through university delivers more utility than buying a second or third Lamborghini.

So shouldn’t the utility function be adjusted for income, or even better, wealth? (Because we spend out of wealth, not income.) Could be simple, like:

Marginal utility of an additional dollar = 10-log(wealth)

This assumes that if you have 10 billion dollars, an additional dollar is essentially valueless to you. Here’s what it looks like as you move down the wealth ladder:

Wealth Marg. Util.

10,000,000,000 0.0

5,000,000,000 0.3

2,500,000,000 0.6

1,250,000,000 0.9

625,000,000 1.2

312,500,000 1.5

156,250,000 1.8

78,125,000 2.1

39,062,500 2.4

19,531,250 2.7

9,765,625 3.0

4,882,813 3.3

2,441,406 3.6

1,220,703 3.9

610,352 4.2

305,176 4.5

152,588 4.8

76,294 5.1

38,147 5.4

19,073 5.7

9,537 6.0

4,768 6.3

2,384 6.6

1,192 6.9

596 7.2

298 7.5

149 7.8

75 8.1

37 8.4

19 8.7

9 9.0

5 9.3

If you’re broke, a dollar is worth 31 time as much as if you have five billion dollars. I’d make it far steeper, especially at the bottom, perhaps shape it differently than a log curve, but it shows that you can fashion a intuitively reasonable wealth-based utility function fairly easily. Not sure how it would wire into your Mathematica model.

May 27th, 2011 at 12:14 pm PDT

link

Very nice discussion, but it misses what that I think is Keynes’ most

important lesson.

You get so close here:

“… future wages in my model are stochastic, but independent of

present consumption. But that makes no sense.”

but the next sentence disappoints:

“My ability to earn future wages depends upon my current

expenditures.”

This statement is certainly true; but current expenditures impact

future wages in another, critical way: if you spend money, someone

else has it, which means they can spend it in the next period, perhaps

on your services. Of course, if one is a small individual agent in a

large economy, one recovers only a tiny fraction of one’s expenditures

by this mechanism, so micro-economists rightly neglect it. The macro

economy taken as a whole, however, recovers *all* expenditures by this

mechanism, so it has a huge, multiplicative impact on total output.

That’s why they call it the multiplier.

During recessions, the output gap is an instance of the tragedy of the

commons. The effect of my expenditure on my future wages is

negligible (except by the self-investment means discussed in the

essay), but the effect of aggregate expenditure on aggregate future

wages is huge. When the economy is in full employment this only

produces inflation, but during a demand-recession getting everyone to

increase spending produces real wealth because it closes the output

gap first.

May 27th, 2011 at 3:19 pm PDT

link

Nothing against math, but post-Keynesian MMT is the way to go. Trying to accommodate all the schools of thought makes it more complicated than it needs to be, unless you are trying to reason with people steeped in the misguided schools of thought. Nothing wrong with that, but I would encourage those who just want the important stuff to stick to MMT…

May 27th, 2011 at 10:36 pm PDT

link

Very creative and cool.

(I’m guessing quasi-monetarists might like this.)

Tiny typo time:

Shortly following figure 1, should be:

“But the Y axis of the graph is

(1 / PRICE_LEVEL)”

Question re the following:

“There’s an important bit of intuition here. We often imagine that deflation causes recessions, and indeed in our graph, we can see that deflation is associated with recessions. We would only see an output gap when the equilibrium fell before the kink in the curve, which is always a price level lower than our original price level. But under flexible pricing, the deflation would have been more severe, without harming RGDP. It is not too much deflation that creates the output gap, but too little deflation given the fall in expenditures! Tepid deflation is a marker of recessions, but it is the decline in nominal expenditure, in NGDP, that drives the show.”

If leveraged firms defend the “Waldman kink” by resisting further price decreases along that curve, but at the same time there is a GDP opportunity cost due to insufficient deflation, doesn’t that mean that the same firms have foregone revenue as a result? And doesn’t that mean they’ve missed out on generating higher income to capital and labour? And doesn’t that mean that they’ve missed out on higher return on equity and a lower probability of bankruptcy by deflating further?

