The debt ceiling and the end of QE2

This is a trivial point, but I haven’t seen it made.

It will be very difficult to tell whether the expiration of QE2 was the end of the world, or whether it will matter very much at all, until the debt ceiling standoff is resolved.

Quantitative easing alarmists tend to take a “flow” view of Treasury bond prices. During QE2, the Federal Reserve was purchasing a substantial fraction of the debt issued by the Treasury, reducing the flow of securities that the private sector was required to absorb. Without the Fed as a megapurchaser, the private sector will have to absorb a larger quantity of debt, and may demand concessions on price (or, equivalently, higher yields) in order to do so.

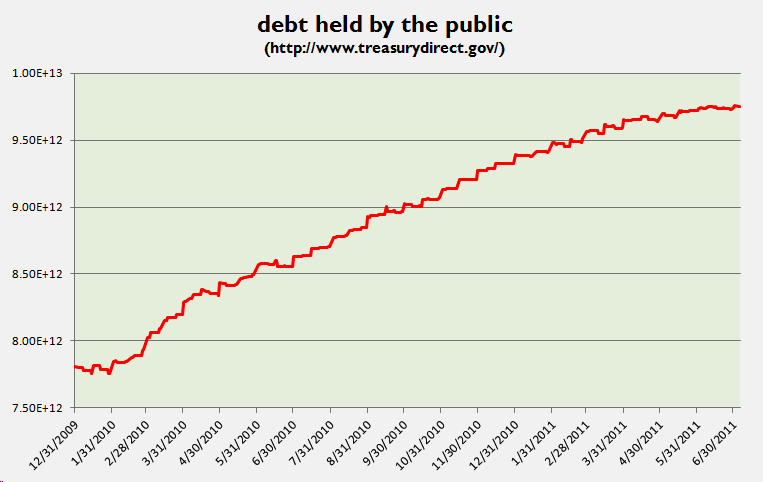

QE2 has ended, but the net flow of Treasury securities to the private sector has not increased. On the contrary, since mid-May net issuance has ground to a halt, as the Treasury has juggled intragovernmental accounts to fund itself without violating the debt ceiling.

I have no idea whether the QE2 Cassandras are correct or not. But we won’t have a reasonable test of their hypothesis, even by the rough and ready evidentiary standards of a blogfight, until the US Treasury resumes funding its deficit by selling securities to the public at large.

FD: I’m short long-term US Treasuries, and have been for years, for reasons that are in part speculative and in part related to hedging other positions. I have no strong view on the degree to which QE2 or its expiration might affect Treasury prices.

- 6-July-2011, 8:25 p.m. EDT: Added parenthetical “(or, equivalently, higher yields)”.

“Without the Fed as a megapurchaser, the private sector will have to absorb a larger quantity of debt”

And there are billions of dollars sat in reserve accounts looking for a home – courtesy of the QE process which did nothing other than give the private sector lower yielding financial assets.

The domestic private sector is net saving billions more every quarter, as is the external sector. That wall of money plus the QE money is always going to be greater than the amount of bonds on offer. It has to be by accounting identity.

So unless dollar holders prefer to sit on billions of cash instead of swapping them for higher yielding bonds the auctions will be more oversubscribed than ever.

Once you look at the spending cycle starting with the currency issuer you get a much clearer view of what is happening in the financial cycle.

July 7th, 2011 at 6:17 am PDT

link

Markets, though, are commonly held to be anticipatory. You don’t have to believe in even the weakest form of EMH to believe that bond traders can notice widely published information that bears critically on their major trading instruments.

“I’m short long-term US Treasuries, and have been for years …”

Ouch! Then if you are going to accuse markets of inefficiency, you are attacking from an insecure position.

July 7th, 2011 at 7:48 am PDT

link

I’m with Neil.

Also, the measure you want is “debt held by private investors,” not “debt held by the public.” The latter includes tsy’s held by the Fed, the former does not.

July 8th, 2011 at 12:17 am PDT

link

[…] The debt ceiling and the end of QE2 Steve Waldman […]

July 8th, 2011 at 5:45 am PDT

link

“QE money” isn’t available to buy treasuries at auctions. It’s only available to buy from the Fed’s portfolio. Banks in aggregate, as principals or agents, don’t buy auctioned treasuries with reserves, net, any more than they lend reserves.

(Although they settle treasuries and TTL accounts with reserves).

And the private sector may demand a concession on price. The private sector factors expected Fed policy into bond prices. And it can factor in tighter Fed policy with higher deficits, whether it’s right or wrong in doing so, in the short run or long run. If it can be wrong about the interpretation of QE, it can be wrong about the interpretation of deficits, in the short run.

July 8th, 2011 at 8:05 am PDT

link

antecedent is that the private sector can’t factor expected Fed policy into QE reserve remuneration

July 8th, 2011 at 8:19 am PDT

link

OK, I’m with JKH, too.

July 8th, 2011 at 8:52 am PDT

link

[…] Over Debt Ceiling Huffington PostMr. President; You Are Out Of Touch on Debt Jon Walker, FireDogLakeThe debt ceiling and the end of QE2 Steve WaldmanThe Carry Trade and Fed Swap Lines Ed HarrisonDimon-Bernanke Skirmish Shows Bankers […]

July 8th, 2011 at 12:50 pm PDT

link

A good question to ask is “After the Debt-Ceiling Issue is resolved, how much debt will have to be issued to the (Non-Fed) Public by the Treasury by the end of the year in order to unwind the extraordinary accounting measures already taken in the stand-off?”. My estimate is over $1 Trillion in new debt (busting us past the 100%-GDP ratio) – $600 Billion to unwind and $400 Billion in new deficit.

That’s a lot of flow and a lot of stock. Also, recall that the the average debt instrument is of a particularly short maturity right now. Hopefully everyone rolls over.

July 9th, 2011 at 1:44 pm PDT

link

Perhaps the debt ceiling is just a big distraction planted by the Republicans so that the Obama Administration doesn’t successfully deal with the employment crisis, thereby ensuring that Obama doesn’t get reelected. Certainly, the Republicans show no signs of bargaining in good faith.

After the debt ceiling issue fades away, there will be some new manufactured outrage…

July 10th, 2011 at 10:01 pm PDT

link

I’ve wondered if QE2 didn’t push China temporarily to the sidelines in the Treasury markets. After all, why would China want to get into a bidding war with the Fed over bonds the Fed has already announced they are determined to buy? Perhaps China will revert to buying more Treasuries once the market returns to *normal*.

July 11th, 2011 at 2:05 pm PDT

link