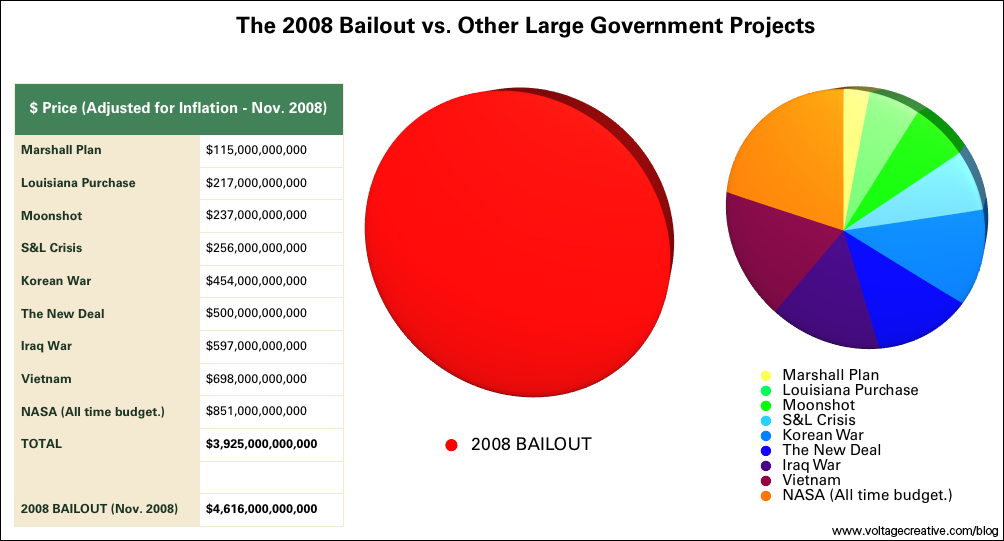

I like this little graphic that's been making the rounds, courtesy of Voltage Creative, hat-tip nonSense, Simoleon Sense, Paul Kedrosky.

Paul Kedrosky is a reasonable fellow, and takes care to note that the numbers "are in current dollars, and all treat expenditures and investments as equivalent." Kevin Drum is even more reasonable:

This stuff has gotten completely out of hand, with "estimates" of the bailout these days ranging from $3 trillion to $7 trillion even though the vast bulk of this sum comes in the form of loan guarantees, lending facilities, and capital injections. The government will almost certainly end up spending a lot of money rescuing the financial system (I wouldn't be surprised if the final tab comes to $1 trillion over five years, maybe $2 trillion at the outside), but it's not $7 trillion or anything close to it. People really need to stop throwing around these numbers as if the bailout is comparable to World War II or something. That's not reality based, folks.

But reasonable and right are sometimes different, and this graphic helps to think it through. We have some idea what we paid for, for example, with the $851,000,000,000 for NASA. We bought space shuttles, satellite systems, a moon shot, planetary probes, a lot of research and development, some air bases and research facilities.

What are we buying when the government purchases mortgage-backed securities, or buys preferred shares of banks that can only pay if a portfolio of real-estate loans does not totally sour? We are buying "paper", right?

No. We are not buying paper. Ironically, the pejorative term "paper" hides what we are actually doing in a way that is overflattering. All of the iffy securities that are weighing down the banking system represents money already spent on real projects or consumption. When the government purchases a security, it is taking the place of the party that originally fronted money for that expenditure. Every penny of government "investment" is retroactive expenditure on housing, real-estate, consumer credit, whatever.

If a government were to borrow funds in order to build a new stadium, we'd call that an "expenditure", even if we fully expect use fees and incremental tax revenues to eventually turn a profit for the fisc. Politicians supporting the project would call it an "investment", quite justifiably. But the project would still count as government spending.

If a private party builds the same stadium, and then is reimbursed by the government in exchange for rights to future revenue, that doesn't change the economic substance of the transaction at all. But in the second case, the government would buy "paper" — it would enter into a contract trading current government funds for future revenues. That "security" doesn't make the transaction any more or less an investment than if the government had purchased the stadium itself.

So, in economic substance, the government is currently spending through a financial time machine on the exurban subdivisions and auto loans of several years past. We are retroactively turning in the entire mid-decade "boom" into a gigantic Keynesian stimulus project. Apparently that stimulus was not so successful, since we are likely to enact a brand new massive stimulus very soon. To be fair, it should be easier to design a good stimulus program in the present tense — financial time machines are persnickety things. But the expenditures we are planning to undertake and the "investments" we are making via the universal bail-out are not so different in kind.

I hope that the infrastructure we build next year turns out to be a wise investment, both in financial and use-value terms. It might be, but just because we hope to recoup the cost, we won't pretend that no money was actually spent. We'll call the whole thing an expenditure, even though that will probably overstate the ultimate burden. But if a power grid counts as an expenditure on government books, so should a security derived from a mortgage or credit card loan made two years ago. You can argue that the latter are more likely to pay-in-full than the former. Or you can easily argue the opposite, given the prices that the government is paying for its financial investments relative to private-sector bids. But you can't claim that securities are "investments" while a power grid, or NASA, or even World War II are mere "expenditures". (It does not seem unlikely that the US government earned has earned more in tax and other revenues over the years having entered WWII than it would if it had not, perhaps by a large enough margin to justify the financial costs of the war.)

Figures of 7 or 8 trillion dollars recently bandied about by the Communists at Bloomberg are overstated, since they do not distinguish between expenditures and guarantees, which are contingent liabilities. The government's contingent liabilities aren't usually counted as spending until the contingency has been triggered. But the amount of money already spent or committed on "financial investments" to date is more than $3 trillion dollars, and it is perfectly right to call that government spending on the financial bail-out.

The scale of the largely unlegislated current government program to save the financial system is breathtaking and quite unprecedented. Taxpayers might be made whole, in financial terms, or might reap sufficient dividends in terms of suffering avoided to justify the program. But don't let anyone convince you that the scale of this intervention is "overstated" because it is all "investment". NASA and the Marshall Plan were investments too, and pretty good ones.

| Steve Randy Waldman — Tuesday December 2, 2008 at 12:03am | permalink |

If Bernanke and Paulson had a time machine and could go back in time to the year 2004 with their superpowers, what would they do to fix the economy, so it wouldn't drive off the cliff in 2007-2008? Would they stimulate it more by lowering the Fed rates to zero? Would they raise the rates at least above inflation rate? Would they increase government spending? Would they talk about overheated housing markets? Would they talk about installing more regulation?

I think that they would walk out of the time machine in to the 2004, look at each other, and started doing the exact same things as they did in the past. Their role in the economy is very limited yet powerful. Their DNA and only superpower is money. And I can't even blaim them.

There is only one key structure change that could have a true meaning, and that is changing Federal Reserve System. Either abolish it, or create another Fed to compete with the current one. Markets aren't free if government and banks don't have but one choice where to loan money.