Great Britain as a case study: which sticky price?

Richard Williamson offers a report from the UK. Combining bits via Tyler Cowen and Williamson’s own excellent blog:

I think there has been a lot missing from the discussion of the UK in the blogosphere. We are a bit of a puzzle on a purely AD-based explanation of the recession.

We didn’t have deflation (on annual basis at least), and even stripping out the effect of the VAT rise in 2011 should still show persistent inflation over 3% since 2010 http://www.tradingeconomics.com/united-kingdom/inflation-cpi

UK inflation expectations seem to be significantly higher here (if falling away a little recently) http://www.bondvigilantes.com/2012/03/19/markets-start-to-think-about-inflation-again/ http://uk.finance.yahoo.com/news/uk-inflation-expectations-drop-1-093038319.html

…I’m not really sure what is going on… If we were to just look at inflation (at expectations thereof), the country that ought to be having an AD-driven double-dip recession would appear to be the US…

I am becoming steadily less convinced that [an aggregate demand deficiency] is the whole story, at least for the UK. Back in November, Karl Smith made the clearest statement I have ever read of the New Keynesian explanation of a recession:

I can’t hammer this home enough. A recession is not when something bad happens. A recession is not when people are poor.

A recession is when markets fail to clear. We have workers without factories and factories without workers. We have cars without drivers and drivers without cars. We have homes without families and families without their own home.

Prices clear markets. If there is a recession, something is wrong with prices.

Right now, unemployment remains at over 8% in the UK while real wages are lower than they were 7 years ago and are continuing to fall. Yes, you read that correctly. Which immediately leads one to ask: on this explanation of a recession as expounded by Karl, how much further do real wages have to fall to eliminate disequilibrium unemployment?

There are two broad stories having to do with “sticky prices”. One, the mainstream New Keynesian story, emphasizes rigidity in the price of goods and services, most especially “sticky wages”. The other, emphasized by post-Keynesians and sometimes by monetarists, has to do with the sticky price of satisfying debts.

In the standard New Keynesian story, a depression is caused by the relative prices of goods and services falling out of whack. This is the basis for much of the mainstream policy consensus. The source of macroeconomic problems is sluggish adjustment of some goods and service prices, and stabilizing the price level should diminish the need for such adjustments. Macro policy can’t prevent relative prices in the real economy from needing to change sometimes. But it can prevent difficult-to-adjust prices from requiring frequent updates due to fluctuations in the overall price level. Because some important prices — the price of labor especially — are thought to be “sticky downward” (meaning they can “ratchet” upwards but can’t adjust down), targeting a positive inflation rate is recommended. The gradual, predictable movement of prices allows slow updates, preventing misalignments due to sluggish adjustment. The upward-slope permits “sticky downward” prices to fall in real terms relative to other goods and services by simply not rising with other prices. A recession, in the New Keynesian telling, occurs when this stabilization policy is not sufficient. If changes in supply and demand are so great that “sticky downward” prices must fall faster than the targeted rise in the price level, markets won’t clear. If the “sticky downward” price is workers’ wages, then it is employment markets that won’t clear, and we will experience mass joblessness. If this occurs, a cure would be to increase the targeted rate of inflation until real wages fall relative to other goods and services. When real wages fall enough, employment markets will clear again and the recession will end.

In the post-Keynesian story, a depression is driven by an decrease in agents’ willingness or ability to carry debt. Agents “pay for” decreased indebtedness by devoting their income to the purchase of safe assets (including especially their own outstanding debt) rather than spending on real goods and services. Unfortunately, money spent on financial asset purchases does not create income (they are asset swaps), and may not be cycled back into income for producers of real goods and services. So, in aggregate the attempt to reduce indebtedness can lead to a reduction of income that sabotages the attempt to pay down debt. This is the famous “paradox of thrift”. We simultaneously experience unemployment (reduced spending and income to real goods and service providers plus sticky wages means that people get canned) and financial distress (reduced income and fixed debt makes prior debt ever more burdensome). In this story, reducing real wages is not a solution. Real wage reductions might mitigate unemployment temporarily, but they also engender financial distress. Financial distress then causes agents to redouble their efforts to satisfy debts, reducing aggregate income and requiring further reductions in real wages ad infinitum. The only way out of a post-Keynesian depression is to increase real wages relative to the real burden of debt. In the post-Keynesian story, inflation is helpful only if real incomes hold steady, or, at very least, fall more slowly than the real value of prior debt.

One data point is not dispositive. But Williamson’s account of the UK experience is not consistent with the New Keynesian story, while it is perfectly consistent with the post-Keynesian account. There has been inflation in the UK. The real price of labor has not been sticky. The real burden of debt has fallen, sure, but real wages and incomes have fallen even farther, leaving people less able than ever to satisfy debts they’ve contracted and so purchase financial security.