How do you reconcile their original strategy (i.e. probability distribution for bankruptcy; chosen line (kink) of defense) with this? Is there any contradiction? (I’m probably missing something simple here.)

May 28th, 2011 at 6:04 am PDT

link

Ashwin — So, I don’t want to get too bogged down in the sort of ideological squabbles I’m trying to circumvent. But I think that the post-Keynesians, especially the Minsky acolytes (among whom I’m proud to count myself, to a degree), do in fact rely upon sticky prices, although they don’t use those words. The core of Minsky’s model of the economy is that “profits equal investment”, that is, the price structure of the economy must be set such that there is a sufficient mark-up over the direct labor costs of production to cover all of the secondary and indirect costs, including especially the cost of producing capital goods. In an economy in which investment goods are funded over time via financial commitments, the economy’s mark-up must produce sufficient profit to “validate” (Minsky’s delightful insightful term) capital commitments previously undertaken. Failure of this condition is how “it” would happen again, meaning a depressionary debt-deflation dynamic.

Minsky does not (as far as I know) posit a microeconomic story about how firms might resist pricing that would preclude validation of their commitments. (That’s what I’m trying to do with my leverage and sticky prices schtick.) But it’s clear that his account is incompatible with flexible prices, just arithmetically. This is easy to explain if you’ve followed my graphical reasoning. In Minsky’s world, full employment real GDP, at a point in time, under a given technology, sociology, and price level, is essentially fixed. (Minsky models it as a multiple of direct-production wages, which fraction of total wages would be technologically and sociologically determined, and which under full employment are fixed.) Above the price level necessary to pay diret wages and validate firm capital structures — above the “kink” in my diagrams — nothing bad happens. But, should total income fall below the “kink”, Minsky predicts that “it” happens again, implying that somehow, real GDP collapses. If real GDP — the area of a rectangle at the bottom left corner of my diagrams — collapses below a certain price level, arithmetically that implies an expenditure demand curve that falls somewhere below the hyperbola. It might not have the shape I describe or be perceived at a microlevel as sticky prices, but an implication of Minsky’s view is that a fall in expenditures that is not resisted leads to pricing that is above what would obtain under full production and flexible prices. You might dislike describing this as “sticky prices”, preferring to call it a collapse of real production concomitant with higher prices due to scarcity. But we are just giving different names to the same phenomenon. An implication of any sticky price account of depressions is that there is a glut of capacity at the sticky price level that is resolved by unemployment (of resources in general, but especially labor). We can tell a story that goes “sticky high prices” -> “temporary overcapacity” -> “financial collapse of many firms + underemployment”, or we can tell a story that goes “financial collapse of many firms + underemployment” -> “high prices due to scarcity” , but we end up in the same place. At a macro level, the economy cannot allow prices to adjust downward smoothly, in a manner consistent with maintaining full production. Prices, while they may fall in absolute terms, cannot adjust downward sufficiently to accommodate full production. (Note that by “high” prices, I mean high relative to flexible pricing. What we observe when “it” happens is deflation in absolute terms, but high prices relative to what would be consistent with both full-employment production and observed nominal income.)

Minsky, like any sticky price theorist, therefore suggests that nominal income must be stabilized above the “kink”, at levels that validate business structure commitments, in order to prevent “it” from happening. He points out that in modern economies, that’s exactly what central banks and governments do (first via lender-of-last-resort operations to prevent financial collapse, then via deficit spending to support nominal income). And he observes that this approach imparts an inflationary bias to the economy.

I don’t want to claim that there is no important difference between a vision of flexible prices that imply a collapse of real production and New-Keynesian-ish stories that suggest rigidity due to inherent but somewhat mysterious “menu costs” and such. But at a macro level, downward-sticky absolute pricing and a Minskian vision look very similar. And if we replace stories of menu costs or sequential price adjustment with a micro story about firms refusing to set prices below a solvency threshold, the sticky prices and Minskian stories come to look very much alike.

