what the hell is even happening?

what i want to know is, who would even think of spelling “kristi” with an m?

settling up with loans from banks is the Federal Funds market. resorting to that, how much need there is to resort to that, is precisely what makes the FFR in a no-IOR world.

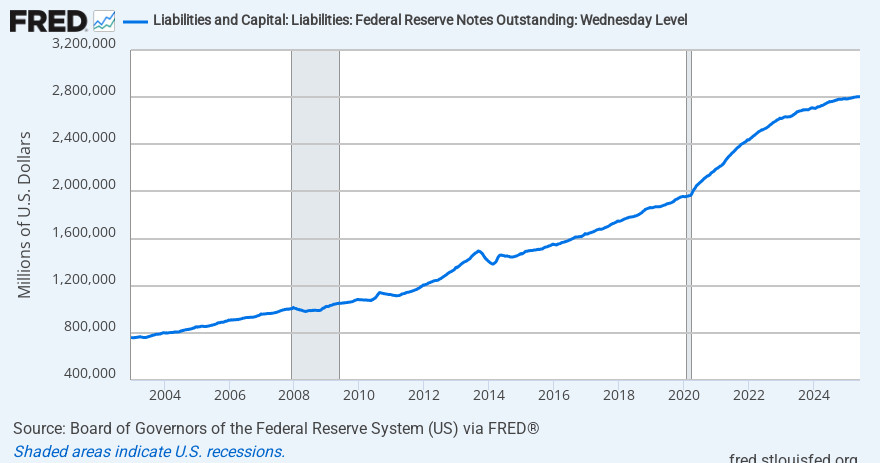

currency is not reserves. currency earns nothing. it’s astonishing that $2.4T of zero interest currency is outstanding while interest rates are 4%ish. kind of wow. (according the FRED, 2.8T of FRNs are now outstanding. that’s a lot of seignorage!) fred.stlouisfed.org/series/RESPP... 1/

Liabilities and Capital: Liabilities: Federal Reserve Notes Outstanding: Wednesday Level

Link Preview: Liabilities and Capital: Liabilities: Federal Reserve Notes Outstanding: Wednesday Level: Liabilities and Capital: Liabilities: Federal Reserve Notes Outstanding: Wednesday Levelcurrent reserve balances are about $3T. securities are about $6T, so I was wrong to say the Fed would run short of FFR collateral. (my intuition was formed in the theory that zero-interest currency would be small, not 1/3 to 1/2 of the balance sheet!) 2/

a lot of factors can affect the relationship between reserves outstanding and the FFR that prevails absent IOR. again, we did live in this world for a long time. it’s not fanciful. 3/

it’s not based on the relationship between the Fed’s balance sheet and currency or reserves outstanding, however. it depends upon how banks manage reserves, a game of balancing minimizing the cost of zero-interest reserves vs the cost and risks of having to borrow if short. 4/

the cost and risks of having to borrow if short are a function of the scale and volatility of net-settlement requirements. 5/

from the central bank’s perspective it’s an empirical art, not a game of first principles. 6/

(but it’s an empirical art whose rules central banks can change if necessary. beyond settlement requirements, in theory there are reserve requirements. in a no-IOR world we might revisit the sweeps loophole, if CBs find they want both control of rates + contemporary girth in balance sheets.) /fin

very perceptive from @graue.bsky.social. scott.mn/2025/06/11/c...

Text: When cities and transit agencies bring in Walker's firm, the assignment is: "Our budget is X million dollars. How can we best use this fixed budget to deliver service?" Even the best consultant? has to work within such terms. A consultant who retorts, "Your budget is too small for a world-class system. You need to go to the voters and politicians for better funding," wouldn't get hired again. That's not their job. Walker's error is to project that same role onto voters in a democracy.

