you’ll know evil when you see what people will do in the name of god.

“A method of legal interpretation that relies on this kind of historical inquiry only when it will yield the answer it wants is clearly far more opportunistic than principled.” #KateShaw https://www.nytimes.com/2025/07/01/opinion/supreme-court-trump.html

“Republicans are literally subsidizing dirty, cheap steel production in India and China.” @ryanlcooper https://prospect.org/environment/2025-07-02-big-beautiful-bill-green-energy-climate-china/

“Boasting about incompetence is signaling that you can be trusted to be corrupt.” @henryfarrell https://www.programmablemutter.com/p/elon-musk-and-the-power-of-the-bro

This post may have been deleted.

the whole “alligator alcatraz” thing is unfair to the alligators.

@BenRossTransit huh! new to me, but pretty interesting.

if i built a vanity LLM, i'd name it @delphi.

why doesn't the existence of sex or gender segregated sports constitute unlawful discrimination? sports could legitimately be segregated by weight, musculature, skill, lots of characteristics rationally related to competition on like terms.

but sex and gender are noisy proxies for any of this, and constitute categories discrimination by which demands elevated scrutiny under all circumstances.

i’m beginning to think President Miller might be even worse than President Musk.

too much algorithmic social media consumption is like receiving one of those serial killer notes written in clipped-out magazine letters and being like “hey, this ‘Q’ is from The NewYorker so what the note says must be true!”

a collage of a lie is not redeemed by the quality of elements collaged.

@paninid yeah, fine as far as i know! thanks for asking!

“what if we just gave the worst people in the world unchecked power for a while? that would shake things up.”

it’s weird that we pass when our body fails.

conjecture: the quality of life in its prisons is a pretty good measure of the success and level of civilization of a society.

(note “measure”, which does not make a claim of “cause”. there are Goodhart’s Law risks.)

i guess the other place you might see this is a voting booth.

i periodically repost this one. never really know why. https://www.interfluidity.com/v2/7964.html

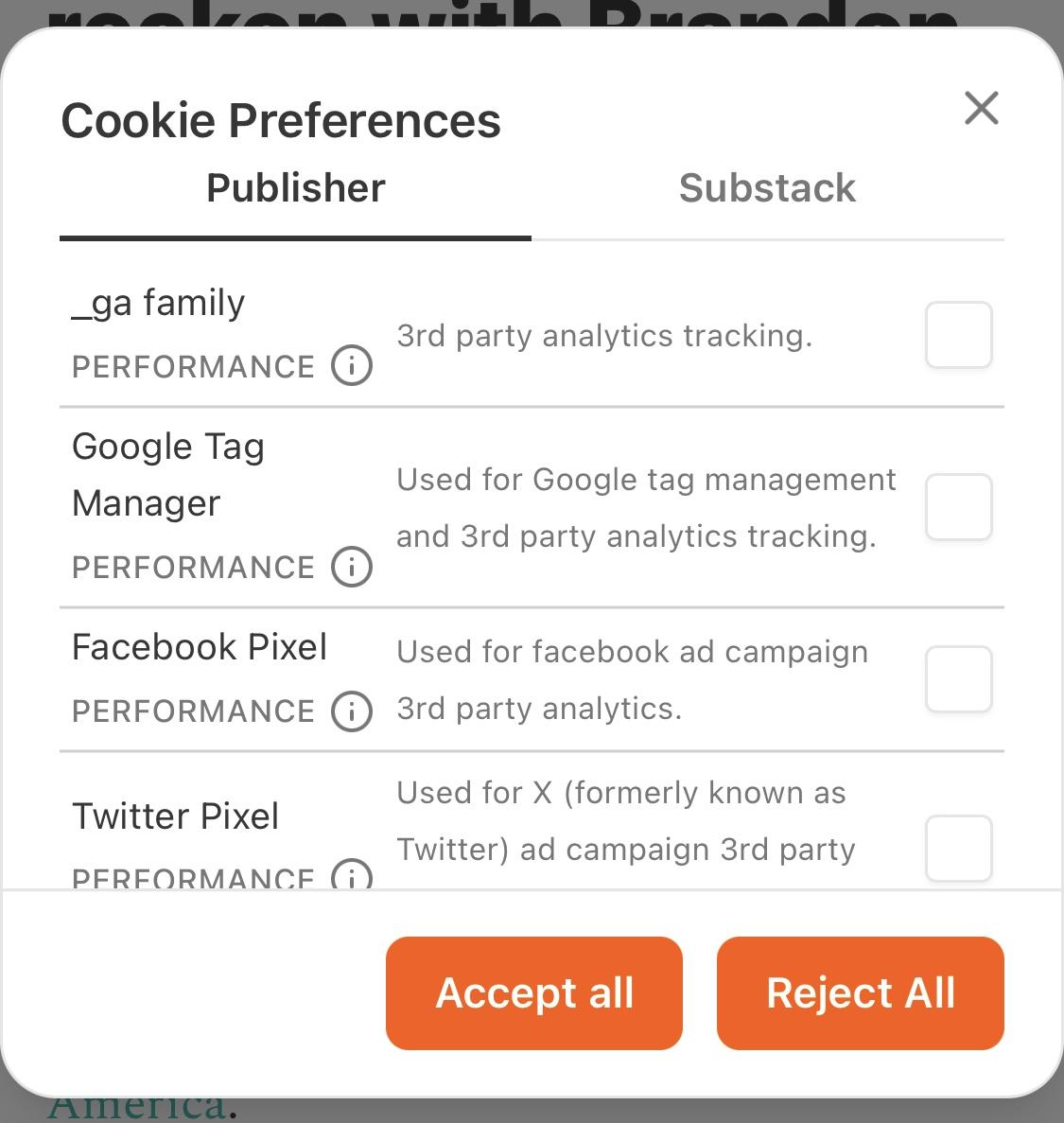

one nice thing about being in Europe is you get to see all the surveillance Substack is putting you through.