May 28th, 2011 at 8:14 am PDT

link

Steve R — So I’ve circumvented a lot of questions about setting inflation expectations (and important distinctions between price level and inflation expectations) by using a two period model. In a two period model, expectations of the next period price level and an expected inflation rate contain the same information. Had I used a longer model, I’d have to be careful. Agents might have an inflation expectation that is independent of isolated changes in the price level, so a central bank / fiscal authority could might have the freedom to adopt policies that cause a one-time jump in the price level without creating expectations of an increased inflation rate. Ultimately it is expectations about the sequence of price levels, not the inflation rate per se that determines expenditure, unless you want to make a case for including the inflation rate per se, rather than just the expected consumption value of expenditure in the utility function. But to say that inflation expectations may be distinct from isolated price level expectations is short-hand that says something (fairly loose) about the expected shape on the long-term series of price levels. If we say that a central bank commits to price-level targeting rather than inflation targeting (and if people believe that commitment), that implies a much stronger constraint on the shape of expected future price levels (any isolated “misses” will be corrected, so long-term prices are more predictable than under an inflation commitment).

May 28th, 2011 at 8:29 am PDT

link

Steve R @ 5 — So the utility function I’m using does imply declining marginal utility of expenditure. That’s already wired in. My “revelation” (and it was that) is that this alone is not sufficient to imply greater expenditures when you are poor. In absolute terms, sure, a poor person gets a lot more value from an additional dollar of expenditure than a rich person. But a poor person also faces much larger costs from an additional dollar of expenditure, in terms of consumption lost next-period. So, counterintuitively, a poor person is as unlikely to spend an additional dollar on a desperately needed meal as a rich person is to spend an additional dollar on a third scoop of ice cream. The poor person desperately needs a meal now but also desperately needs to save for her next meal. A rich person gains almost no benefit from the extra scoop of ice cream, but loses almost nothing in terms of the value of future consumption for indulging.

That the fraction of total wealth expenditure is invariant to total wealth does depend on my choice of utility function, but not in any way that redeems the intuition that the poor spend more than the rich because the absolute value of a unit of consumption is higher. [The fraction of expenditure would also be invariant under Log utility, which is a weird special case of the utility function I used. Playing around with CARA utility, whether rich or poor spend more present wealth depends on the relationship between the interest rate and the utility discount rate, among other things.]

You really do need to introduce extra features — features that are usually not introduced into macro models — to capture the intuition that if a poor person has $1 and a sandwich costs $1, she will spend her whole dollar today, while a person with $100 will spend a much smaller fraction of her wealth. Diminishing marginal utility just won’t take you there.

May 28th, 2011 at 9:47 am PDT

link

Alexey — We are talking across each other, I think. In the sentence you quote, I am discussing distribution: why would an individual agents future income depend on present expenditure? As you say, the macroeconomic effect on any individual of such expenditure is minimal. The aggregate effect on future income of increasing current expenditure may be large, but that doesn’t tell us anything about the distribution of wealth among individuals in future periods.

Putting aside distributional questions, we could sort of to model a Keynesian multiplier intuition by letting expected w2 be a function of expenditure rather than exogenously imposed. Our model becomes a “representative agent” model then, because doing that makes no sense for an individual, unless we assume that everybody gets the same w2 as a function of what everybody spent in period 1. But that would be fun to try. In terms of this model, adding a positive relationship between future wages on present expenditure would presumably reduce the slope of the expenditure supply curve (increasing the amount of expenditure for any price).

Note that under my framework, the only way that anything about future wages can impact present expenditure is through expectations. That’s not at all inconsistent with Keynes, who has people planning expenditures based on present knowledge, but those plans don’t always compose well. The multiplier effect is not something planned by individual consumers or firms, but describes the way in which plans either do or don’t work out in aggregate. Including an expectation that present expenditure increases future wages is an odd mix of Keynesian intuition and rational-ish expectations. Keynes doesn’t really expect individuals to consider the macro effect of their plans. The question of how future income expectations are actually formed, and under what circumstances that leads to present behavior consistent with those expectations being ratified, is an interesting one. Of course, if everybody expects awful future income, they might help ratify that by spending little today and causing a depression. More interesting is under what circumstances people have reasonably good expectations and their present behavior composes (perhaps with the help of government or a central bank) to make those good expectations transpire.

