Steve Randy Waldman

@interfluidity.com

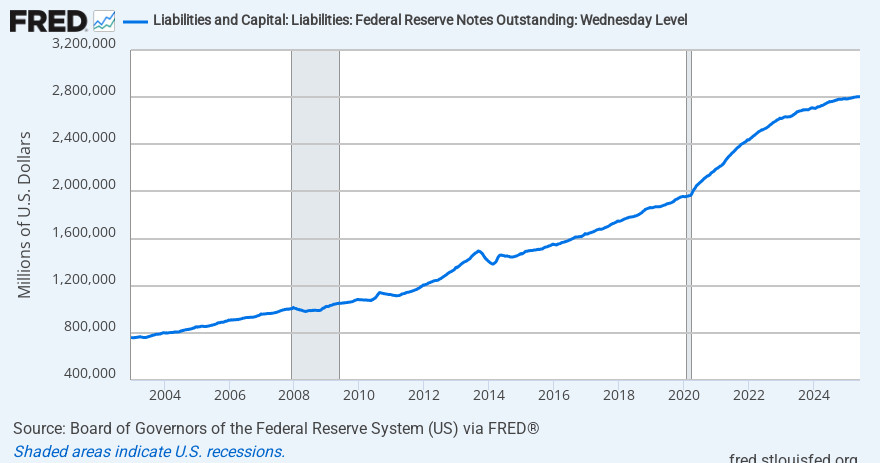

currency is not reserves. currency earns nothing. it’s astonishing that $2.4T of zero interest currency is outstanding while interest rates are 4%ish. kind of wow. (according the FRED, 2.8T of FRNs are now outstanding. that’s a lot of seignorage!) fred.stlouisfed.org/series/RESPP... 1/

Liabilities and Capital: Liabilities: Federal Reserve Notes Outstanding: Wednesday Level

Link Preview: Liabilities and Capital: Liabilities: Federal Reserve Notes Outstanding: Wednesday Level: Liabilities and Capital: Liabilities: Federal Reserve Notes Outstanding: Wednesday Level

Steve Randy Waldman

@interfluidity.com

current reserve balances are about $3T. securities are about $6T, so I was wrong to say the Fed would run short of FFR collateral. (my intuition was formed in the theory that zero-interest currency would be small, not 1/3 to 1/2 of the balance sheet!) 2/

Steve Randy Waldman

@interfluidity.com

a lot of factors can affect the relationship between reserves outstanding and the FFR that prevails absent IOR. again, we did live in this world for a long time. it’s not fanciful. 3/

Steve Randy Waldman

@interfluidity.com

it’s not based on the relationship between the Fed’s balance sheet and currency or reserves outstanding, however. it depends upon how banks manage reserves, a game of balancing minimizing the cost of zero-interest reserves vs the cost and risks of having to borrow if short. 4/

Steve Randy Waldman

@interfluidity.com

the cost and risks of having to borrow if short are a function of the scale and volatility of net-settlement requirements. 5/

Steve Randy Waldman

@interfluidity.com

from the central bank’s perspective it’s an empirical art, not a game of first principles. 6/

Steve Randy Waldman

@interfluidity.com

(but it’s an empirical art whose rules central banks can change if necessary. beyond settlement requirements, in theory there are reserve requirements. in a no-IOR world we might revisit the sweeps loophole, if CBs find they want both control of rates + contemporary girth in balance sheets.) /fin