Michal Kalecki on the Great Moderation

So, it is to my great discredit that I had not read Kalecki’s Political Aspects of Full Employment (html, pdf) before clicking through from a (characteristically excellent) Chris Dillow post. There is little I have ever said or thought about economics that Kalecki hadn’t said or thought better in this short and very readable essay.

Here is Kalecki describing with preternatural precision the so-called “Great Moderation”, and its limits:

The rate of interest or income tax [might be] reduced in a slump but not increased in the subsequent boom. In this case the boom will last longer, but it must end in a new slump: one reduction in the rate of interest or income tax does not, of course, eliminate the forces which cause cyclical fluctuations in a capitalist economy. In the new slump it will be necessary to reduce the rate of interest or income tax again and so on. Thus in the not too remote future, the rate of interest would have to be negative and income tax would have to be replaced by an income subsidy. The same would arise if it were attempted to maintain full employment by stimulating private investment: the rate of interest and income tax would have to be reduced continuously.

Dude wrote that in 1943.

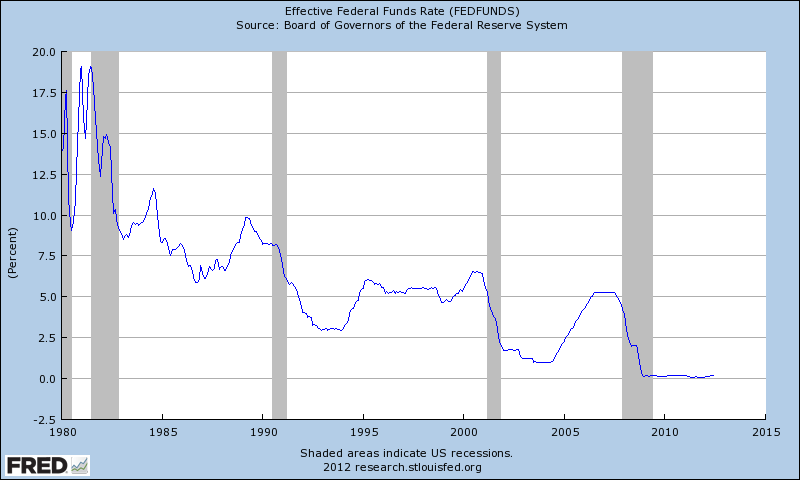

Let’s check out what FRED has to say about interest rates during the era of the lionized, self-congratulatory central banker:

Yeah, those central bankers with their Taylor Rules and DSGE models were frigging brilliant. New Keynesian monetary policy was, like, totally a science. Who could have predicted that engineering a secular collapse of interest rates and incomes tax rates (matched, of course, by an explosion of debt) might, for a while, moderate business and employment cycles in a manner unusually palatable to business and other elites? Lots of equations were necessary. No one would have guessed that, like, 70 years ago.

The bit I’ve quoted is perhaps the least interesting part of the essay. I’ve chosen to highlight it because I hold a churlish grudge against the “Great Moderation”.

Bloggers say this all the time, but really, if you have not, you should read the whole thing.

I wonder what K-thug has to say about this. I bet he has some interesting thoughts.

July 22nd, 2012 at 5:00 pm PDT

link

Well put. The Great Moderation was the palliative treatment that allowed a wage-growth free, corporate welfare economy to maintain a stable growth pattern. I should also add that encouraging increased leverage to maintain consumption in the face of wage stagnation also necessitated that the financial sector be unshackled. Simply cutting rates with the financial system of the 50s would not have allowed the palliative treatment to work. Quoting from an old post http://www.macroresilience.com/2011/11/02/innovation-stagnation-and-unemployment/ :

“For the neo-liberal revolution to sustain a ‘corporate welfare state’ in a democratic system, the absence of wage growth necessitated an increase in household leverage for consumption growth to be maintained. The monetary policy doctrine of the Great Moderation exacerbated the problem of competitive sclerosis and the investment deficit but it also provided the palliative medicine that postponed the day of reckoning. The unshackling of the financial sector was a necessary condition for this cure to work its way through the economy for as long as it did.”

Minsky also understood this dynamic but whereas Minsky incorrectly thought that the end-point would be an economy that rapidly cycles between inflation and deflation in the search for full employment, Kalecki always understood that this economic fragility would be protected against via an acceptance of a higher rate of unemployment rather than a higher rate of inflation.

July 22nd, 2012 at 5:22 pm PDT

link

Do you have a ‘churlish grudge’ against statistical analysis?