May 28th, 2011 at 10:11 am PDT

link

Detroit Dan — I guess a meta-case I’m trying to make is that we are drawing lines to sharply.

I read a lot of MMT papers now, and it bugs me how frequently authors explicitly speak to only one another, invoking the post-Keynesian tradition or speaking from the perspective of a “progressive economist”. That’s a strategy for staying marginal. If you think MMT has much to offer at the level of ideas (and I do), it’s probably counterproductive to require everybody to abandon their existing affiliations and join an explicitly progressive, post-Keynesian project. The ideas behind MMT can be translated into terms that “mainstream” and even “neoliberal economists” can make sense of, and can be used in pursuit of goals that even “Austrians” or “conservatives” might approve of. I hope to put things into terms that people of a variety of affiliations can make sense of, and point out how seemingly opposed camps might disagree less than they think. At some level this might be futile — people with different associations and sensibilities want to define themselves in opposition to one another, and intellectual differences are sometimes just an excuse for the fight.

But I hope that, to some degree, ideas do motivate people, and finding common ground for conversation might improve our understanding of one another’s perspectives and even create space for better policy.

May 28th, 2011 at 10:34 am PDT

link

JKH — Thanks a ton for finding that error! I’m really hoping that people try to make sense of these graphs. It doesn’t help if my explanations are incoherent.

Re the kink and foregone revenue:

Aggregate revenue, in the diagrams, is expenditure on the X axis. If you look at a recession (e.g. Figure 3, you’ll see it’s usually true that firms in aggregate would have higher revenue in expectation if they dropped to flexible prices.

Let’s consider a single, capacity constrained firm. (As we discussed ad nauseam in earlier comments the capacity constraint can be eliminated and replaced with a claims about the distribution of sales, e.g. that the variability of sales is limited. But capacity constraint is an easy way to form the intuition.) The firm requires nominal revenues of $0.95 in order to service its commitments and avoid bankruptcy. The firm will set a minimum price (but it can choose a minimum price of zero if it wishes, so we lose no generality.) The firm can produce 1 unit of goods.

Here’s a graph of a single leveraged firm. The horizontal line represents it’s minimum price (as 1/min_price, but you can read the minimum price off the right axis).

The firm sets a minimum price of $0.95. The intersection of its very kinked expenditure demand curve (representing the firm’s willingness to supply real goods) and the expenditure demand curve (representing demand for the firm’s products) shows the firm’s expected outcome. In expectation, the firm will sell only 0.86 units for a price of 0.94 units for $0.95, earning a total revenue of $0.89. In expectation, the firm is bankrupt.

But in expectation, the firm produces below capacity. The flexible price demand curve (the hyperbola including the curved part of the yellow line and the dotted white line), represents the firm’s capacity constraint. At the price of $0.95, if demand turned out to be more than expected, the firm could survive. If, at 95¢, the firm were to sell its full capacity, it would survive.

No consider a firm which prices its goods according to the flexible-price expenditure demand curve. That’d be the equilibrium where the green line meets the white dotted curve. Given the expected expenditure supply (consumer demand), it sets its price at $0.91. In expectation, the firm will sell its one full unit, and earn a total revenue of 91¢. 91¢ is more than 89¢, so in expectation, this is a better outcome.

Except that the firm is still bankrupt, equityholders still get nothing. Under the flexible price equilibrium, there might be a downside surprise to sales, but there will be no upside: the firm is expected to sell its full capacity. So, if the firm prices according to the flexible price equilibrium, it is bankrupt with certainty.

One way of understanding the capacity constraint is that it limits the area of the blue rectangle under the chosen price. The area of the rectangle can be no greater than one.The graphed firm, the one that set a minimum price of $0.95, can see that rectangle expand horizontally to 0.95, because its expected area is small. A firm that set its price according to the flexible price equilibrium’s expected outcome would include both the red and green rectangles, whose areas sum to 1. There is no room for rightward expansion along the revenue axis (X axis).