There is a lesson here. If we mean to pursue reflationary policy, the goal should not be to reduce real wages, but to reduce the real value of debt relative to incomes. One way to do this, which the post-Keynesians’ closest frenemies suggest, is to stabilize the nominal income path at its prior trend while tolerating whatever inflation that engenders. This implies a large increase in nominal income from current levels. Going forward, if we hold nominal income to a gently rising path, the burden of aggregate debt relative to income will never unexpectedly rise. (Unfortunately, predictable distress may not prevent debtors in aggregate from taking on more debt than they can service, due to the competitive dynamic of a boom. I think NGDP targeting would be a big improvement, but not sufficient: We must always be mindful of leverage and debt.)

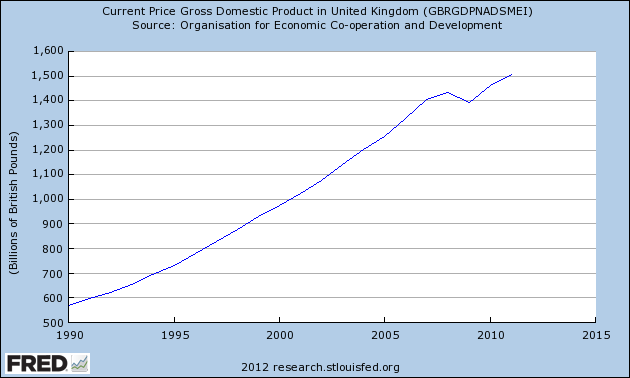

Pace the very brilliant Chris Dillow, the UK has not stabilized the path of NGDP:

Even if, as Dillow suggests, policymakers could not have held NGDP on path in 2009 due to forecast error, after the collapse they certainly could have restored total income to its prior trend with some combination of monetary and fiscal policy. They have not, and so the burden of debt relative to incomes in the UK has increased.

The UK has just entered a “double-dip” recession, and remains, in my view, in a depression, despite occasional thaws and recoveries. That this has happened, despite the plummeting real wages that Williamson reports, tells a tale. It is not “sticky wages” that should concern us, but the sticky burden of precontracted nominal debt.

Afterward: David Andolfatto wonders whether debt dynamics could play so large a role more than three years after a collapse in nominal income. Yes it can, I argue in his comments.

Karl Smith responds to Williamson here.

Update History:

- 28-Apr-2012, 6:00 a.m. EDT: Had mistakenly used a FRED graph that I thought was NGDP, but was really RGDP. I’ve replaced it with a proper NGDP graph. Removed the word “remotely”, as the proper graph shows a less dramatic picture: “the UK has not

remotelystabilized the path of NGDP.

[…] Waldman (of the indispensable Interfluidity blog) has answered my plea for an explanation of the UK’s economic woes, offering a […]

April 28th, 2012 at 7:41 am PDT

link

“So, in aggregate the attempt to reduce indebtedness can lead to a reduction of income that sabotages the attempt to pay down debt. This is the famous “paradox of thrift”.”

Good. That correctly identifies “balance sheet recessions” (etc.) as a subset of paradox of thrift transmissions (all of which have some balance sheet effect).

It’s a continuum from that logical starting point; not an entirely separate species of recession.

April 28th, 2012 at 8:04 am PDT

link

Williamson is being very silly. What was the biggest failure of aggregate demand in history? It would be that thing in the 1930s, no? But the steepest fall in nominal wages in US history came in 1929-1933. If falling wages are incompatible with aggregate demand shortfalls, then I guess the Williamson must think the Great Depression really was the Great Vacation. Right?

I think we should be clear that sticky prices, and specifically sticky wages, is *not* the only way to think about failures of aggregate demand. Keynes himself could not have been clearer that more wage flexibility would tend to exacerbate shortfalls in demand

It is perfectly possible to describe an economy with multiple equilibria such that, with the same real resources, it is possible to be a high-unemployment or a low-unemployment state. It is also possible to suppose –as, again, did Keynes, that the most important sticky price is the interest rate, in which case falling wages and prices represent an adjustment in the wrong direction. Either way, if you think the existence of deflation is a sign that output must not be constrained by aggregate demand, then you don’t understand basic Keynesian logic.

April 28th, 2012 at 10:11 am PDT

link

“David Andolfatto wonders whether debt dynamics could play so large a role more than three years after a collapse in nominal income. Yes it can, I argue in his comments.”

I don’t have the expertise to pick this paper apart, so maybe its bunkum, but this presentation from INET last month argues that almost all the run up in consumer debt in the last thirty years (the housing bubble being an exception) is a result what the authors call “Fisher Dynamics” whereby a higher effective interest rate combines with a lower inflation rate to push consumers ever deeper into debt without their actually having taken on more debt by monkeying with the denominator of the debt to income ratio.

http://ineteconomics.org/sites/inet.civicactions.net/files/jayadev-arjun-mason-joshua-berlin-paper.pdf

If true, this paper means we have built a “dealer always wins” financial economy where you don’t have to borrow more to go further into debt, once a consumer steps onto the debt treadmill, the odds are eventually he’ll/she’ll be bankrupt, at least in aggregate. By this argument, preservation of current institutional realities guarantees most people will loose, and that seems to map pretty well to my experience. The longer it goes the more people loose and the further up-market attacks on the denominator move.