July 22nd, 2012 at 6:28 pm PDT

link

Glad you posted that, b/c I’d always regarded the great moderation with scepticism … More like derision, actually. It was purely the erroneous description of an economy that had had its downside attenuated by increasingly lower rates (and lower peaks prior to the next easing cycle), with the upside flatlining near 4%.- ie. requiring even lower rates through time to achieve best ‘recorded’ results. End game? Kalecki seemed to know … Negative rates. More simply put, the end of the limits and putative power of the one trick central bank, who were then at a loss when the private sector cried uncle on debt burdens, then the subsequent negative asset price loop. Where else could it have ended? I mean, really. Each easing and re-easing episode was an exercise in pumping up private debt, which was generally suffering lower real wages (not at the top though …) as well as that noted above. Where did the central bank think it would end? It is almost like mainstream policy (NK on the case of the central bank) has worked ‘despite” itself, which is undoubtedly now well recognised. Just look at the data and charts – a classic rising wedge that, once broken, broke hard. And not coincidentally, the falling channel of Funds rates that enabled it.

July 22nd, 2012 at 6:56 pm PDT

link

Your graph isn’t very convincing, since it uses the nominal fed rate and not the real one. Here’s a better graph, which turns out to show the same thing: http://research.stlouisfed.org/fred2/graph/?g=8WP.

Oddly, we would expect this sort of asymmetric response in a fiat-money system to result in steadily increasing inflation, but instead the Great Moderation saw steadily *decreasing* inflation. Maybe the cause isn’t quite as simple as Kalecki described in 1943?

July 22nd, 2012 at 10:30 pm PDT

link

Would be interested in a translation of this:

“Another problem of a more technical nature is that of the national debt. If full employment is maintained by government spending financed by borrowing, the national debt will continuously increase. This need not, however, involve any disturbances in output and employment, if interest on the debt is financed by an annual capital tax. The current income, after payment of capital tax, of some capitalists will be lower and of some higher than if the national debt had not increased, but their aggregate income will remain unaltered and their aggregate consumption will not be likely to change significantly.”

July 23rd, 2012 at 12:16 am PDT

link

It amazes me how (seemingly) prevalent a proper understanding of fiscal policy was back then (ie, how govt spending works, what determines the interest rates on govt bonds, etc). What happened?

July 23rd, 2012 at 12:31 am PDT

link

Amazing, #2 on pg 325, he discusses the confidence fairy!

July 23rd, 2012 at 12:40 am PDT

link

Oddly, we would expect this sort of asymmetric response in a fiat-money system to result in steadily increasing inflation, but instead the Great Moderation saw steadily *decreasing* inflation. Maybe the cause isn’t quite as simple as Kalecki described in 1943?

If I were to channel Kalecki, I would say the following. Assume the owners of capital expect a rate of 8%., but the full employment rate is 3%. So the CB lowers rates, and this allows the owners of capital to obtain a total return of 8% — 5% from capital gains and 3% from dividends. But what happens next period? Rates must be lowered again.

In a perfect foresight model, nominal rates would asymptotically fall to zero, allowing the the owners of capital to continue to obtain returns of 8%, while maintaining full employment. Except that as nominal rates fall, time horizons expand and the risk premium goes up. In a finite time, it becomes all risk — the owners of capital are being delivered more volatility rather than their expected return of 8%. At that point, firms start slashing expenses really demanding the 8% and there is nothing the CB can do.

The only solution is to beat the owners of capital with a rubber club that says “3% is all you get!”, but learning that this is all that they can get takes time, possibly a long time.

July 23rd, 2012 at 1:14 am PDT

link

[…] Michal Kalecki on the Great Moderation – interfluidity […]

July 23rd, 2012 at 3:08 am PDT

link

[…] Michal Kalecki on the Great Moderation – interfluidity […]

July 23rd, 2012 at 3:21 am PDT

link

To play devil’s advocate, could there not be simpler reasons for observing a secular decline in the real interest rate? For example, increasing life expectancy and decreasing birthrates leading to a greater aggregate desire to shift consumption into the future.

July 23rd, 2012 at 4:59 am PDT

link

[…] Michal Kalecki on the Great Moderation Steve Waldman […]

July 23rd, 2012 at 5:15 am PDT

link

[…] Michal Kalecki on the Great Moderation Steve Waldman […]

July 23rd, 2012 at 5:15 am PDT

link

The battle has always been, and will always be, between conservatives trying to resurrect monetary policy and not-so-conservatives realising that fiscal policy is the only way to properly manage an economy. When Kalecki wrote this interest policy was dead. But he saw that it would make a comeback. And that comeback began (in Britain) when the Tory government raised the interest rate in 1953. After it was obviously having no effect on the post-war inflation, the Tory government launched the Radcliffe Commission to investigate how to make monetary policy more effective.

The Radcliffe Commission was chaired by sensible types of people — i.e. not economists. After three years of taking testimony and investigating the banking system they found that monetary policy basically didn’t work at all. It’s effects were probably largely psychological.