As long as equityholders control the firm (under our assumption that capacity is constrained and/or the width of the sales distribution does not much grow with falling prices), they will set the price no lower than $0.95, because at that price they have a shot of paying their debts. So the yellow expenditure demand curve will have the “dipper shape” shown. In expectation, the firm foregoes revenue by adopting this shape, but it preserves a lottery ticket to solvency. A firm could increase revenue in expectation by adopting a flexible price, but surrenders any chance of avoiding bankruptcy.

The expenditure demand curves drawn in the main body of the post are produced by “horizontally adding” dipper-shaped curves like the one shown, whose “kinks” are uniformly distributed around some average leverage value. This corresponds to a variety of industries, each of whose firms have very similar capital structures, in an economy with a given average leverage value.

(Some notes: I’ve treated revenue as synonymous with EBIT. Threshold sales — the location of the kink — would change, but little else, if we properly considered EBIT rather than revenue. Leverage conceptually includes operating as well as financial leverage, if the cost of failing to meet high fixed expenses is sufficiently disruptive to the value of the firm.)

May 28th, 2011 at 12:07 pm PDT

link

Thanks for the response, Steve. That makes good sense.

The way I see things is that MMT is correct on first principles, and the other perspectives aren’t. The issue of solvency versus debasement is one example of this, the endogenous nature of money is another, and the significance of horizontal and vertical transactions is a third. It’s hard to have a meaningful discussion when fundamentals aren’t acknowledged or discussed meaningfully.

In my experience, conventional New Keynesians refuse to discuss these fundamental ideas, but rather shift the discussion into details that just obscure things. Krugman and Quiggins come to mind. But you are different, and I appreciate that…

May 28th, 2011 at 12:48 pm PDT

link

Thanks for your explanations, Steve. As usual you’ve already incorporated much that I’m still flailing with. Also thanks for indulging tangents that don’t cut to the central point of the post (resolving different schools’ modeling approaches).

o As usual you’re right: the revelation is an “aha.” Without some wealth-indexed adjustment to current-versus-future spending predilections, ricardian equivalence (correct term?) means that marginal utility doesn’t affect propensity to spend now versus later at different wealth levels. Welfare economists hadn’t figured that out?

o You characterize Figure 5 as modeling “uncertainty surrounding future wages increases.” But isn’t it actually modeling low *expectations* for future wages? “they have been made [predictably?] worse off in the future.” Higher uncertainty would imply equal chances of higher or lower. Perhaps w[sub]2 models this in a way I don’t understand, with wage uncertainty causing lower wage expectations.

o I understand how incorporating investment as you suggest would model higher current expenditures by those with less wealth, and that may suffice in the model to roughly adjust for current versus future spending at different wealth levels.

But I wonder if accurate modeling wouldn’t require wealth-adjusted certainty and risk-aversion functions. (Maybe CARA and its cousins do that — as usual you’re way ahead of me.)

If we characterize the downside at the bottom end as suffering rather than starvation (or more generally failure to provide for future income hence consumption), and couple that with lower certainty among the less-wealthy, that would predict higher consumption expenditures, especially at the bottom end. “I know this will make me feel good/better right now, and I really don’t know what the future holds.”

o I’m not sure since you sort of reverse the supply and demand curves here — does this:

“different expenditure supply curves for subpopulations of different wealth levels, and “horizontally add” those curves to get the economy-wide expenditure supply.”

Run foul of the Sonnenschein–Mantel–Debreu theorem that Steve Keen makes so much of in Chapter Two of his book? (He also zeroes in on distribution as the crux issue: changes to price levels affect income distribution which affects demand curves which…)

Related: “deficiencies that I think are shared with most utility functions used to build macro models. ”

This (obviating the current/future spending effects of marginal utility via ricardian equivalence) appears to shoot a gaping hole at the waterline of most welfare economics models. Keen would certainly agree, though he states his reasons in different — though roughly equivalent? — terms. (He would also point to “static”/periodic modeling as the culprit, and he offers us a downloadable/executable dynamic simulation model as an alternative.) I’m assuming you wouldn’t go so far, but…?