April 28th, 2012 at 10:25 am PDT

link

JW Mason,

I think either you’ve read me the wrong way round or I know way, way less about macro than I thought I did. Nominal wages are increasing (slightly) in the UK, just not as fast as prices. If this graph from Scott Sumner on the Great Depression is to be believed, this should be good for UK output and employment http://www.themoneyillusion.com/?p=4220

If real wages were lowered through the adjustment of nominal wages, then obviously that would make things a whole lot worse. But they’re being lowered in the UK through inflation. As you can see on my new post, NGDP is basically the same relative to trend in the UK as the USA, but we are having significantly more inflation and significantly less growth. So there’s some other factor at play.

April 28th, 2012 at 11:08 am PDT

link

I don’t believe that graph, not a bit. The claim that lower real wages are associated with higher employment is rejected by vastly more data than it is supported by.

April 28th, 2012 at 11:54 am PDT

link

From the General Theory, p17:

“In emphasising our point of departure from the classical system, we must not overlook an important point of agreement… with a given organisation, equipment and technique, real wages and the volume of output (and hence of employment) are uniquely correlated, so that, in general, an increase in employment can only occur to the accompaniment of a decline in the rate of real wages. Thus I am not disputing this vital fact which the classical economists have (rightly) asserted as indefeasible. In a given state of organisation, equipment and technique, the real wage earned by a unit of labour has a unique (inverse) correlation with the volume of employment.”

That may be wrong, but Keynes said it. As for the relationship more generally, surely the relationship between real wages and employment/output depends on whether the change in price is due to demand or supply/productivity?

April 28th, 2012 at 12:56 pm PDT

link

Yes, he did. But he also said afterwards that that was a mistake, writing (in 1939) that it was “the portion of my book which most needs to be revised.”

April 28th, 2012 at 2:26 pm PDT

link

Interesting, I didn’t know that. I have found the paper where Keynes wrote that and am reading it now. Thanks. R

April 28th, 2012 at 2:57 pm PDT

link

[…] Interfluidity on the UK, and a response from Richard Williamson, who notes the UK has not really started […]

April 28th, 2012 at 3:18 pm PDT

link

“The only way out of a post-Keynesian depression is to increase real wages relative to the real burden of debt.”

Fascinating. Isn’t this the dynamic that predominated during WWII? We had huge government spending (fiscal policy), *combined* with people working their ass off in war factories and unable to spend their earnings because of rationing. They could only pay off their debts.

April 28th, 2012 at 4:28 pm PDT

link

[…] interfluidity » Great Britain as a case study: which sticky price?. […]

April 28th, 2012 at 5:04 pm PDT

link

Steve, are you not assuming that the benefits of increasing NGDP fall in a “fair” way?

That is, if rising NGDP brings inflation which eats into the real value of debt, for “most people” to see any benefit from this, their nominal wage needs to keep up with that inflation.

Also, isn’t there also a psychological element to this – a low income person in debt sees on a daily basis the price of food etc rising in nominal terms, but they don’t so much notice that their debt burden is becoming less due to inflation?

RW:

“As you can see on my new post, NGDP is basically the same relative to trend in the UK as the USA, but we are having significantly more inflation and significantly less growth. So there’s some other factor at play.”

We haven’t had “significantly more inflation. As numerous commenters pointed out below one of the posts at MR, you need to strip out things like indirect taxes. Krugman had a comparison once you do that:

http://krugman.blogs.nytimes.com/2011/10/19/more-uk-inflation/

April 28th, 2012 at 5:24 pm PDT

link

“In the post-Keynesian story, a depression is driven by an decrease in agents’ willingness or ability to carry debt. Agents “pay for” decreased indebtedness by devoting their income to the purchase of safe assets (including especially their own outstanding debt) rather than spending on real goods and services. Unfortunately, money spent on financial asset purchases does not create income (they are asset swaps), and may not be cycled back into income for producers of real goods and services.”

This is not a logically consistent story, AFAICT, since asset purchases do create real “income” in the form of realized capital gains; money received for debt repayment also becomes income as it is exchanged away. There _are_ cases where increased demand for assets/debt repayment causes an AD shortfall, but they are rather complex. For instance: (1) the asset is a substitute for money, e.g. in a liquidity trap, or (2) the change indirectly affects the velocity of money, through its effects on the financial system, or (3) the asset trades cause currency outflow in a fixed-exchange-rates economy.

April 28th, 2012 at 5:57 pm PDT

link

This post seems to me to get to the heart of government spending in a balance sheet recession. If the government is a “risk-free” borrower and can borrow at very low or even negative real rates then part of the exit from a balance sheet contraction comes from the government borrowing to transfer wealth from savers to debtors. Of course, monetary policy retains a crucial role in this system because it delivers the inflation surprise that pays for the government debt.

April 28th, 2012 at 8:23 pm PDT

link

If people need more income to pay off debt, why not massive tax cuts? That is a more reliable way to increase income than any government spending.