So, monetary policy was dead and buried. Until… well… until around the time that Waldmen’s graph begins. That is, around the time the monetarist cranks got their hands on policy. Monetarism failed, of course, but it sent another signal: a signal to the economists. That signal went something like this: “We know that your little models rely on monetary policy and interest rates to function. We know that for the past thirty-five years you’ve had to repress this to some extent and pretend that interest rates were a secondary phenomenon. But no more! Come out of your interest rate closet — loud and proud!”

And so the economists — part of a profession that relies on fashion more than perhaps any other (fashion itself included) — obliged. And at that moment all the lemmings set out on their way to the cliff-face.

July 23rd, 2012 at 6:10 am PDT

link

“To play devil’s advocate, could there not be simpler reasons for observing a secular decline in the real interest rate? For example, increasing life expectancy and decreasing birthrates leading to a greater aggregate desire to shift consumption into the future.”

So, an increased desire to save led to falling interest rates? Well, first of all:

http://www.mybudget360.com/wp-content/uploads/2010/07/household-debt.jpg

No shifting consumption to the future going on there.

And second of all, Waldman’s graph is tracking the Fed Funds rate. That has nothing to do with savings. It is set by the Fed in response to what they feel to be the correct response to the state of the economy.

July 23rd, 2012 at 6:17 am PDT

link

Philip:

That seems pretty convincing to me, should have done a quick google before I posted that. Here is global savings as a % of global gdp, again showing a decline.

http://economistsview.typepad.com/economistsview/2005/09/is_there_a_glob.html

Thanks

Richard

July 23rd, 2012 at 6:51 am PDT

link

Richard,

Yes, Tom Palley has said essentially the same thing regarding the savings glut. Palley rightly points out that the ‘savings glut’ hypothesis is a great example of economists using pseudo-Keynesian (half-understood Keynesian?) language to excuse certain peoples’ roles in causing macroeconomic imbalances. In an interview with yours truly he put it as such:

“In my view the savings glut hypothesis is nonsense economics. Looking at it from the big picture, you see it is just another in a series of explanations of the US trade deficit by mainstream economists. My book shows clearly how these explanations evolve to fit the political moment rather than to explain the phenomenon. And the enduring common feature of all these explanations is they avoid blaming globalization as the cause of the problem or having any downside.

That is absolutely staggering. Mainstream economists blind themselves to the most obvious explanation, and that is a pattern that repeats over and over again in other areas of economics. And because the explanation is so obvious and simple you can never write about it in journals which are fixated on complexity. The story about the emperor’s new clothes really does apply for much of modern economics.

With regard to the saving glut hypothesis, it ignores the fact that the US trade deficit has been rising for 30 years, long before China emerged on the scene. And there is much other evidence and argument against it – but that is in the book.”

Fortunately for the more parsimonious among us (the ‘evil’ savers who are apparently the cause of… everything!!!) you don’t need to buy the book because he lays out the same argument in this paper:

http://www.boeckler.de/pdf/p_imk_wp_13_2011.pdf

July 23rd, 2012 at 7:05 am PDT

link

[…] Steve Randy Waldman highlights an important paper on The Great Moderation you're going to want to read. (Interfluidity) […]

July 23rd, 2012 at 7:31 am PDT

link

And so the economists — part of a profession that relies on fashion more than perhaps any other (fashion itself included) — obliged.

Current reading is Robert Leeson, The Eclipse of Keynesianism 2001, a history of 20th Century economic discourse. Chapter 2 is on Friedman, George Stigler, the Chicago School, their understanding of the sociology and politics of top-level economics, and their methods used to crush Chamberlin, Robinson and monopolistic competition among their other victories.

The point and purpose of economics is not to be right but to win and implement preferred policy.

Most economists (on my side) are simply doing it wrong.

July 23rd, 2012 at 8:41 am PDT

link

JKH,

That says that under certain assumptions, the public debt keeps rising relative to gdp (even if one assumes in a scenario that interest rate is held fixed in constructing the scenario) – because interest payments keep rising. So the government should tax wealth in some form so that public debt/gdp isn’t unbounded.

This can for example happen if growth isn’t high and interest rate is higher (although, the actual condition is slightly less stronger). All this in modelspeak of course.

In SFC models, this is not needed as if the consumption function is assumed to be both a function of income and wealth.

All this for the case of a closed economy model :-)

July 23rd, 2012 at 9:51 am PDT

link

So NGDP targeting by the Fed is a farce?

July 23rd, 2012 at 10:45 am PDT

link

Thanks for posting Kalecki. The argument really comes down to “what is the point of economic activity?”.

In some quarters the point of economic activity is to live well. In other quarters the point is to get rich. This drives a political cycle:

1) Eventually the wannabe-rich gain political power. 2) Eventually they squeeze too hard and some of the wannabe’s revisit Henry Ford’s epiphany: “If they don’t have money they can’t buy my stuff”.