May 28th, 2011 at 12:57 pm PDT

link

”

under flexible pricing, the deflation would have been more severe, without harming RGDP. It is not too much deflation that creates the output gap, but too little deflation

”

~~JKH~

The nutshell

But government rulers always do opposite to the remedy. They always try to prop up prices with clunker cash. They always try to extend the slow down just for the chance to buy in at the bottom of the Ponzi when things hit bottom 4 years later.

You can read their minds

!

May 28th, 2011 at 10:02 pm PDT

link

Thanks for that, Steve.

I utterly botched the relationship between nominal and real in my question.

This is a post worth investing time in – like learning a new language.

May 29th, 2011 at 12:06 am PDT

link

[…] Visualizing Keynesian & Monetarist recessions – via Interfluidity- So this will be an unusual post, more picture book than essay. Plus, it’s interactive! If you are willing to install the Mathematica plug-in, you can be the central banker / fiscal authority of your very own graphical economy! […]

May 29th, 2011 at 12:30 am PDT

link

I downloaded the plugin, played with it, and tried to read the posting. But it was too much for me to get through entirely. As JKH said, it’s like learning a new language; i.e. interesting but very time consuming.

The main point seems to be “the post-Keynesians, especially the Minsky acolytes (among whom I’m proud to count myself, to a degree), do in fact rely upon sticky prices, although they don’t use those words.” And you make an interesting case in that regard (in comment number 9, in particular).

However, MMT advocates claim that savings leakages also lead to output gaps and recessions. For example, if I buy government bonds rather than spending all of my income, that money is withdrawn from the economy. Isn’t that another difference between MMT and the other models? If so, could you adjust your model to take that into account?

May 29th, 2011 at 8:41 am PDT

link

Here’s a quote from MMT guru Bill Mitchell regarding savings leakages:

May 29th, 2011 at 5:42 pm PDT

link

I thank Steve Waldman for a stimulating and provocative artice.

I’ve been trying to understand the Expenditures Supply and Demand graphs. As noted, these graphs are mirror images of the usual supply and demand graphs. Along the top of the Expenditures graph could be entered an axis of Quantities (of goods and services) to go along with the Prices on the right hand side. (Am I correct that this Quantities axis is similar to the blue RGDP rectangle in the bottom of the left corner, and that a presumed blue rectangle in the upper right hand corner (prices times quantities) would be similar to the Expenditures axis at the bottom of the graph? If so, strange.)

I tried thinking of S&D graphs as generalizations of a single exchange, say a house sale. Suppose a house buyer is willing to pay up to $140k for a house, but no more. Because he owns and can supply dollars, he looks upon the dollar as the “numeraire”; he is willing to exchange one dollar for 1/140k (or more) of house. Similarly, suppose a seller putting a house on the market is willing to sell it for $130k, but no less. Because he owns and can supply the house, he looks upon the house as the “numeraire”; he is willing to exchange one house for $130k (or more). We normally think of money as the numeraire, as it is in regular S&D graphs, but in the expenditure S&D graphs, the goods are the numeraire.

If the prospective house buyer and seller reach an agreement and the house is sold, the selling price that actually occurs will fall somewhere in a field between the prices of $130k and $140k. (One could look at this field, among other things, as comparative advantage or arbitrage opportunities; economic fields occur whenever different parties place different valuations on items to be possibly exchanged)

Before the actual sale occurs, all prices in the field, between $130k and $140k inclusive, are merely potential (expected? hoped for?) prices. But then, how is the actual price determined? Where on the supply curve will it fall? Will it be the buyer’s maximum price of $140k, which the seller would be happiest with, or the seller’s minimum price of $130k, which the buyer would be happiest with, or something in between? The potential price that will be actualized depends upon the relative bargaining power of the seller and buyer. How desperate is the seller to sell or the buyer to buy? What other houses are on the market? How many other potential buyers are around.? How much money does the buyer have? Power–a concept that seems to be concealed in economics–enters into the determination of prices as well as most everything else.

In the graph “Expenditure Supply & Demand: Flexible Prices” the prices of money in terms of real output, the regular prices, and the potential, nominal and real GDP are all set at one. Presumably the sellers of money might have preferred lower prices, and the buyers of money higher prices. Thus the actual prices represent some kind of accommodation between the sellers and buyers.