But, of course, if the UK government has been pulling the debt lever so hard for for so long, is there not then a credibility problem with government borrowing? (On tax cuts or spending increases?)

With the job of monetary policy being to give people an nominal anchor for their income and value-of-money-across-time expectations.

April 28th, 2012 at 8:48 pm PDT

link

Lorenzo:

“If people need more income to pay off debt, why not massive tax cuts? That is a more reliable way to increase income than any government spending.”

But tax cuts don’t get money into the hands most likely to spend it – the very poor and the unemployed.

You can increase income and get the money to these people via government spending by increasing transfer payments or by paying the unemployed a wage to do a job.

“But, of course, if the UK government has been pulling the debt lever so hard for for so long”

But it hasn’t. It currently has a policy of austerity, the previous government enacted one of the smallest fiscal stimuluses in the OECD, and while it’s fiscal policy during the boom may not have been perfect, IIRC it had the lowest government debt to GDP ratio in the G7, and it had more sustainable fiscal policy then the US (we properly paid for our contribution to the little war crime in Iraq).

“is there not then a credibility problem with government borrowing?”

Maybe in the mainstream media, but in scientific terms there can’t be. But it doesn’t have to borrow anyway, it can just create money ex nihilo. Which it is doing already, but QE didn’t work in Japan, and it won’t work here.

Instead of the banks, we should quantitatively ease the people (a bit too much of a mouthful to become a political warcry unfortunately).

April 29th, 2012 at 12:25 am PDT

link

On the issue of what a recession is, or what kinds of recessions there could be, I have a few crude and simple questions.

First, imagine a society in which 100 people own everything – absolutely everything.

They pay 100,000 people to do certain kinds of work for them. This work consists in transforming some of the stuff that the 100 owners own into various kinds of consumable products, and also in using some of those products and some raw materials to perform various kinds of services for the 100.

The result is, that the 100 owners are absolutely sated. They have no need to hire any other people to do any additional work for them.

The work of the 100,000 also produces a surplus beyond what is needed to meet the sated consumption needs of the 100, and that surplus goes entirely to providing a few goods to the 100,000 workers – just enough to make it worthwhile to do the work offered by the owners, rather than remain unemployed.

The owners possess laser blasters they built in an earlier period, and that are sufficiently powerful to discipline the 100,000 workers and keep them under control. They are also determined to maintain possession of, and save, everything they own and control that is not being used for current production.

Yet assume there are millions and millions of people in this society. All but the 100,000 are unemployed. The 100 owners permit these people to forage for subsistence in the vast plains and forests that belong to the owners, and lie outside the walls of their compound, but they otherwise enforce their property regime, and do not permit these millions to engage in any productive transformations of these vast properties.

Among the jobs performed by the 100,000 workers is the job of shooting, burning, laser blasting or otherwise punishing any of the millions of unemployed humans who turn themselves into pests and threaten the property of the owners.

So here are my questions:

Would economists classify this hypothetical situation as a recession or depression?

Do the markets in this hypothetical situation clear?

Is this hypothetical situation a case of equilibrium?

Could this hypothetical situation persist for a very long time?

April 29th, 2012 at 1:06 am PDT

link

“First, imagine a society in which 100 people own everything – absolutely everything.”

Dan,

It’s hopeless. Their imaginations are closed to any logical extensions of their arguments that would tend to disprove said arguments.

I can’t believe people really think that nominal growth alone would help households delever given the current system for apportioning that growth.

Does anyone doubt that credit card interest rates will fail to rise faster than the incomes of those who are buried in such debt ? Are variable-rate mortgage writers going to lose their asses in a 5% NGDP growth world ? The bottom 80% will see trivial wage gains and non-trivial food and energy cost increases under NGDP targeting , just as the top 1% enjoy the asset inflation of commodity and equity securities , and capture the bulk of any wage gains.

NGDP-targeting would have worked well in the 1960’s , when wage gains were evenly distributed across the distribution and we had usury laws that allowed debtors to benefit from inflation-mediated delevering. Isn’t it strange that the NGDP crowd doesn’t recommend an accompanying policy package including such changes that would ensure that NGDP-targeting would accomplish its goal of helping consumers deleverage ?

I don’t find it strange at all , not when I see the band of greedy misanthropes who’re sucking up to Sumner. One ( “Organ Wrassler” , or something like that ) has a “full-employment plan” , self-described as brilliant and revolutionary , which , pitifully , otherwise intelligent bloggers seem to have given some serious consideration. His idea is not new , by a long shot. Aside from the Ebay angle – an upgrade obvious to anyone who would have lowered themselves to consider such a scheme – this is an old idea indeed , as shown in this graphic :

http://tinyurl.com/78s5b38

April 29th, 2012 at 2:50 am PDT

link

[…] Great Britain as a case study: which sticky price? – interfluidity […]

April 29th, 2012 at 3:25 am PDT

link

Scott it’s true that the UK has not suffered from low inflation. Yet explaining why it’s them rather than the US suffering a double dip, a lot of that is austerity. Still your point that lowering real wages is not the solution is well taken-that what’s needed is to lower “real debt.”