Text: When cities and transit agencies bring in Walker's firm, the assignment is: "Our budget is X million dollars. How can we best use this fixed budget to deliver service?" Even the best consultant? has to work within such terms. A consultant who retorts, "Your budget is too small for a world-class system. You need to go to the voters and politicians for better funding," wouldn't get hired again. That's not their job. Walker's error is to project that same role onto voters in a democracy.

sure. if IOR goes away but RRP, the facility maintained to allow nonbanks to earn effectively IOR, was maintained, then IOR would just be replaced by banks using that facility. 1/

as you suggest, there are potential glitches: RRP is limited by the Fed’s collateral. “the Fed’s balance sheet” is too vague a descriptor for constraints: reserve liabilities are a greater share of that balance sheet than suitable RRP collateral. 2/

but setting that aside, this is all a way of saying if the Fed did away with IOR but didn’t REALLY do away with IOR by maintaining RRP, little might change if technicalities are addressed. 3/

if the Fed is forced to actually stop paying IOR—whether directly or via interest paid to repo lenders—on the theory that banks don’t deserve the interest, presumably the RRP loophole would be eliminated as well. 4/

in which case, short-term risk-free rates are pinned at zero until the quantity of reserves is made scarce relative to banks — still extant! — need for reserves to clear and settle overnight. 5/

(yes, other facilities, other technicalities, but none are designed to replace actual settlement at scale. absent IOR, unless facilities are retooled to literally replace reserve-based net settlement, banks will come to demand and pay to borrow reserves when quantity grows sufficiently scarce.) 6/

(new systems and tools and facilities are layered on top of old systems and practices which, like a reptile brain, remain, sit beneath, backstop our monetary system. no existing facility is capable of replacing net settlement at scale, with FFR and the discount window and all of that.) /fin

Treasury would be paying very little interest to banks, because banks would bid short-term bills to yields of zero+ε, while the banking system holds such a large pool of suddenly zero-interest, hot potato, reserves. 1/

they are likely nearly always to be, now that politics has fully nationalized. 50/50 is a structural attractor. a party getting much less than 50% will steal positions from its opponent, like Trump Republicans did, until it’s back to near even. www.interfluidity.com/v2/7687.html

the two party system has become the fascists and everyone-else-not-fascist. it’s not surprising that the former has something of an advantage in coherence.

bring the abhorrent-view-holders by! people’ll be mean to ‘em, but it’s not like the other place is known for niceness!

doing anything that matters makes critics wail louder than supporters praise. in a multiparty system, where you face multiple competitive candidates, other people getting heat doesn’t guarantee any benefit to you. but in a two party system, it does. denouncing while doing nothing becomes the play.

Loading quoted Bluesky post...

there are versions of being mean that comprise harassment or hate speech, and we as a “community” or, less grandly, platform should have no tolerance of that. 1/

but most being mean is just meanness. on an open social media platform there will be a lot of it, tolerating it is less censorious than the alternative. 2/

if you are going to speak about controversial things, my advice is do your best just let it wash off your back (blocking or muting, or not, as you please). 3/

don’t mistake what annoys you for some fatal flaw in the platform. people aren’t nicer anywhere else. yes, you may find more compatriots with particular views or interests in other places. stop complaining and bring those people here if you don’t like there. /fin

actually millennia of foundational immigration law was written in fortran.

what do the national guardspeople and marines, most of whom don't have Stephen Miller's view of the world, think of the role into which they've been thrust?

approval voting is much more tractable. fewer moving parts, voters can more accurately understand the implications of their choices.

Loading quoted Bluesky post...

i mean, surely Joe Biden’s presiding over the onset of COVID, the initial lockdowns, and most of the inflationary stimulus checks is bad enough. (poe’s law. i know.)

Loading quoted Bluesky post...

i think most people who express anger and disappointment towards Barack Obama aren’t in particular trying to win influence within the Democratic coalition, but are simply expressing their own profound anger and disappointment towards Barack Obama and the choices he made.

Loading quoted Bluesky post...

i don’t doubt these tools will help knowledgable people. but they won’t automatically supplant human experts and institutions, rise like benevolent gods to solve all our problems for us even as we destroy competences within ourselves we’ve spent centuries developing.