In the graph “Expenditure Supply and Demand: Immaculate Deflation,” the shrinkage of expenditures by the money sellers, as pictured by the changed expenditure supply curve, pushes down the prices received by the goods sellers/money buyers; prices decline from 1.00 to .88. The goods sellers/money buyers lose clout; they produce as much as before (1.00), but their incomes decline from 1.00 to .88.

In the graph “Expenditure Supply and Demand: Recession,” the goods sellers/money buyers gain some of the clout that they lost earlier, as pictured by the changed expenditure demand curve; their prices rebound from .88 to .95 (?.95 on the graph, .96 in the text), but the goods (RDGP) available to the money sellers/goods buyers decline from 1.00 to .88.

It seems that shifts or changes in the shapes of supply and demand curves represent changes in the clout of sellers and buyers, of producers and consumers.

Some questions: Under what conditions do households, businesses, governments, and foreigners act as money sellers (expenditure suppliers)? Similarly, under what conditions do households, businesses, governments, and foreigners act as goods suppliers? And what about the financial institutions that “create” the money (“expendditures”)? What about debt? Do the financial institutions create any “goods”? If so, does their “production” belong in the top Quantities axis or the bottom Expenditures axis? Would “financial production” be considered Real production or Nominal production? If the later, should it be adjusted as nominal prices may be? Any answers or suggestions as to how to find answers to the above and similar questions, as well as any corrections or criticisms of the above analysis, would be appreciated. (allis 2@cox.net)

May 29th, 2011 at 7:24 pm PDT

link

Steve R —

Re: distribution — That something is a revelation to me doesn’t mean that it’s not been noticed by others. I’m sure this point has been made. But nevertheless, it remains the case that most “microfounded” macro models are built on frameworks that fail to reproduce obvious distributional effects. This might not be so consequential, since most macro models assiduously avoid considering distribution, allowing for some “representative agent” to stand happily in for everyone. But even those models might miss a lot by failing to take into consideration the path-dependency of consumption, or what you and I might call “investment” that takes some form other than letting mere non-consumption magically transform into undifferentiated capital.

Re: uncertainty: In both Figure 4 and Figure 5, the expected or average wages are 1. On the graphs you can read expected future wages directly; it is the parameter μw2. In Figure 4, agents expect to receive wages of 1 with perfect certainty. In Figure 5, agents expect to receive wages of either 0.45 or 1.55, each with probability 1/2. So, on average, agents expect to receive a dollar. But they still reduce current expenditures, and consider themselves worse off. The utility function I am using implies risk aversion. In fact, risk aversion is precisely a consequence of the declining marginal utility we were discussing before.

To see this suppose that my utility for $1 of certain income is exactly 100. Suppose instead of $1, I receive $1.50 of income. How much utility will that give me? Something more than 1. Let’s call it, arbitrarily but for the sake of discussion, 140. Now suppose I receive only 50¢ of income. How much utility will I have?

If a 50¢ gain from $1 gave me an extra 40 units of utility, you might think that a 50¢ loss means 40 units less utility, so 50¢ would be worth 60 utils. But that’s not right, if you think agents experience declining marginal utility. I must get more utility, going from 50¢ to $1 than I get going from $1 to $1.50.

So let’s say that the utility associated with only 50¢ of income is only worth 40 units of utility. So, jumping from 50¢ to a dollar gives an addition 60 units, while going from $1 to $1.50 gives only an additional 40 units.

So, let’s consider our situation looking forward. If we know for sure we’ll get $1 in future income, we expect to experience 100 units of utility. But if we have a 50% chance of earning 50¢ and a 50% chance of earning $1.50, our average outcome, in terms of utility, is 0.5 × 40 units + 0.5 × 140 units = 90 units of utility. Even though our average outcome in dollar terms is entirely unchanged by the increase in uncertainty, our average outcome in utility terms is reduced!