I like you calling the Market Monetarists and Post Keynesians “frenemies.” I guess there’s truth it this in the sense that both actually think what’s important is aggreage nominal spending. Even MMT’s Job Gurantee is seen as doing for prices what NGDP for the MMers is supposed to be-stabilize nominal spending.

April 29th, 2012 at 3:59 am PDT

link

Scott great post. It actually inspired me to write my own.

http://diaryofarepublicanhater.blogspot.com/2012/04/market-monetarism-and-mmt-frenemies.html

April 29th, 2012 at 4:27 am PDT

link

re:Dan Kervick – all sorts of arrangements about as bad or worse as what you describe have lasted for periods ranging from 70 years to several centuries. One disquieting realization is that horrible errors (at the level of slavery, disenfranchisement of women, communisms, various harsh authoritarian regimes, etc.) do NOT instantly or even moderately quickly correct themselves.

Indeed, the US with its current restrictions on immigration to some degree enforces such a rule right now. (Yes, it’s 300MM rather than 100, and we don’t actually prevent the inhabitants of say Argentina from improving Argentina by shooting at them. At least not directly. But 300MM out of 7BN is still quite an elite…)

In your example, the “laser blasters” is probably more like “understanding of politics” or “ability to make sense of complicated systems of rules” or “ability to manipulate political processes for gain whilst appearing uninvolved and honorable”. But it could also be “ability to make X work at all” where X is most anything important.

April 29th, 2012 at 10:42 pm PDT

link

re:SRW and the General Issue – we must always consider *flows* as well as *stocks*. And in particular, it’s very difficult to help general citizens with any scheme that upsets lenders as a whole. The reason being that if lenders decide they will get burned, they’ll simply stop lending (as we saw demonstrated with great force in the recent crises.) Hence, saying “well, let’s arrange a scheme in which real wages rise and real interest rates and debt stocks fall, and by some bizarre magic apply that to all citizens” could turn out to be a disaster. Because those hard working citizens trying to use their increased real incomes to retire debt will suddenly find that they cannot turn it over, or cannot turn over the assets it bought. (So the real of value of my mortgage is now much less than the value of my house – but nobody on Earth can arrange to buy it – what have I gained?)

There are other circularities – those same citizens trying to get out of debt hold, directly or indirectly, claims of their own. They have some set of investments of their own, and indirectly claims for things like pensions (theirs or those of public employees they depend on). So if debt instruments in effect loose a lot of real value, what does that do to say CALPERS? And what does cratering CALPERS do to state employes? And the rest of the folks in CA on the hook for whatever defined benefit pension plans are left?

I don’t think it’s possible to “melt” the value of debt without also “melting” pension values, savings accounts, even checking accounts.

April 29th, 2012 at 10:46 pm PDT

link

re:The Specific Demographic Issue.

Economic theory assumes that people’s wants are effectively infinite, and so total output of the economy should always be constrained by real resources, not by unconstrained demand. Put another way, virtually everybody would buy more product if they had more money, and doing so should in general drive unemployment to very low levels. (Shortage of AD and unemployment are real issues for most economic theories.)

But what if that is not true? Or not completely true? After all, at some level, being unemployed is equivalent to being told “the rest of society cannot think of any use for your talents.” What if at some level the ability to consume is limited by personal energy, interest, and time. Combine this with the built up stocks of material of an aging population. To give some striking examples – I consume all of the water, hot and cold, I could possibly want. Likewise electricity. And I will not live long enough to read the books I already own, let alone others I might buy. So in a VERY real sense I (and to be honest YOU) have NO USE for more water, electricity, books, and so on. This is PROFOUNDLY unlike what prevailed for most of history.

But Wait – what about all of those people (in some sense the poor 1/2 of the baby boomers and everybody under 50) who are NOT sated – who WOULD consume more houses, cars, TVs, haircuts, dancing lessons, etc. if only they had money. Why can they not find full employment selling these services to one another?

In some “state of nature” they could – but in the current world, where water, once found or carried is a Solved Problem, where electricity, unknown 200 years ago is an (economically) Solved Problem, and where making or providing any good or service anybody now wants requires skills, capital, and working past a thicket of regulation, the automatic employment of the “state of nature” is gone.

It’s not just that unemployed Jo can’t buy land to build a house to sell to Pat (or buy land to build a house Jo can live in), it’s that Jo lacks the required training to be ALLOWED to build herself a house – she needs money for permits, MUST hire a plumber and an electrician, in effect MUST BUY (rather than make or find) lumber, nails, and so forth. So Jo cannot enrich herself by her own efforts to transform the resources of the world – she MUST engage in behavoirs that will cause other people to give her money. (To pay the property taxes if nothing else.)

This is not unlike Dan Kervick’s scenario – what our society says in effect is YOU MUST do SOMETHING THE REST OF US LIKE or your WILL BE POOR no matter how HARD YOU MIGHT WORK. And for some of YOU, WE CAN’T THINK OF ANYTHING TO LIKE.