So it goes. Kalecki believed in a transformation. I don’t think this needs to happen. We will all bump along, living more or less well. Perhaps right now it is morally preferable to get folks out of scrabbling through third world garbage dumps than it is to ensure that rich economies can pay down our snowmobile loans.

July 23rd, 2012 at 11:18 am PDT

link

“There is little I have ever said or thought about economics that Kalecki hadn’t said or thought better”

Ditto moi. i.e. capital taxes:

http://www.asymptosis.com/want-a-flat-tax-i-got-a-flat-tax-for-you.html

July 23rd, 2012 at 11:35 am PDT

link

[…] The always excellent Interfluidity chimes in on continual currency debasement, Michal Kalecki and the science of economics. Share […]

July 23rd, 2012 at 5:51 pm PDT

link

@ Detroit Dan

Yes, I’d say it is. Not sure if we’ll get consensus on that quite yet. But it’s pretty obvious that it’s a joke policy concocted by cranks who don’t understand the wage-bargaining system and its relationship to unemployment and the amount of outstanding union power (countervailing power). But then we’ll see. I’m sure the cranks will win out once again — after all, after QE what do the Fed have left? And, more importantly, if QE is dead what on earth will the market trade on? That’s the real question. They’ve become used to signals thrown out every six months or so by Mr. Central Bank.

July 23rd, 2012 at 6:35 pm PDT

link

I’ve been pondering the graph of real interest rates minus real GDP growth. It seems to show that throughout the great moderation interest rates were higher than they were in the postwar period. Not sure what to make of that, except that it seems to be another aspect of finance taking the surplus.

It also shows that the Bush years were a really strange time of low but positive growth, low interest rates and low inflation.

July 24th, 2012 at 1:48 am PDT

link

[…] from Paul Krugman to Steve Waldman to Yichuan Wang is giving their spin on the plunging nominal interest […]

July 24th, 2012 at 2:52 pm PDT

link

[…] perfectly) Plant Tomatoes. Harvest Lower Crime Rates. WE ARE ALIVE: Bruce Springsteen at sixty-two. Michal Kalecki on the Great Moderation Bubble Standards: Why the Poor Are on the Hook for the Housing Crash Persuasion vs. Suppression: […]

July 24th, 2012 at 4:44 pm PDT

link

What happened?

Friedman?

July 24th, 2012 at 4:56 pm PDT

link

The excessive monetary accommodation that was the greatest enabler of the “great moderation” represented a historically one-off (per long cycle) abuse of monetary policy (because leading to an impossible to service debt load) that was prima facie an encouragement to moral hazard by one and all, from the home flipper to Wall Street.

So I’d prefer to call it the Great Moral Hazard (=fiat money central banking), as there was nothing moderate about it.

July 24th, 2012 at 8:15 pm PDT

link

As an amateur very ignorant student, I was on the Webs 2 years, around 2003, when I gravitated to New School, Bard, UMKC, the Post-K’s, and read the Kalecki. I could have been attracted to Mises and Rothbard, but I didn’t find it attractive. Without anything more than a social question, why do you think you are discovering Kalecki now? But leaving the sociology of economics aside:

Kalecki was a genius, and possibly the most empirically erudite and broadly policy-experienced macro-economist of the twentieth century. Check his biography. Brad DeLong mocked him incessantly, which should be good enough for some to read the guy. There is a lot more wothwhile than that single article.

Recommended: Michal Kalecki Palgrave McMillan 2010

And Jan Toporowski has been studying Kalecki for decades, especially in finance and money. There is a recent lecture on Kalecki (and Oskar Lange) online. The End of Finance (not read) and the smaller and lighter but interesting Theories of Financial Disturbance (HET) are recommended.

July 24th, 2012 at 9:30 pm PDT

link

[…] source* […]

July 26th, 2012 at 10:58 am PDT

link

To all those who want to know more about Kalecki, business cycles and innovation, I recommend the book “Cycles, Crises and Innovation” by Jerry Courvisanos, EDWARD ELGAR PUBLISHING 2012

July 27th, 2012 at 8:29 am PDT

link

Someone who writes about the Hitler era as being a period of full employment without elaborating on the reasons why it happened without it being the aim of the government, has a hidden agenda.

July 30th, 2012 at 1:44 am PDT

link

[…] rates — upward in an economy facing inflation, downward in one facing unemployment. (As Steve Randy Waldman recently noted, Michal Kalecki pointed this out long ago.) That’s important, but I want to make another […]

July 31st, 2012 at 2:52 pm PDT

link

[…] source* […]

August 3rd, 2012 at 5:56 am PDT

link