This is a characteristic of all preference functions with declining marginal utility. Mere uncertainty makes agents worse off, and people are willing to accept losses in dollar terms in exchange for eliminating uncertainty. Thus, people are willing to purchase insurance, even though, if insurance companies are profitable, the cost of their premiums in more than the expected claims payments they will receive. Purchasing profitbly-priced insurance reduces the buyers expected wealth, but it also reduces the uncertainty of her future wealth, and that reduction of uncertainty is worth accepting the expected dollar loss.

Re: the Sonnenschein–Mantel–Debreu theorem — I’d need to look into this more, but I don’t think it’s too relevant here. That irrelevance, however, is arguably a deficiency, in that it suggests that my analysis that may be abstract beyond any hope of empirical challenge.

If I understand correctly (a big if!), the theorem concerns drawing inferences about aggregate demand functions based on observed prices and/or revealed preferences of individuals. If individuals can have arbitrary and heterogenous preferences, observed prices and the revealed preferences of individuals provide insufficient information to capture or even much restrict the shape of aggregate demand. This is a big deal, if you have a theory of demand that you wish to validate by observing prices and individual preferences.

In my analysis here, there are only two goods, a numeraire and GDP, and agents’ preference structure is assumed, and therefore known. Given assumed preferences (and cross-preferences), constructing demand functions isn’t problematic. The problem would come if I then tried to claim that observed demand was consistent with my construction, and therefore validated my theory. The theorem says that observed demand could validate a whole lot of different theories, so there’s little information content in producing a set of preferences consistent with observed demand.

Further, I’m not sure that the theorem applies in a two-good world, since intuitively it might rely upon complexities in the structure of demand that arise because of substitution effects and complementaries among different goods, which might vary among different people.

But again, to say that a two-good world immunizes my analysis is rather a Pyrrhic boast.

In a broader sense, Keen’s work is beyond the scope of this post. I’ve seen some of his models. I’m interested, but also a bit perplexed by some facets of them. But I’m very “catholic” about these things: I think we need lots of different ways of thinking about things, that the trouble with standard neoclassical models is not their existence but their hegemony. The style of modeling Keen uses, descriptive systems of differential equations, is I think potentially quite useful and undervalued by conventions that demand all models be structured as outcomes of optimizing agents. I suspect that Keen and I would agree that it’s a problem if the overwhelmingly dominant economic theories rely on models that not only ignore distribution, but whose agents have preferences inconsistent with differences of behavior between rich and poor that are overwhelmingly obvious in the real world.

May 30th, 2011 at 2:35 am PDT

link

Johannes — So, I’m sympathetic, I’m not a big fan, for example, of government activism in supporting high housing prices.

But it’s too easy, I think, to say that deflation is simply the solution. This came up a bit in my response to Ashwin above. Historically, even in the teeth of an uncontrolled debt deflation, the economy fails to produce at capacity and prices therefore do not fall to the level suggested by my hyperbolic expenditure demand curves, because real capacity is destroyed when prices fall below the level required for businesses to service their debts and mass insolvency ensues. In theory, this needn’t happen — the purpose of Chapter 11 bankruptcy is to permit the reorganization of financial claims without impairing the real capacity of businesses that would be valuable concerns under a different capital structure. But in practice, that doesn’t seem to happen: bankrupt firms often face “distress costs” and lose capacity, or are liquidated for scrap even when their assets might have remained valuable if owned by an all-equity firm able to withstand financial fluctuations. In a world where financial debt is nominally contracted, and where bankruptcy destroys real capacity, deflation leads to a loss of real capacity, and even if governments stand aside, prices do not fall to the level that would permit full utilization of the original capacity. They fall too little, because goods actually become more scarce as capacity is destroyed. Some of that capacity might be “malinvestment”, whose eventual repurposing justifies the temporary loss, but probably much of the lost capacity is an “overshoot” due to imperfections in the bankruptcy process.

If we want more flexible prices, so that economic output is independent of changes to nominal expenditure, we really need to do something about the rigidity of debt and contracted fixed costs. These prices need to adjust as well, if we are to succeed at managing “immaculate deflations”.

May 30th, 2011 at 2:52 am PDT

link

JKH & Detroit Dan,

If you have to invest too much time in this, I haven’t done my job of explaining things very well. I’m sorry about that.