Here, I will note that in addition to the issues around debt, monetary policy, and so on, tax policy and regulatory policy work to maintain the status quo, and in particular to require that people meet some socially approved criteria to be allowed to consume much of anything.

For example, tax policy means it is hyper expensive to give more than a realtively small amount of money to another person – so even if I can’t think of anything to hire Jo for, I can’t give her enough money to live on without government hitting me with a nasty tax. Likewise, hiring her for any task, no matter how minor, implies that I must deal with administrative burdens.

Some want to tax me (and You) more to “give” things to Jo, but it would be more accurate to say they want to compel Jo to follow their rules. And want to forbid anybody else from enabling her to NOT follow their rules.

So Dan Kervick – the world to postulate in fact exists. And merely redistributing money, or capital, won’t mitigate it very much.

April 29th, 2012 at 11:24 pm PDT

link

[…] interfluidity » Great Britain as a case study: which sticky price? […]

April 29th, 2012 at 11:30 pm PDT

link

[…] stimulus will reduce real wages and boost real income. I can’t be sure, but I wonder if Steve Waldman might have made a similar error: A recession, in the New Keynesian telling, occurs when this […]

April 30th, 2012 at 8:40 am PDT

link

[…] Waldman is known around the internets as mega-smart. His latest post is another in a long line of incredible posts and […]

April 30th, 2012 at 9:28 am PDT

link

when we say things like “depression is driven by an decrease in agents’ willingness or ability to carry debt” and “So, in aggregate the attempt to reduce indebtedness can lead to a reduction of income that sabotages the attempt to pay down debt.” I prefer to real rather than abstract issues here because they are connected:

1. lets not forget that the decreased willingness/ability to carry debt is primarily due to the reduced value of housing as collateral for mortgages; and

2. mortgage defaults are driven by the dual trigger of negative equity and unemployment (or otherwise inability to pay). people with negative equity generally pay until they can no longer pay. high unemployment increases the probability they will not be able to pay, and subsequent defaults feed lower collateral values.

I am pretty skeptical that higher nominal income would produce or result from higher inflation. I am skeptical that what is needed is an overall erosion of debt through inflation (and if it is, its going to happen through defaults and foreclosures anyway, eventually). I would need to see the evidence that *everyones* wages and debts need to decline, or that further stimulus would be mainly inflationary and not result in much real growth. stable ngdp prevents the caustic cycle of unemployment-default-declining collateral values.

Wages are sticky, and construction wages its true should be lower to clear the market… but thats because of very low demand in those sectors. when demand comes back (it will) it would not surprise me to see wages rebound.

April 30th, 2012 at 9:41 am PDT

link

[…] A Choice, Not an Echo Romney on Jobs and Economic Growth Romney: Jobless College Grads Show Obama Has Failed Great Britain as a case study: which sticky price? […]

April 30th, 2012 at 10:17 am PDT

link

There is by now a substantial literature that shows that with insensitive interest rates (either due to the zero lower bound or due to central bank’s unwillingness to lower the interest rate), the standard New Keyensian model suggests that increased wage or price flexibility can be destabilizing. Eggertsson, Krugman, Werning, Woodford have all written on this, along with others:

-http://dl.dropbox.com/u/125966/zero_bound_2011.pdf

– http://newyorkfed.org/research/staff_reports/sr540.html

-http://www.newyorkfed.org/research/economists/eggertsson/EggertssonKrugmanR2.pdf

While the NK liquidity trap is about how much nominal interest rates react to the downturn (i.e., central bank policy response function, and its subjection to the zero lower bound), the PK story – as I understand it – is about how demand for real investment may become interest-rate insensitive due to fundamental uncertainty. But if the central bank follows a Taylor rule and gets to zero when the downturn occurs, the two stories (PK, NK at ZLB) seem to become observationally equivalent – at that point, the paradox of thrift kicks in, flexibility is bad, etc. In all these cases, a wage reduction leads to some agents deleveraging, which creates a negative aggregate demand externality from a wage fall.

So I think it’s not quite accurate to characterize the NK explanation of recessions as needing price/wage inflexibility. For “small downturns” yes, but for “big downturns” wage flexibility can worsen the problem.

April 30th, 2012 at 10:48 am PDT

link

Steve

Scott Sumner thinks you are confusing real wage rate with real income (or even real wage income, I think). His argument is that the wage rate/ NGDP would have gone up in 2009, regardless of what happened to the real wage. The data bears him out (weekly wage rate/ NGDP is currently 107 if indexed to 100 in 2008, and shot up from 100 to 104 in Q4 2008), though of course with a story told at the AD/AS level of aggregation like Scott’s is, it’s absurdly hard to establish directional causality.

April 30th, 2012 at 12:44 pm PDT

link

Note that the inflation expectations on bondvigilantes.com are for different measures in the UK than the US or Europe.

In the UK inflation breakevens refer to RPI rather than CPI, (the BoE targets is 2%+-1 CPI).

Whereas I presume in Germany and the US their inflation measure is equivalent to CPI.

