massachusetts should just send their national guard off to tulsa without telling anyone and have them deploy in parks and pick up litter.

if i wanted to found a trustworthy news site now, i guess i’d have to call it “rank propaganda”

looking forward to PSAs touting the health benefits of tofu and how eating three servings a day pimps your T level.

Loading quoted Bluesky post...

( was a subtweet of this stuff xcancel.com/antoniogm/st... )

people think the president doesn’t care, but i think he stays up nights worrying the situation in gaza might become as bad as portland.

Remarkable that so few people participating in a life-or-death tournament to escape permanent precarity make space for expensive, time-consuming outside interests.

maybe the reason why you see fewer American and European young people traveling isn’t their lack of interest or adventurousness, but the fact the West has grown profoundly more unequal, and the tourist industry caters to dollars, not bodies, and dollars are disproportionately in older hands.

i just think you're all great and this is a pretty good site and community.

Are there “readers” for archived or zipped websites, distributed as a single file? (That is, without users having to overtly unzip and open the top directory’s index.html or whatever.) For offline convenience or as a kind of samizdat, one might imagine passing around zipped sites rather than links.

"What appeals to me most abt American traditions is the creedal nature of national identity, the Declaration’s insistence on universal equality…the rights enumerated in our Constitution…I consider innovation…growth…sustained material prosperity…downstream of free expression." @rajivsethi.bsky.social

from Annie Mueller anniemueller.com/posts/how-i-...

How I, a non-developer, read the tutorial you, a developer, wrote for me, a beginner - annie's blog

Link Preview: How I, a non-developer, read the tutorial you, a developer, wrote for me, a beginner - annie's blog: “Hello! I am a developer. Here is my relevant experience: I code in Hoobijag and sometimes jabbernocks and of course ABCDE++++ (but never ABCDE+/^+ are you kidding? ha!) and I like working with ...i love how you dust that but i’m not sure i can sanction all of your behavior.

the word “subject”, referring to a person, is fascinating. on the one hand it means a subordinate, a “subject of” someone who rules them. on the other hand it means a locus of agency, a subject can act, not merely be acted upon (which is the role of an “object”) 1/

among the most selfish, but perhaps the least self-aware person in all of human history. xcancel.com/elonmusk/sta...

we’ve redefined meritocracy as a tournament to acquire the best “cheat codes”.

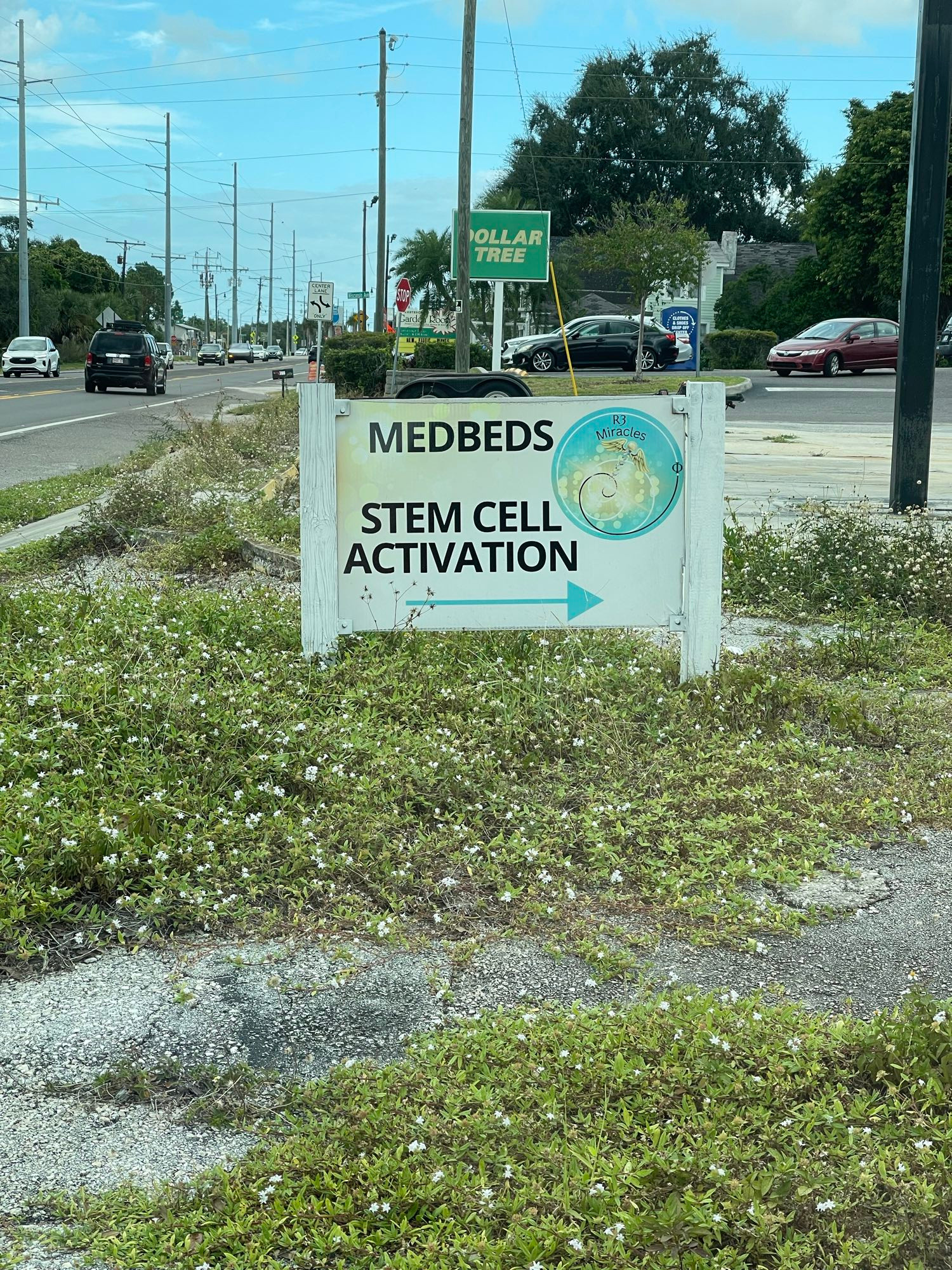

i guess they’re real guys!

“The lesson we shld be taking from LLMs is the immense social value there is in having all kinds of material—all kinds of products of human intellectual labor—freely available online. They shld be reminding us of the early utopian promise of the web.” @jwmason.bsky.social jwmason.org/slackwire/ac...

[new draft post] A fertile corpse https://drafts.interfluidity.com/2025/10/04/a-fertile-corpse/index.html