RPI is an arithmetic mean whereas as CPI is a geometric mean, and as a rule of thumb UK RPI is 0.75pp higher than CPI. If you subtract 0.75pp from bondvigilantes.com’s UK 5 year breakevens series, it would overlap with the US expectations and would also have been under 2% since September last year.

If the BoE were targeting inflation expectations then they would have been more aggressive over the last six months.

Furthermore, given we suspect the UK has an issue with debt, surely the BoE should keep expectations of RPI relatively high, i.e. closer to 2.75-3.75%. That series is consistent with a 5 year expectations RPI of 2.3% in late December 2011.

Two year CPI breakevens were even lower, around 2.0%.

Two year RPI expectations rose from 2.1% to 2.81% after the most recent round of QE was announced in February. The BoE discontinued their 2 year breakevens series in March, but their 3.75 year breakevens have since fallen to around 2.5% throughout April.

RPI expectations of 2.5% is entirely consistent with the CPI undershooting 2% at some point over the next few 3.75 years.

Anyone care for a wager?

April 30th, 2012 at 1:29 pm PDT

link

[…] A Choice, Not an Echo Romney on Jobs and Economic Growth Romney: Jobless College Grads Show Obama Has Failed Great Britain as a case study: which sticky price? […]

April 30th, 2012 at 3:44 pm PDT

link

Firstly please forgive my ignorance – I have no qualifications in economics and anything I know comes from blogs/wikipedia but something seems a little bit odd here.

Walras’ law suggests (if I understand it correctly) that if a system of markets is in equilibrium in all but one market, then that last market is in equilibrium. In this case if all markets but the labour market were in equilibrium then the labour market would be as well; as the labour market isn’t at least one other market must not be clearing. The post also seems to identify this as the market for debt.

If interest rates cannot fall below 0% (or a higher figure to give 0% return on aggregate when default is factored in) then would we not have an obvious candidate for a second market failing to clear?

Could we not be in a world where both of these are true? Sticky wages and sticky interest rates at a zero lower bound give rise to a pair of markets that dont clear – this gives rise to unemployment, cutting output and wages and also at the same time reduced investment (positive interest rates are too high to clear the market) which cuts out the ability for normal investment to provide the capital compliment of labour to increase labour demand. Falling prices of labour which would help clear labour markets aggrevates the condition in the credit markets (as described ) – driving down liquidity and the ability to finance new investment realtive to the negative interest rates needed to clear the market?

April 30th, 2012 at 7:51 pm PDT

link

[…] Williamson, Steve Waldman and others have produced some interesting posts about the UK economy. The CPI numbers tell a […]

April 30th, 2012 at 8:19 pm PDT

link

[…] A Choice, Not an Echo Romney on Jobs and Economic Growth Romney: Jobless College Grads Show Obama Has Failed Great Britain as a case study: which sticky price? […]

April 30th, 2012 at 11:22 pm PDT

link

Another line of (Post Keynesian) argument that might explain some of what’s going on in the UK is that the depreciation of the GBP

…may very well be contractionary. One way in which this works out is that depreciation (everything else constant) reduces wages, increases the profits of exporters, and leads (yes, the economy is wage-led) to a reduction in spending and lower levels of activity …. In this case, a depreciation does help reduce your external constraint, but by leading to a contraction.

from http://nakedkeynesianism.blogspot.com/2012/03/sscrer-this.html

May 1st, 2012 at 5:04 am PDT

link

In the event of the bursting of a large asset bubble and the following depression, the best policy is likely to be neither monetary policy nor fiscal policy but rather jubilee policy.

Insufficient aggregate demand, deflation, etc. are not the root cause, they are symptoms, albeit ones that can and do make the underlying problem worse.

The root cause is the existence of significant debt contracts that simply cannot be repaid no matter what actions the debtors take. Furthermore, the actions the debtors take to try and repay them tend to be precisely the actions that will make the overall situation worse from an overall systems standpoint.

At some point, the government has to go Gordian if it wants to actually solve the problem.

May 1st, 2012 at 7:03 am PDT

link

[…] Steve Randy Waldman points out in the case of the United Kingdom, worker pay has fallen by a lot, and it doesn’t appear to […]

May 1st, 2012 at 8:34 am PDT

link

Just because real wages have fallen 7%, doesn’t mean they have fallen to the market-clearing level.

And you are correct, debt/GDP ratios haven’t fallen much or at all either, mostly because governments have stepped in to guarantee worthless debts, and have borrowed immense amounts to stimulate demand.

The amount of adjustment needed in a depressed and overly indebted economy is usually a decline in real wages and debt levels of between 33% and 50% (from looking at economic history). Modern developed countries haven’t seen this sort of adjustment since the 1930s, and are laboring quite heavily to avoid it via short-term stimulus and guarantee programs, while keeping inflation relatively low. This is the Japanese way, and as Japan has shown, it is not the way out, it is merely a path of stagnation that avoids the market-clearing level. Rich countries with credible borrowing capacity can follow this path of stagnation for a long time.

May 1st, 2012 at 8:56 am PDT

link

[…] interfluidity.com – Tagged: Wonks View on Counterparties.com → This entry was posted in Reuters by […]

May 1st, 2012 at 10:23 am PDT

link

[…] Steve Randy Waldman points out in the case of the United Kingdom, worker pay has fallen by a lot, and it doesn’t appear to […]

May 1st, 2012 at 11:19 am PDT

link

just print more money and give it free to bankers who have government guarantees and can buy unlimited US government bonds. In the long run the US is destroying itself with debt. A first year economic student would see that…the US gets poor by the day as investment bankers use printed money to juice the bonus…while every other taxpayer gets poorer and poorer. The UK is doing the hard work now…the US will be falling off the cliff with japan.

May 1st, 2012 at 5:10 pm PDT

link

SRW:

re: “The only way out of a post-Keynesian depression is to increase real wages relative to the real burden of debt”

Is this true? Can’t real wages stay flat or fall, just so long as nominal wages rise and nominal debt stays constant?

Of course, it is better if wages rise in both real and nominal terms and debt stays constant nominal, but I think so long as nominal wages rise relative to nominal debt you can escape a balance sheet recession.

May 1st, 2012 at 5:11 pm PDT

link

Doc at the radar station

“Fascinating. Isn’t this the dynamic that predominated during WWII? We had huge government spending (fiscal policy), *combined* with people working their ass off in war factories and unable to spend their earnings because of rationing. They could only pay off their debts.”

Yep.

And it works even better if you don’t issue bonds which are just a future promise from the poorer to subsidise the already rich.

May 2nd, 2012 at 5:08 am PDT

link

[…] NGDP matters because wages and debt are sticky. […]

May 2nd, 2012 at 12:32 pm PDT

link

A first year economic student would see that…

Yes, indeed. And I would trust the first-year economic student over, say, the folks who TEACH first year economics. Because, after Econ 101, what more is there to learn?

Sigh. . .

May 2nd, 2012 at 12:45 pm PDT

link

[…] nixing regulations and reducing the cost of labor (i.e. lowering workers’ wages). But Steve Randy Waldman, as quoted by Brad Delong, counters that lowering wages could actually prolong the economic […]

May 2nd, 2012 at 2:12 pm PDT

link

[…] “There has been inflation in the UK. The real price of labor has not been sticky. The real burden of debt has fallen, sure, but real wages and incomes have fallen even farther, leaving people less able than ever to satisfy debts they’ve contracted and so purchase financial security,” economist Steve Randy Waldman writes in his blog. here#comments […]

May 3rd, 2012 at 12:30 am PDT

link

[…] as measured by the personal consumption expenditure deflator is 2.1%. (More on the UK, from Interfluidity, which stresses the Neoclassical synthesis vs. New Keynesian vs. Post-Keynesian interpretations. I […]

May 3rd, 2012 at 11:14 am PDT

link

But is it possible to raise wages? Or CPI inflation? Dan Alpert thinks not:

http://www.economonitor.com/danalperts2cents/2012/04/25/earth-to-paul-krugman/

In a word, old Malthus is coming home, traveling faster and faster, and neither liquidity nor debt can stop him.

So the neoliberals gambled on globalization and lost, both their innocence and your children’s trousers.

What comes next? Neo-leninism? A great coastal wall plus a conscript army of engineers?

History as a perpetual yo-yo?

May 5th, 2012 at 2:43 am PDT

link

25.Bryan Willman said: “Economic theory assumes that people’s wants are effectively infinite, and so total output of the economy should always be constrained by real resources, not by unconstrained demand. Put another way, virtually everybody would buy more product if they had more money, and doing so should in general drive unemployment to very low levels. (Shortage of AD and unemployment are real issues for most economic theories.)

But what if that is not true? Or not completely true?”

EXACTLY!!!! That means the idea of a retirement market needs to be added to models along with the idea that retirement ages may actually need to be lower. Next, link this to the medium of exchange market (especially what debt does to the retirement age) and time.

May 7th, 2012 at 10:06 pm PDT

link

Dan Kervick @18. What you are describing is a retirement market out of balance. The few have enough to retire and spend down what they have accumulated (stop running surpluses) but won’t. Everyone else can’t accumulate enough to retire and are forced to keep working.

May 7th, 2012 at 10:09 pm PDT

link

“The only way out of a post-Keynesian depression is to increase real wages relative to the real burden of debt.”

That would probably help but …

Will it be a lot harder to have a “depression” if there is zero public debt AND zero private debt (meaning too much debt is a medium of exchange problem, specifically related to time)?

May 7th, 2012 at 10:20 pm PDT

link

Just out of curiosity, does everyone believe in the concept of real aggregate demand (real AD)?

Also, if a recession was caused by real wages being too low, why would anyone expect to “fix it” by lowering real wages even more?

May 7th, 2012 at 10:28 pm PDT

link

[…] at 5:33 am and is filed under uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site. PERMALINK Category: […]

May 8th, 2012 at 4:00 pm PDT

link